Ever wondered if you can balance a regular job with a side hustle or passion project? In today’s fast-paced world, many people are exploring new ways to boost their income or turn hobbies into something more.

With flexible work options and digital tools, the idea of juggling both employment and personal business ventures is becoming more common. But is it actually allowed? And if it is, how does it work when it comes to taxes, National Insurance, and your rights at work?

Whether you’re thinking about freelancing after hours or starting your own venture on weekends, there are a few key things you should know before diving in. Let’s break it down.

What Does Dual Employment Mean?

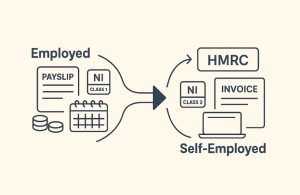

Dual employment means holding two different types of work statuses simultaneously: being employed by a company while also running your own business or working as a freelancer.

When you are employed, you work under a contract for an employer and are paid through the PAYE (Pay As You Earn) system. This means your income tax and National Insurance contributions are deducted automatically from your salary.

In contrast, when you are self-employed, you are your own boss. You are responsible for handling your own taxes, National Insurance, and business expenses.

Being both employed and self-employed allows you to benefit from the stability of regular employment income while pursuing entrepreneurial projects.

For example, a person may work full-time as a graphic designer for a company while also running their own web design business on the side.

This setup provides financial security while enabling them to expand their personal business ventures. However, it is essential to keep clear financial records and understand tax obligations for both income streams.

Can You Be Self Employed and Employed in the UK?

Yes, you can be both self-employed and employed in the UK without any legal restrictions. Many people choose this path to increase their income or develop a business alongside their regular job.

The UK government allows individuals to earn from self-employment while working for an employer, provided that they declare all earnings accurately to HMRC.

However, it is crucial to check your employment contract before taking up self-employment. Some employers have clauses that prevent employees from engaging in work that competes with their business or affects job performance.

If you are free from such restrictions, you can proceed with setting up your self-employment. Popular examples include working full-time as a teacher while tutoring privately or managing a part-time online store alongside your office job.

Balancing both roles requires good time management and a clear understanding of your legal and financial obligations. You must declare both your PAYE income and self-employment earnings to HMRC, ensuring that you comply with tax laws and National Insurance contributions.

How Does Tax Work When You’re Both Employed and Self-Employed?

PAYE for Employed Income

When you are employed, your income tax is deducted automatically by your employer through the PAYE system. This includes tax and National Insurance contributions, which are calculated based on your salary. Your tax code determines how much tax is deducted from each payslip.

Self-Assessment for Self-Employed Income

For your self-employment income, you must complete a Self-Assessment tax return each year. This process involves declaring all income earned from your business, calculating expenses, and paying any additional tax due. The deadline for filing your online Self-Assessment is the 31st of January following the end of the tax year.

Combining Both Incomes

Both income streams, your salary from employment and your self-employment earnings—are combined to determine your total taxable income.

If your total earnings exceed the basic rate tax threshold, you may be required to pay additional tax. It is important to set aside money for these payments throughout the year to avoid unexpected bills during tax season.

Do You Need to Register with HMRC If You’re Both Employed and Self-Employed?

Yes, if you are self-employed, even while holding a job, you must register with HMRC as a sole trader or through your business structure. Registration is necessary to report your earnings and pay tax on your self-employed income.

You are required to do this by the 5th of October following the tax year you start earning self-employed income. The registration process is straightforward. You need to create a Government Gateway account and register for Self Assessment.

Once registered, HMRC will provide you with a Unique Taxpayer Reference (UTR) number, which you will use to submit your tax return. Failure to register on time can result in penalties, so it is important to complete this step promptly.

Once registered, you are obligated to file a Self-Assessment tax return each year, declaring both your PAYE earnings and your self-employment profits. This ensures that you are correctly taxed for all income streams.

How Are National Insurance Contributions Managed for Dual Employment?

Class 1 National Insurance for Employment

If you are employed, your employer deducts Class 1 National Insurance from your wages automatically. This is calculated based on your earnings and is managed through the PAYE system. For the 2025/26 tax year, you pay 8% on earnings between £242 and £967 per week, and 2% on any earnings above that threshold.

Class 2 and Class 4 National Insurance for Self-Employment

For your self-employment income, you must pay Class 2 and Class 4 National Insurance. Class 2 is a flat rate contribution, while Class 4 is based on your annual profits.

If you earn more than £12,570 from self-employment, you pay 6% on profits between £12,570 and £50,270, and 2% on profits over £50,270.

Managing Both Contributions

Since you are paying National Insurance through both PAYE and Self Assessment, it is crucial to keep records and understand your contributions.

You may be eligible for a refund if you overpay, but this requires proper documentation and communication with HMRC.

How Do You Declare Your Income from Both Employment Types?

Declaring income from both employment and self-employment is done through a Self-Assessment tax return. This process involves reporting your salary income from your employer and any profits earned from your self-employed activities.

To make the process smoother:

- Register with HMRC as self-employed.

- Complete your Self-Assessment tax return each year.

- Declare your employment income under PAYE.

- Report your self-employed earnings and any business expenses.

Key things to remember include:

- Keep accurate records of both employment and self-employment income.

- Submit your tax return by the 31st of January deadline.

- Pay any tax due by the specified deadlines to avoid fines.

Staying organised throughout the year can save time and reduce stress when filing your return. If you’re ever unsure, it’s wise to consult a qualified tax adviser.

What Employment Rights Do You Have When Self-Employed and Employed?

Rights as an Employee

When you are employed, you are protected under UK employment law. This includes rights such as holiday pay, sick pay, maternity or paternity leave, and protection against unfair dismissal.

You are also entitled to a minimum wage, a safe working environment, and access to a workplace pension scheme. These rights are enforced by your employer and safeguarded by law.

Rights as Self-Employed

As a self-employed individual, your rights are different from those of an employee. You do not receive benefits such as holiday pay, sick pay, or redundancy protections. However, you have the freedom to negotiate your rates, choose your clients, and set your working hours.

You are also responsible for managing your own health and safety, as well as complying with contractual agreements. Understanding the difference between these two roles is essential to manage expectations and fulfil legal responsibilities.

Understanding the difference between these two roles is vital for managing expectations and complying with legal obligations.

What Challenges Might You Face When Balancing Both Roles?

Balancing both employment and self-employment can be rewarding but also presents unique challenges that require careful planning and time management. Below are some of the primary challenges you may face:

- Time Management: Balancing two workloads can be exhausting and requires strong time management to avoid burnout.

- Financial Planning: Managing dual incomes demands careful budgeting, especially for taxes not covered by PAYE.

- Compliance with Tax Laws: You must accurately report both incomes and file a Self-Assessment to avoid penalties.

- Understanding Your Rights and Obligations: Self-employed roles don’t offer the same benefits or protections as employed positions.

- Potential Conflicts with Employers: Your employment contract may restrict outside work or require prior approval.

To succeed in balancing both roles, it’s crucial to stay organised, manage your time efficiently, and understand the legal and financial obligations for both types of work.

Can You Transition from Being Employed to Fully Self-Employed?

Yes, transitioning from being employed to fully self-employed is entirely possible and is a path many people take after establishing a stable side business. This transition requires strategic planning to ensure financial stability and compliance with legal obligations.

The first step is to evaluate your self-employment income. If your business earnings are consistently growing and covering your expenses, it might be a good time to consider full-time self-employment. Financial planning is crucial during this phase, including setting aside emergency funds to cover periods of low income.

You should also review your employment contract to understand any notice periods and obligations before leaving your current job. Clear communication with your employer is recommended to maintain professional relationships.

Before making the switch, ensure your business is legally registered, your finances are well-organised, and you have a strategy for managing taxes and National Insurance. Proper planning helps ensure a smooth transition to full-time self-employment.

Conclusion

Being both self-employed and employed in the UK is not only possible but increasingly common. It offers the opportunity to pursue entrepreneurial ventures while maintaining the security of a regular paycheck.

However, it also brings added responsibilities such as managing two different tax systems, keeping detailed financial records, and understanding employment rights for both roles.

To succeed, it’s crucial to stay organised, understand your legal obligations, and plan your finances carefully. With the right approach, dual employment can provide financial stability and the freedom to explore new opportunities. Balancing both roles may be challenging, but with proper management, it can also be incredibly rewarding.

Frequently Asked Questions

Can I work as a contractor while being employed?

Yes, you can work as a contractor alongside your regular job as long as it does not conflict with your employment contract.

Do I need separate National Insurance payments for both jobs?

Yes, your employer handles your Class 1 contributions, while you are responsible for Class 2 and Class 4 contributions from self-employment.

Is there a maximum amount I can earn while being both employed and self-employed?

There is no maximum earning limit, but all income must be declared, and you may be liable for higher tax rates.

Can I claim business expenses if I am both employed and self-employed?

Yes, you can claim business expenses for your self-employed income, even if you are also employed.

Do I need to inform HMRC if I start a side business while employed?

Yes, you must register with HMRC as self-employed and complete a Self-Assessment tax return annually.

Will my employer know if I register as self-employed?

Not unless you inform them; your self-employed status is separate from your employment unless there is a conflict of interest.

Can I switch from employed and self-employed to fully self-employed easily?

Yes, with proper planning and financial preparation, you can transition smoothly to full self-employment.