In July 2025, major reforms have come into effect impacting UK pensioners born after 1951. These changes involve revised calculations for contracted-out National Insurance years and a continuing freeze on personal tax allowances.

As a result, many retirees are seeing lower state pension payments and higher tax liabilities. Understanding the implications of these adjustments is crucial for those planning their retirement finances.

This blog explores what has changed, who is most affected, and how pensioners can respond effectively.

What Has Changed for UK Pensioners Born After 1951?

In July 2025, the UK pension system underwent critical changes that are particularly affecting individuals born after 1951. These changes are altering both how state pensions are calculated and how they are taxed.

Two central shifts are having the greatest financial impact:

- The reassessment of contracted-out National Insurance (NI) years

- The continued freeze on the personal tax-free income allowance despite pension increases from the triple lock

These adjustments have caught many pensioners off-guard, particularly those who were anticipating full state pension entitlements based on the number of qualifying years they have contributed.

How Are Contracted-Out National Insurance Years Being Reassessed?

The UK’s state pension system has undergone multiple reforms, but one of the most complex and consequential changes for post-1951 pensioners is the reassessment of contracted-out National Insurance (NI) years.

This refers to a system where employees paid lower NI contributions in exchange for reduced state pension entitlements, usually because they were building up workplace or occupational pensions instead of earning entitlement to the Additional State Pension (formerly known as SERPS).

Historical Background

Between 1978 and 2016, millions of employees across the public and private sectors were enrolled in contracted-out schemes. During these years:

- Employees paid reduced NI contributions

- In return, they built up pension benefits in a separate occupational or personal pension

- The state reduced their additional state pension (SERPS/S2P) entitlement accordingly

This arrangement was meant to offer workers flexibility, particularly in sectors with generous occupational pension provisions. However, it created a two-tier pension system, and understanding the impact of contracted-out years has long been a challenge.

The 2025 Reassessment

In July 2025, the Department for Work and Pensions (DWP) implemented a revised formula for how contracted-out years are deducted from an individual’s new state pension entitlement.

Previously, many pensioners could expect minor deductions that were fairly predictable. But under the new approach, deductions are being recalculated more stringently, based on:

- The length of time spent in contracted-out schemes

- The NI contribution record compared to a hypothetical “full” career in the state pension system

- How much private or occupational pension income is assumed to have replaced the additional state pension

As a result, many individuals are seeing significant reductions in their state pension, even if they believed they had sufficient qualifying years.

Impact on Pension Income

For someone who spent a significant portion of their working life in a contracted-out scheme—common among NHS staff, civil servants, teachers, and many private sector workers—the reduction can be substantial.

- A retiree with 35 qualifying years, but 15 years contracted out, may find that their weekly pension is reduced by £10 to £20

- This equates to between £520 and £1,040 less income per year than originally anticipated

These reductions are not always clearly explained in pension forecasts, causing confusion and financial shock for many pensioners when they begin claiming their benefits.

Why This Matters Now?

Although contracted-out deductions have existed since the 2016 introduction of the new state pension, the 2025 changes tighten the criteria, making the system less forgiving to pensioners who were not fully informed of the long-term effects.

The reassessment is affecting pensioners born between 1952 and 1960 the most, as they were active in the workforce during the bulk of the contracted-out period and are now entering or currently in retirement. For these individuals, a discrepancy of even £15 per week can have a significant effect on annual income and budgeting in retirement.

Why Is the Tax Allowance Freeze Hurting Retirees?

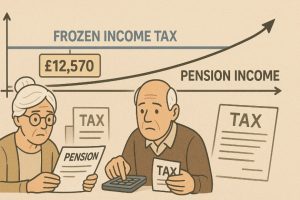

While contracted-out deductions lower the state pension amount for some, the freeze in the personal tax-free allowance has introduced a separate and growing problem: taxation of state pensions.

Despite inflation and rising living costs, the personal income tax allowance in the UK has remained fixed at £12,570 since the 2021/22 tax year.

At the same time, the triple lock mechanism continues to increase state pensions. This is leading to a scenario where the pension itself grows to meet or even exceed the tax-free threshold, pushing pensioners into tax brackets without their income necessarily increasing in real terms.

The Triple Lock Mechanism

The triple lock ensures that the state pension increases each April by the highest of:

- Inflation (as measured by CPI)

- Average earnings growth

- 2.5%

For example, due to the high inflation and earnings growth in 2023 and 2024, the new state pension rose to £236.90 per week, or £12,319 annually in 2025. This increase, though welcome, brings many pensioners within £250 of breaching the tax-free threshold with their state pension alone.

If they have any additional income—from an occupational pension, personal pension drawdown, interest on savings, or part-time employment—they cross into taxable income territory.

Real-World Financial Consequences

Let’s consider a common retirement scenario in 2025:

- A pensioner receives the new state pension: £12,319/year

- They also have an occupational pension: £9,443/year

- Total income: £21,762/year

- Tax-free allowance: £12,570

- Taxable income: £9,192

- Estimated tax owed: Over £1,800 annually

Despite the increase in pension income, the actual take-home pay is reduced because of tax deductions. For many pensioners, especially those living on tight budgets, this is a frustrating development, as they feel penalised for receiving what should be a fair pension.

Frozen Thresholds Amid Rising Costs

This freeze on the tax allowance is particularly problematic because it has not kept pace with:

- Inflation, which continues to affect essential costs like energy and food

- The rising cost of living, especially in urban and southern UK areas

- Growth in state pension income due to the triple lock

As a result, a policy designed to protect older citizens through pension increases is being undermined by a parallel policy that draws more of that income into the tax system.

Who is Impacted Most?

This tax burden affects pensioners differently depending on their income sources:

- Pensioners with no other income apart from the state pension may remain below the threshold

- Those with modest private or occupational pensions are most likely to exceed it and pay tax

- Pensioners with significant retirement savings already expected to be taxed, but now face higher tax bills due to inflation-related pension growth

Even basic savings interest or part-time earnings can tip a retiree into the taxable bracket, meaning careful financial planning is now more critical than ever.

Who Is Most Affected by These 2025 Pension Changes?

The pension reforms introduced in July 2025 are not affecting all UK pensioners equally. While anyone born after 1951 may experience changes in their retirement income, the severity of the impact depends on a combination of factors, including year of birth, employment history, the type of pension scheme they participated in, and overall income levels.

By examining these variables, it becomes clear that certain age groups and income brackets are more exposed to the financial downsides of these changes than others.

Age-Based Impact

The most affected individuals tend to fall within the 1952 to 1960 birth cohort. These pensioners are either newly retired or in the early years of retirement, placing them at the centre of both major policy changes:

- Revised contracted-out deductions, which apply retrospectively to years worked between 1978 and 2016

- The ongoing freeze of the personal income tax allowance, while pension amounts continue to rise due to the triple lock

Many of these pensioners had long, stable careers, often in the public sector, where contracted-out pension arrangements were common. As a result, they are now being penalised with reduced state pensions, despite having paid National Insurance for the full qualifying period.

Occupational Background

Those who worked in sectors with strong occupational pension schemes are especially affected by the reassessment of contracted-out years. This includes:

- NHS workers

- Teachers

- Civil servants

- Local government employees

- Workers in large private corporations with defined benefit pension plans

These individuals were often automatically enrolled in contracted-out schemes and may not have fully understood the long-term impact on their state pension entitlements. Even with complete NI records, many are finding that their weekly state pension is lower than the full amount due to deductions linked to their past pension arrangements.

Financial Position

Another key factor is overall retirement income. Pensioners with mixed income streams, including private pensions, part-time earnings, or investment income, are being disproportionately affected by the freeze on the personal income tax allowance.

While the triple lock has increased the new state pension to £12,319 per year in 2025, any supplementary income can easily push a retiree above the £12,570 tax-free threshold, resulting in tax liabilities that many did not anticipate.

This scenario is especially problematic for pensioners with:

- Small or medium-sized occupational pensions (£6,000–£12,000 annually)

- Interest-generating savings

- Part-time or seasonal employment income

- Spousal income that affects household tax banding

For many of these retirees, being classified as a taxpayer means seeing their real retirement income shrink, even though their pension figures on paper are increasing.

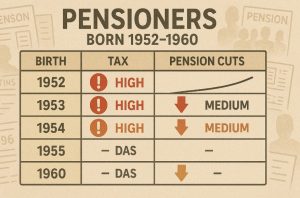

Comparative Impact by Birth Cohort

| Birth Cohort | Contracted-Out Pension Deduction | Tax Burden from Allowance Freeze | Overall Financial Impact |

| 1952–1955 | High | Moderate | Severe |

| 1956–1960 | Moderate | High | Severe |

| Post-1960 | Low to Moderate | Low to Moderate | Emerging |

As shown in the table, pensioners born between 1952 and 1955 are most affected by deductions linked to contracted-out NI years, while those born between 1956 and 1960 are seeing higher tax liabilities as their total pension income exceeds the unchanged personal allowance threshold.

Those born after 1960 may not yet be drawing pensions, but they are expected to face similar or worse challenges unless tax thresholds and deduction policies are revised in the future.

Gender and Employment Gaps

Women who took career breaks for caregiving or part-time work may face added disadvantages.

Although changes to the state pension have aimed to create parity, gaps in NI contributions and time spent in contracted-out part-time roles can result in a reduced pension.

Combined with the stricter deduction policies in 2025, many women are receiving significantly less than the full state pension, even with decades of work.

What Can Pensioners Do to Protect Their Retirement Income?

Although the pension policy changes are fixed for now, pensioners can take certain steps to lessen the financial impact.

Review Your State Pension Forecast

Use the government’s pension service to:

- Check your NI contribution history

- Identify shortfalls or deductions

- Understand how many qualifying years are being counted

Knowing your current forecast allows you to plan and potentially increase your future income.

Top-Up National Insurance Contributions

If gaps are found in your NI record, it may be possible to pay voluntary Class 3 contributions. These payments can:

- Add to your qualifying years

- Raise your weekly state pension amount

- Be a cost-effective investment when compared to the income gained

Apply for Pension Credit

Pension Credit is an underutilised benefit that could be valuable for those whose income has dropped due to the recent changes. Eligibility depends on total weekly income and whether you have a partner. It can also unlock access to other support services such as:

- Housing Benefit

- Free TV licences (for over-75s)

- Warm Home Discount Scheme

Speak to a Financial Adviser or Tax Specialist

Tailored advice can help pensioners make better use of their income and minimise tax liability. Options may include:

- Deferring part of your state pension

- Drawing from other retirement savings in a tax-efficient manner

- Spreading income between partners if applicable

Planning becomes more crucial as thresholds remain static and costs continue to rise.

Conclusion

UK pensioners born after 1951 are facing an unprecedented dual impact lower pensions due to stricter National Insurance assessments and rising tax burdens due to frozen thresholds.

While these changes may seem complex and even unfair, being informed is the first step toward financial resilience. By understanding your entitlements, taking strategic action, and exploring all available supports, you can better manage your retirement income in this evolving policy landscape.

FAQs About UK Pension Changes Post-1951

What is the new full state pension amount in 2025?

The full new state pension in 2025 is £236.90 per week, or approximately £12,319 annually, based on the triple lock increase.

Can I still receive a full state pension if I was contracted out?

Yes, but the amount may be reduced depending on the number of years you were contracted out and your total National Insurance record.

How can I check how much state pension I will receive?

You can use the government’s official pension forecast service on the Gov.uk website to see your estimated pension and NI contribution history.

Why is more of my pension income now taxable?

The state pension has increased under the triple lock, but the personal tax-free allowance has been frozen. This means more of your income now exceeds the threshold.

What is Pension Credit and who can claim it?

Pension Credit is a means-tested benefit for people over state pension age with low income. It can top up your weekly income and unlock other entitlements.

Will the government increase the tax allowance for pensioners?

Although there are calls to raise the personal tax allowance for retirees, no official announcement has been made as of July 2025.

Can deferring my state pension reduce my tax burden?

Yes. Deferring your state pension can increase your future weekly amount and help avoid immediate tax liabilities, especially if you’re still earning income from other sources.