Understanding how to invest money and make money is no longer reserved for financial experts. Today, anyone in the UK can start building wealth by making informed investment choices.

With rising living costs and fluctuating savings interest rates, simply storing money in a bank account isn’t always the smartest option. Investing helps you grow your money and potentially earn passive income over time.

Whether you’re new to investing or looking to sharpen your strategy, knowing where to begin is the first step.

This guide breaks down everything you need to know, from the basics to 13 smart investment options tailored for UK residents aiming to make their money work for them.

What Does It Really Mean to Invest Money?

To invest money means using your funds to purchase assets that have the potential to increase in value or generate income over time. It’s different from saving, where you simply put money aside in a bank.

When you invest, you’re actively growing your wealth. Investments can include shares, bonds, property, or funds, and each comes with its own level of risk and reward.

The key idea is to make your money work for you rather than having it sit idle. By investing, you’re participating in the economy, supporting businesses, lending to governments, or backing new projects.

In return, you may receive dividends, interest, or asset appreciation. Successful investing involves time, patience, and a clear strategy, but even beginners can learn and succeed with the right information and mindset.

Why Is Investing a Smart Move for Your Financial Future?

Investing is essential if you’re aiming for long-term financial success. Rather than letting your money lose value due to inflation, investments help it grow.

Key Benefits of Investing

- Compounding Growth: Reinvesting your earnings leads to exponential growth over time.

- Beating Inflation: Investments typically offer returns that outpace inflation, unlike savings accounts.

- Passive Income: Some investments, like dividends or rental income, generate money regularly.

- Achieving Life Goals: Whether it’s buying a home, funding education, or retiring early, investments make these goals attainable.

- Tax Efficiency: Accounts like ISAs or pensions offer tax advantages that increase your returns.

Building an investment habit, even with small amounts, makes a significant difference over the years. Unlike spending, which is immediate, investing is a forward-thinking strategy that secures your future.

A well-diversified portfolio can help balance risk and reward, and over time, you’ll find your money working for you in ways saving alone can’t achieve.

How Can You Start Investing as a Beginner in the UK?

Starting as an investor in the UK doesn’t require a large sum or expert knowledge. Here’s how you can begin:

- Understand the Basics: Learn the types of investments like shares, bonds, and funds.

- Set Financial Goals: Know why you’re investing: for retirement, property, or income.

- Choose the Right Platform: Use reputable platforms like Lloyds, HSBC, or Raisin for access to investment options.

- Start with Low-Risk Products: ISAs or robo-advisors are beginner-friendly and tax-efficient.

- Diversify Early: Don’t put all your money in one place; spread risk across asset types.

- Invest Regularly: Use direct debits to make monthly contributions.

Most UK platforms offer tools to help you select investments based on your goals and risk appetite. You can start with as little as £1 in some cases.

Educating yourself through guides from MoneyHelper and Moneysavingexpert gives you a head start. The key is to start now and stay consistent.

What Are the Common Risks Involved in Investing?

Investing always carries some risk, and being aware of these is crucial to your success:

- Market Volatility: Share prices can fluctuate, affecting your investment value.

- Interest Rate Changes: Bonds and savings returns may be impacted by Bank of England rate changes.

- Inflation Risk: Your returns may not keep pace with the rising cost of living.

- Liquidity Risk: Some investments may be hard to sell quickly without losing value.

- Credit Risk: Companies or governments may default on payments.

Mitigating these risks means:

- Diversifying across sectors and regions.

- Investing for the long term rather than reacting to short-term changes.

- Staying informed and using trustworthy platforms and tools.

No investment is without risk, but understanding them helps you make informed decisions. Tools provided by Lloyds and HSBC help assess your risk profile so you can match investments to your comfort level.

How Much Money Do You Need to Start Investing in the UK?

A common myth is that investing requires thousands of pounds. In truth, many UK investment platforms allow you to begin with as little as £1.

Robo-advisors and app-based investing tools often accept small deposits and offer diversified portfolios tailored to your risk appetite. Stocks and Shares ISAs provide tax benefits and low minimum investments.

While the more you invest, the greater your potential returns, the most important factor is consistency. Monthly investing, even in small amounts, lets you benefit from pound-cost averaging.

This reduces the impact of market volatility. Whether you’re setting aside £50 or £500 monthly, the key is to make it a habit and stick with it. Your budget and goals should dictate how much to invest, not outdated assumptions.

How to Invest Money and Make Money?

1. Open a High-Interest Savings Account

High-interest savings accounts are an excellent starting point if you’re new to investing. These accounts offer interest rates higher than traditional current accounts, allowing your money to grow passively while remaining accessible.

Though technically not a traditional investment, they serve as a safe and low-risk way to generate returns while you build capital for larger investments.

What Makes Them Worthwhile?

- Backed by the Financial Services Compensation Scheme (FSCS) for up to £85,000 per person.

- Suitable for short-term savings goals with instant access options.

- A great place to store your emergency fund while earning interest.

Pros and Cons:

| Pros | Cons |

| Low risk, FSCS protection | Lower returns than other investments |

| Flexible access to funds | Interest rates can vary |

| Easy to set up and manage | Not ideal for long-term wealth growth |

High-interest savings accounts are best used as a launchpad to more diverse investments or for storing funds you may need in the near future.

2. Invest in Stocks and Shares (UK Market)

Buying stocks in UK companies gives you part ownership and potential for returns through price appreciation or dividends. The FTSE 100 and FTSE 250 offer a range of blue-chip companies that many UK investors trust.

What Makes Them Worthwhile?

- Higher growth potential compared to savings.

- Dividend-paying shares offer regular income.

- Easy access via investment platforms and apps.

Pros and Cons

| Pros | Cons |

| Potential for high returns | Can be volatile in the short term |

| Dividend opportunities | Requires research and monitoring |

| Wide range of sectors to invest in | Capital at risk |

Investing in UK shares is ideal for those looking to grow their money over time and diversify within familiar markets.

3. Use a Stocks and Shares ISA

A Stocks and Shares ISA is a popular investment tool in the UK that allows individuals to invest up to £20,000 annually without paying tax on capital gains or dividends.

It’s one of the most tax-efficient investment options, suitable for both new and seasoned investors. You can put your money into a wide variety of assets, including shares, funds, ETFs, and bonds, making it highly flexible.

Whether you’re looking for growth, income, or a combination of both, a Stocks and Shares ISA offers a solid foundation for long-term investing.

What Makes Them Worthwhile?

- Offers tax-free capital gains and dividend income.

- Access to diversified asset classes in one account.

- Ideal for medium to long-term wealth building.

Pros and Cons:

| Pros | Cons |

| No capital gains or income tax | Limited to £20,000 per tax year |

| Wide choice of investments | Charges vary depending on provider |

| Encourages long-term investing habit | Value can go down as well as up |

Stocks and Shares ISAs are ideal for those who want to grow their wealth over time while maximising tax efficiency.

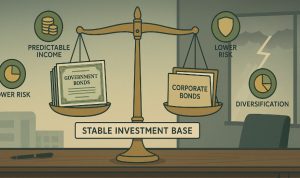

4. Buy Government and Corporate Bonds

Bonds are essentially loans made to governments or companies, which pay interest to the investor over a fixed term. UK Gilts (government bonds) and corporate bonds are widely considered safer than stocks, making them attractive to risk-averse individuals or those approaching retirement.

They offer a fixed income stream and typically have lower volatility than equities, helping to stabilise investment portfolios.

What Makes Them Worthwhile?

- Provides predictable interest income.

- Typically less risky than shares.

- Useful for diversifying portfolios.

Pros and Cons:

| Pros | Cons |

| Fixed and reliable income | Lower long-term growth potential |

| Lower market volatility | Real returns can be affected by inflation |

| Suitable for diversification | Prices may fall if interest rates rise |

Bonds are best suited for conservative investors who value income stability and capital preservation.

5. Real Estate Investment for Passive Income

Real estate remains a go-to choice for many UK investors aiming for long-term capital growth and recurring rental income. By purchasing buy-to-let properties, you can benefit from property appreciation while generating monthly rent.

Although it requires significant upfront capital and ongoing management, property investment is tangible, inflation-resistant, and often lucrative over time.

What Makes Them Worthwhile?

- Provides rental income and long-term asset growth.

- Can be leveraged through mortgage finance.

- Potential tax benefits on expenses and interest.

Pros and Cons:

| Pros | Cons |

| Regular income from tenants | High entry and maintenance costs |

| Long-term capital appreciation | Requires time and active management |

| Mortgage leverage available | Property value may fluctuate |

Property investment works well for those with enough capital who seek stable income along with appreciation potential.

6. Peer-to-Peer (P2P) Lending Platforms

P2P lending allows you to lend money directly to individuals or businesses via online platforms, bypassing traditional banks. In return, you earn interest, often at rates higher than those offered by savings accounts or bonds.

These platforms let you choose your loan terms and risk level, with some offering protection schemes to reduce exposure to defaults.

What Makes Them Worthwhile?

- Higher interest than traditional savings.

- Customisable investment terms and risks.

- Potential for passive income through repayments.

Pros and Cons:

| Pros | Cons |

| Attractive potential returns | Risk of borrower default |

| Flexible investment options | Not covered by FSCS protection |

| Minimal effort once funds lent | Fees may apply on some platforms |

P2P lending is ideal for moderate-risk investors seeking alternatives to traditional markets and wanting to diversify their portfolio.

7. Invest in Index Funds and ETFs

Index funds and ETFs are ideal for investors who prefer a hands-off approach. These products mirror the performance of market indices such as the FTSE 100, offering broad exposure to the stock market. Since they are passively managed, they come with lower fees compared to active funds.

Perfect for those who want steady long-term growth without constantly managing their portfolio, these funds help spread risk across many companies and sectors.

What Makes Them Worthwhile?

- Provide instant diversification by tracking entire market sectors.

- Lower management costs due to passive investment strategy.

- A solid choice for long-term wealth building with minimal involvement.

Pros and Cons:

| Pros | Cons |

| Cost-effective and low maintenance | Cannot beat market performance |

| Diversified portfolio exposure | No control over individual stocks |

| Beginner-friendly | Susceptible to broad market downturns |

Index funds and ETFs are well-suited for those looking to grow their wealth gradually without the stress of picking individual stocks.

8. Start with Robo-Advisors for Automated Investing

Robo-advisors such as Nutmeg or Moneyfarm use algorithms to create and manage investment portfolios tailored to your goals and risk appetite.

They take care of everything from diversification to rebalancing, making them ideal for beginners or those with limited time. With low starting requirements and user-friendly platforms, robo-advisors bring professional investing strategies to everyday users.

What Makes Them Worthwhile?

- Fully automated portfolio management based on personal preferences.

- Regular updates and rebalancing to stay aligned with your goals.

- Low entry points, often starting at just a few hundred pounds.

Pros and Cons:

| Pros | Cons |

| Convenient, hands-off approach | Less personalised than human advisors |

| Rebalances investments automatically | Fees may apply annually |

| Easy to access via mobile or web | Limited choice in individual assets |

Robo-advisors are best suited for busy individuals looking for a low-effort, guided route into investing.

9. Buy Dividend-Paying Stocks for Monthly Income

Dividend-paying stocks provide a dual benefit, regular payouts and potential capital appreciation. These stocks belong to established companies that share a portion of their earnings with investors.

Ideal for long-term wealth generation, reinvesting dividends can significantly boost returns over time through compounding.

What Makes Them Worthwhile?

- Offer consistent income in addition to share price appreciation.

- Reinvestment can grow wealth steadily over the long term.

- Generally considered more stable than high-growth stocks.

Pros and Cons:

| Pros | Cons |

| Income plus growth opportunities | Dividends can be reduced or stopped |

| Ideal for steady, long-term investing | May incur tax unless held in ISAs |

| Encourages disciplined investing | Requires active research and monitoring |

Dividend stocks are great for investors aiming to balance income and growth, especially when held in tax-efficient wrappers like ISAs.

10. Contribute to a Pension Scheme or SIPP

Pensions and SIPPs (Self-Invested Personal Pensions) are tax-advantaged vehicles designed to help you save for retirement. Contributions receive tax relief from the government, and investments can grow significantly over the years due to compounding.

With a wide range of investment choices, SIPPs offer flexibility, while workplace pensions often include employer contributions.

What Makes Them Worthwhile?

- Tax relief boosts your contributions significantly.

- Long investment horizon allows for substantial compound growth.

- Access to multiple asset classes for diversification.

Pros and Cons:

| Pros | Cons |

| Contributions topped up by HMRC | Locked until age 55 or later |

| Encourages disciplined, long-term saving | Early withdrawals incur penalties |

| Potential employer contributions | Market risk still applies |

Pensions and SIPPs are highly recommended for those planning ahead, offering tax-efficient ways to build a secure financial future.

11. Invest in Gold and Other Precious Metals

Gold and precious metals are traditional safe-haven investments that tend to hold their value during economic instability. Whether it’s bullion, coins, or precious metal ETFs, these tangible assets provide a hedge against inflation and market volatility.

While they don’t generate income like dividends or interest, their defensive role makes them a popular component in diversified portfolios—especially in uncertain financial times.

What Makes Them Worthwhile?

- Tangible assets with global recognition and acceptance.

- Used historically as a hedge during inflation or currency devaluation.

- Can be accessed via online bullion dealers, ETFs, or metal funds.

Pros and Cons:

| Pros | Cons |

| Hedge against inflation | No income generated |

| High liquidity | Storage and insurance costs |

| Portfolio diversification | Prices can fluctuate significantly |

Investing in gold and metals works best as a conservative anchor in a broader portfolio, especially for risk-averse investors.

12. Explore Crowdfunding and Startup Investing

Crowdfunding enables individual investors to fund early-stage UK startups and innovative ideas via platforms like Crowdcube or Seedrs. These investments offer the chance to be part of a company’s journey from the ground up, often with the potential for significant equity gains.

However, they also come with a high level of risk and require long-term commitment, making them more suitable for seasoned investors.

What Makes Them Worthwhile?

- Opportunities to invest in cutting-edge innovation and new businesses.

- Potential for high returns if the startup succeeds.

- Access to tax relief through SEIS and EIS schemes.

Pros and Cons:

| Pros | Cons |

| High growth potential | High risk of business failure |

| Personal connection with startups | Difficult to exit investment |

| Tax incentives available | Requires long holding period |

Crowdfunding is ideal for those willing to back bold ideas and accept the risks that come with early-stage investing.

13. Utilise Compound Interest through Long-Term Plans

Compound interest is the strategy of earning interest on your investment and reinvesting those earnings to build wealth over time. Whether through pension schemes, ISAs, or reinvested dividends, compound growth rewards patience and consistency.

This long-term method is a cornerstone of financial independence, particularly when started early and maintained with regular contributions.

What Makes It Worthwhile?

- Allows your savings to grow exponentially over time.

- Encourages a disciplined, long-term approach to investing.

- Minimal effort required once the plan is in motion.

Pros and Cons:

| Pros | Cons |

| Excellent for long-term returns | Benefits take time to materialise |

| Encourages consistent saving | Short-term market dips impact it |

| Passive and low-maintenance | Requires discipline and patience |

Compound interest is often considered the most reliable way to build wealth steadily, perfect for those who play the long game.

Conclusion

Learning how to invest money and make money doesn’t require a finance degree or a large budget. With access to trustworthy platforms and resources in the UK, you can build a diverse portfolio tailored to your risk tolerance and financial goals.

From savings accounts to dividend stocks and long-term pension plans, there are smart options for every type of investor.

The earlier you start, the more your money can grow, thanks to the magic of compounding and time. Take that first step with confidence, continue educating yourself, and let your money begin working for you.

Whether your goal is income, growth, or future security, the right investment strategy can make all the difference.

FAQs About Invest Money and Make Money

Can you lose all your money by investing?

Yes, certain high-risk investments can result in total loss, but diversified portfolios reduce this risk.

Is it better to save or invest in 2025 UK?

Investing typically offers higher returns than saving, especially over the long term, despite short-term market risks.

How can I invest without knowing much about the market?

Use robo-advisors or diversified index funds that require minimal knowledge to get started.

Are there ethical investing options in the UK?

Yes, many platforms offer ESG funds focused on environmental and socially responsible companies.

What’s the best investment for generating passive income in the UK?

Dividend stocks and rental property are leading passive income sources with relatively stable returns.

Do I need a financial adviser to start investing?

Not necessarily, many UK platforms are beginner-friendly, though advisers can help with complex portfolios.

How do I track the performance of my investments?

Most platforms offer dashboards, reports, and mobile apps to monitor your investment performance in real-time.