Understanding how much it costs to extend a lease on a flat in the UK is essential for any leaseholder considering long-term ownership or preparing to sell.

With property values and lending criteria influenced by lease length, extending a lease can be a strategic financial decision.

This guide breaks down the various factors that determine lease extension costs, including legal fees, valuation charges, and premium calculations, while also addressing upcoming legislative changes that could affect the process and pricing in the near future.

What Is a Lease Extension and Why Does It Matter?

A lease extension gives a leaseholder the right to add years to the remaining term of their leasehold property. Leasehold ownership is common for flats in the UK, especially in England and Wales.

When you purchase a leasehold flat, you only own the property for the duration stated in the lease agreement. Once the lease expires, ownership reverts to the freeholder, who owns the land and the structure.

A lease extension becomes crucial as the lease term gets shorter. Property value diminishes when the lease nears expiry, and it becomes increasingly difficult to sell or remortgage.

Extending the lease not only preserves the value but also increases the property’s appeal to lenders and buyers. Most leaseholders aim to extend their lease well before it reaches a critical low term, particularly the 80-year mark.

When Should a Leaseholder Consider Extending a Lease?

The 80-year threshold is a vital benchmark in leasehold law. Once a lease falls below this term, the leaseholder must pay what is known as “marriage value.”

This value reflects the increase in the property’s market value as a result of extending the lease. Current legislation requires leaseholders to pay 50% of this increase to the freeholder.

Properties with shorter leases are also more challenging to finance. Many mortgage providers will not lend on flats with fewer than 70-75 years left on the lease, and some set their limit even higher. Buyers may also be discouraged, reducing the marketability of the property.

Although recent reforms propose to abolish marriage value and simplify the lease extension process, these changes are not yet fully in effect. Until they are enacted, extending the lease before hitting the 80-year threshold remains a financially prudent decision.

What Factors Influence the Cost of a Lease Extension?

Several variables determine how much it will cost a leaseholder to extend their lease. The most influential are:

- Length of the remaining lease: The shorter the lease, the higher the premium.

- Current market value of the property: More valuable properties incur larger extension costs.

- Ground rent terms: Higher or increasing ground rent leads to a higher buyout cost.

- Whether the leaseholder negotiates informally or proceeds with a statutory extension.

- Professional fees payable to surveyors and solicitors for both parties.

Each leaseholder’s situation is unique, so the total payable amount can differ significantly from one case to another.

How Is the Lease Extension Premium Calculated?

The lease extension premium is the core cost of extending a lease. This amount is negotiated between the leaseholder and the freeholder or determined by a statutory formula if no agreement can be reached.

The statutory formula considers:

- The reduction in the freeholder’s interest due to ground rent loss

- The value added to the leaseholder’s flat

- Marriage value, if the lease has fewer than 80 years remaining

Example: Lease Extension Premium Calculation (Flat Value: £350,000, 85 Years Lease, £100 Ground Rent)

| Factor | Assumption |

| Lease extension premium | £6,000–£8,000 |

| Property value post-extension | £350,000 |

| Ground rent buyout | £100/year reduced to £0 |

| Remaining lease term | 85 years |

| Marriage value | Not applicable (>80 years) |

In this scenario, the lease extension premium typically falls within the £6,000 to £8,000 range. However, if the lease was below 80 years, the cost could rise significantly due to the addition of marriage value.

How Much Do Lease Extension Solicitor Fees Typically Cost?

Legal costs are a necessary part of the lease extension process. Solicitors help with legal notices, reviewing lease terms, managing negotiations, and registering the extension.

Leaseholders are responsible for paying:

- Their own solicitor’s fees

- The freeholder’s reasonable legal costs

Solicitor fees for the leaseholder generally range from £800 to £1,300. This includes handling all documentation, statutory notices if applicable, and Land Registry processes.

For the freeholder, legal fees can fall within the same range, typically between £800 and £1,300. These costs are usually fixed unless the process becomes particularly complex.

Leaseholders are advised to hire solicitors who specialise in leasehold law and ideally belong to the Association of Lease Extension Practitioners (ALEP), ensuring the expertise required for a smooth and compliant extension process.

What Are the Valuation Surveyor Fees?

A valuation surveyor is essential for estimating the lease extension premium accurately. The surveyor evaluates:

- The flat’s market value before and after the lease extension

- Ground rent terms and frequency of escalation

- The amount of marriage value (if applicable)

Just like with solicitor fees, leaseholders must also cover the surveyor costs for both themselves and the freeholder. The fees typically range between £600 and £900 per party. This can vary depending on the property’s complexity, location, and the extent of research required.

An experienced valuation surveyor will support the negotiation process, help challenge unreasonable demands, and provide expert evidence if the case proceeds to a tribunal.

What Is the Typical Total Cost of Extending a Lease in the UK?

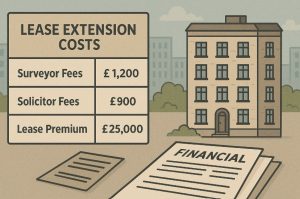

The total cost is the sum of the lease extension premium, legal fees, surveyor fees, and administrative charges such as Land Registry fees. Here’s a breakdown for a typical case:

Total Lease Extension Cost Estimate (85-Year Lease, £350,000 Property Value)

| Item | Estimated Cost |

| Lease extension premium | £6,000–£8,000 |

| Your valuation surveyor | £600–£900 |

| Freeholder’s valuation surveyor | £600–£900 |

| Your solicitor | £800–£1,300 |

| Freeholder’s solicitor | £800–£1,300 |

| Land Registry and misc. fees | £65 |

| Total Estimated Range | £8,865–£12,465 |

This cost can rise significantly if the lease term is shorter or if negotiations require tribunal proceedings. Delays and legal disputes may also add to the financial burden.

How Can Leaseholders Estimate Their Lease Extension Cost?

To get an early estimate, leaseholders can use free online tools such as:

- The Leasehold Advisory Service (LEASE) calculator

- HomeOwners Alliance lease extension cost estimator

These calculators request basic information like property value, lease term, and ground rent to generate a projected premium. However, they can only provide a rough estimate.

For more precise figures, leaseholders should instruct a qualified surveyor to carry out a full valuation. Many legal firms specialising in lease extensions have partner surveyors and may offer a combined package at a discounted rate. An accurate valuation helps strengthen negotiations and provides clarity on what offers are reasonable.

How Will the Leasehold and Freehold Reform Act Affect Costs?

The Leasehold and Freehold Reform Act, passed in 2024, is expected to reshape leasehold property law in the UK significantly. The key expected outcomes include:

- Abolition of marriage value from lease extension calculations

- Standardisation of lease extensions to 990 years

- Zero ground rent on extended leases

- Simpler and cheaper processes for leaseholders

While these changes have been approved in principle, their rollout will occur in phases over the next few years. The government outlined implementation milestones in a statement released in November 2024, with full implementation projected by 2026.

Until the reforms are active, leaseholders extending short leases under the current system will continue to face marriage value costs and more complex negotiations. Those with leases close to 80 years must weigh the risk of waiting against the potential future savings from reform.

What Are the Next Steps for Leaseholders Considering an Extension?

Extending the lease on a flat can be a complex but manageable process if approached in the right order. Leaseholders should be aware of the necessary steps and the timing involved to avoid unexpected delays or costs. This section outlines a practical roadmap for navigating the lease extension journey.

Assessing the Remaining Lease Term

The very first step is to check how many years are left on the lease. This can usually be found in the original lease document or obtained through a solicitor or conveyancer. If the lease term is nearing or below 85 years, it’s important to act quickly.

Once the lease drops under 80 years, the cost to extend increases sharply due to the inclusion of marriage value, which represents half the uplift in the property’s value after a lease extension.

Lenders are also less likely to approve mortgages on short leases. Therefore, timing plays a crucial role in avoiding inflated costs or limited financing options.

Estimating Potential Costs

Before engaging professionals, leaseholders should try to get a rough idea of what the lease extension might cost. Online calculators, such as those provided by the Leasehold Advisory Service and HomeOwners Alliance, can be useful starting points. These tools ask for basic details like the flat’s value, remaining lease term, and current ground rent.

Although these calculators only give indicative figures, they help set realistic expectations and prepare financially. A better understanding of the likely range also helps in conversations with surveyors and solicitors.

Appointing a Valuation Surveyor

Once preliminary estimates have been considered, the next formal step is to hire a valuation surveyor. This professional calculates the lease extension premium based on statutory guidelines and market conditions.

A qualified surveyor considers factors such as the current value of the flat, ground rent terms, and how the lease length affects property value.

The surveyor will prepare a report that is crucial during negotiations and, if necessary, for tribunal proceedings. Costs typically fall within the £600 to £900 range and are paid by the leaseholder.

It’s important to ensure the surveyor is experienced in leasehold valuations and ideally a member of the Royal Institution of Chartered Surveyors (RICS).

Instructing a Lease Extension Solicitor

At this stage, leaseholders should also appoint a solicitor with specific expertise in lease extensions. The solicitor’s role includes reviewing lease terms, preparing legal notices, negotiating with the freeholder, and registering the new lease. Legal fees for the leaseholder generally range from £800 to £1,300.

A good solicitor will also assist in deciding whether to follow an informal route or begin a statutory lease extension. They will explain the implications of each option and ensure all procedures are compliant with current law. It is essential to appoint someone who regularly handles lease extensions, as general property lawyers may not have the required expertise.

Choosing Between Informal and Statutory Lease Extensions

The route you choose can significantly affect both cost and outcome. An informal lease extension involves direct negotiation with the freeholder. This route can be quicker and less rigid, but it comes with the risk of less favourable terms, such as retaining or increasing ground rent.

Alternatively, a statutory lease extension under the Leasehold Reform Act 1993 guarantees a 90-year addition to the current lease and reduces ground rent to zero.

However, it requires that the leaseholder has owned the property for at least two years. The statutory process provides stronger legal protections but is more procedural and time-sensitive.

Your solicitor will advise you on the route best suited to your situation, often based on the freeholder’s reputation and willingness to negotiate reasonably.

Serving the Section 42 Notice (Statutory Route)

For leaseholders choosing the statutory path, the next step is serving a formal Section 42 Notice to the freeholder. This legal document sets out your request to extend the lease and your proposed premium. It triggers a set timeline that the freeholder must follow, including responding with a Counter Notice (Section 45) within two months.

Failure to meet deadlines on either side can affect the leaseholder’s rights or delay the process. A solicitor ensures that the notice is accurate, valid, and served correctly. If the freeholder does not respond or negotiations stall, the matter can be taken to the First-tier Tribunal for determination.

Preparing for Negotiations or Tribunal Proceedings

In most cases, negotiations proceed smoothly following the service of notices. The leaseholder and freeholder, supported by their respective surveyors and solicitors, agree on a premium and terms. If this does not happen, the leaseholder can apply to the First-tier Tribunal to resolve the matter.

The tribunal will assess the evidence provided, including the valuation reports, and decide on a fair premium. Although this route offers a final resolution, it adds additional time and cost, so it’s generally seen as a last resort.

Registering the New Lease

Once terms are agreed and documents are signed, the final step is to register the extended lease with HM Land Registry. This is a formal requirement and ensures the new lease term and zero ground rent are recorded on the title. The solicitor usually manages this process and pays a small registration fee on the leaseholder’s behalf.

Registration secures the legal status of the extended lease and completes the process. Once this is done, the property is more marketable, more valuable, and more easily financed, benefiting the leaseholder in both the short and long term.

Conclusion

The question of how much it costs to extend a lease on a flat in the UK has no one-size-fits-all answer. Each case depends on the lease length, property value, and whether the extension follows a statutory or informal route.

While reforms may reduce future costs, leaseholders close to the 80-year mark should consider acting now. By understanding the cost structure and seeking expert guidance, leaseholders can make informed decisions that protect both their property’s value and future marketability.

FAQs About Lease Extensions in the UK

How long does it take to extend a lease?

The process typically takes between three and six months but can take longer if disputes arise or tribunal intervention is needed.

Can I extend my lease without the freeholder’s agreement?

You have the legal right to a lease extension under the Leasehold Reform Act 1993 if you’ve owned the property for at least two years. This is known as a statutory lease extension.

What happens if my lease drops below 80 years?

Once the lease falls below 80 years, marriage value is factored into the premium, increasing the cost of extension significantly.

Is it cheaper to negotiate informally?

Sometimes. Informal agreements can avoid tribunal fees, but they might result in less favourable terms, such as continued ground rent.

Do I need to live in the property to extend the lease?

No, you only need to have owned the property for at least two years. Occupancy is not required.

Can I include lease extension costs in a mortgage?

Potentially. Some lenders allow remortgaging or additional borrowing to fund lease extensions, but this depends on the lender’s criteria.

What is the difference between statutory and informal lease extensions?

Statutory extensions offer legal protection and reduce ground rent to zero, while informal agreements vary and may retain or increase ground rent.