Living at home with your parents is increasingly common, especially with the rising cost of living in the UK.

But when it comes to financial support, particularly Universal Credit, many people wonder whether their living arrangements affect their eligibility.

This guide provides clear and factual information on whether you can claim Universal Credit while living with your parents, and what factors determine your entitlement.

What Is Universal Credit and Who Can Apply?

Universal Credit is a monthly payment introduced by the UK government to help people who are on a low income or are out of work.

It was developed to replace six legacy benefits, including Income Support, Housing Benefit, and Jobseeker’s Allowance.

The aim is to simplify the benefits system and offer a more streamlined way for individuals and households to access support.

To apply for Universal Credit, the applicant must:

- Be aged 18 or over (some exceptions apply for those aged 16 or 17)

- Be under State Pension age

- Reside in the UK

- Have less than £16,000 in savings and investments

The support is available to people in various circumstances, including those who are unemployed, employed on a low income, self-employed, or unable to work due to a disability or health condition.

Eligibility may also vary for EU, EEA, or Swiss citizens, who are generally required to have settled or pre-settled status under the EU Settlement Scheme.

Does Living With Parents Affect Universal Credit Eligibility?

Living with parents does not automatically disqualify someone from claiming Universal Credit, but it can influence the amount received.

The Department for Work and Pensions (DWP) treats adults over the age of 18 as separate claimants, even if they live with family.

However, certain components of Universal Credit, such as the housing element, may not apply.

Universal Credit is based on individual circumstances, not the entire household, unless the person is claiming jointly with a partner.

Parents’ income is not factored into the calculation, unless they provide financial support or the claimant is classed as a dependent.

Claimants who live with their parents are generally not considered liable for rent, which means they are unlikely to receive the housing costs component unless there is a formal rental agreement in place.

Can I Get the Housing Element of Universal Credit While Living With My Parents?

The housing element of Universal Credit is designed to assist with rent payments. However, individuals living with their parents are unlikely to qualify for this component because they typically do not pay rent under a legal agreement.

For the housing element to apply:

- The claimant must be responsible for paying rent under a recognised tenancy agreement

- The arrangement must not be informal (i.e., giving money to parents without a tenancy contract)

In most cases, if a person is not legally liable for rent, this part of the benefit will not be paid. This rule is consistent across the UK and helps ensure that housing support is directed toward those with a legal rental obligation.

The table below outlines eligibility for the housing element based on living arrangements:

| Living Arrangement | Eligible for Housing Element? | Notes |

| Living with parents, no rent | No | Informal contributions are not counted as rent |

| Living with parents, formal rent | Possibly | Must have a tenancy agreement and pay rent regularly |

| Renting privately | Yes | Requires proof of rental payments |

| Living in supported accommodation | Yes | May be eligible for housing benefit or special arrangements |

How Does Parental Income Impact My Universal Credit Claim?

Parental income is not directly included in the calculation for Universal Credit if the applicant is over 18 and is claiming in their own right. However, it can have indirect implications depending on the living and financial arrangements within the household.

Individual vs. Household Eligibility

Universal Credit is generally calculated based on the claimant’s personal circumstances or, if applicable, their partner’s income and savings.

It does not typically consider the income of other adults in the household such as parents, unless there is a joint claim or financial dependency.

For example, if a young adult lives with their parents but pays for their own living costs, their claim is assessed independently.

However, if they rely on their parents for financial support, the DWP may question whether they truly need Universal Credit.

Regular Financial Support from Parents

Occasional support from parents, such as paying for groceries or occasional travel, is not treated as income. However, regular financial contributions that significantly reduce living costs may be considered.

If a parent gives a fixed amount of money to the claimant on a weekly or monthly basis, and this support continues over time, it could be interpreted as income.

This might not necessarily reduce the award to zero, but it could reduce the overall payment depending on the amount.

Impact on Housing Element

Parental income is particularly relevant if the claimant is requesting the housing element of Universal Credit.

If the individual is not legally responsible for rent and is living in a household where parents cover all housing expenses, the DWP will not provide any support for housing costs.

Even if the claimant gives money to their parents as a contribution, this must be backed by a formal rental agreement for it to qualify under Universal Credit rules.

What Happens If I’m Under 25 and Live With My Parents?

Young people under 25 face slightly different treatment under the Universal Credit system, particularly in relation to standard allowance rates and access to additional elements.

Reduced Standard Allowance for Under 25s

Universal Credit includes different payment rates depending on the claimant’s age. Individuals under the age of 25 receive a lower standard monthly allowance than those aged 25 and over.

The justification from the government is that younger individuals are more likely to live with parents and have fewer financial responsibilities.

Here’s an example of current standard allowance amounts (subject to updates):

| Age Group | Standard Monthly Allowance |

| Single under 25 | £311.68 |

| Single 25 or over | £393.45 |

| Couple both under 25 | £489.23 (combined) |

| Couple, one or both over 25 | £617.60 (combined) |

This lower amount applies even if the claimant is fully financially independent. It’s important for under-25s to be aware of this before making a claim.

Housing Element Limitations

Claimants under 25 living with parents are generally not eligible for the housing costs element of Universal Credit.

The DWP assumes that they are not paying rent in a formal capacity. As such, no housing support is granted unless they can demonstrate a tenancy agreement and responsibility for rent payments.

If a young person is living in a shared flat or rented accommodation and has legal responsibility for paying rent, they may be eligible for housing support.

But in the case of living at home, this is unlikely unless special arrangements have been made.

Exceptions for Vulnerable Young People

There are exceptions in place for young people who may be vulnerable or have special circumstances.

Universal Credit rules allow certain groups under 25 to receive the higher rates or qualify for additional elements.

These include:

- Care leavers aged 18 to 21

- Those without parental support

- Young people responsible for a child

- Those with a disability or health condition who are assessed as having limited capability for work

In these cases, the standard age-based restrictions may not apply, and additional financial support may be available.

Can I Claim Universal Credit if I’m a Student Living With My Parents?

Full-time students are usually not eligible for Universal Credit, but there are some important exceptions.

If a student lives with their parents but meets one of the following conditions, they may still be able to claim:

- They are under 21, studying non-advanced education, and do not receive parental support

- They are responsible for a child

- They live with a partner who is eligible and they are applying as a couple

- They have a disability or health condition and have been assessed as having limited capability for work

- They have received a Migration Notice instructing them to move to Universal Credit

Students in part-time education may also be eligible, particularly if they are not receiving student finance.

Those receiving disability benefits such as Personal Independence Payment (PIP) may have more flexibility in their eligibility.

To claim, students typically need to demonstrate that they meet the criteria and that their course does not interfere with job-seeking or work commitments, unless they are exempt.

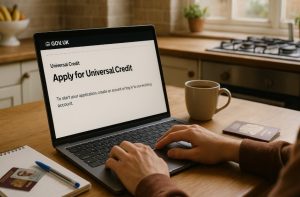

How Do I Apply for Universal Credit if I Live at Home?

The application process for Universal Credit remains the same, regardless of whether a person lives with their parents or independently. The process begins with creating an online account through the GOV.UK Universal Credit portal.

Applicants must:

- Complete an online form with personal and financial information

- Provide documentation, including ID and National Insurance number

- Confirm their living arrangements

- Attend an appointment at the local Jobcentre, if required

It’s important to be honest about living circumstances, especially if the individual contributes to household costs or receives any financial help from family. These details can affect the assessment of the claim, even if only slightly.

While applicants living with parents may not receive housing support, they may still be entitled to the standard allowance and any other applicable elements, such as child or disability-related components.

Are There Any Alternatives to Universal Credit for People Living With Parents?

Although Universal Credit is the primary support for those on a low income, other benefits and support may also be available depending on the claimant’s circumstances.

Some individuals may qualify for additional help such as:

- Personal Independence Payment (PIP) – for those with a long-term health condition or disability

- Carer’s Allowance – for individuals who care for someone receiving a disability-related benefit

- Council Tax Reduction – even if living with parents, local authorities may offer discounts on council tax

- Budgeting Advances – available to those already on Universal Credit, to help with emergency expenses

In some cases, a claimant may be advised to stay on an existing benefit, such as Pension Credit, instead of transitioning to Universal Credit. This is especially true for those who have reached State Pension age or who have received a Migration Notice.

Local charities and housing associations may also provide financial support or advice, especially for those living in multi-generational households where formal tenancy arrangements are not in place.

Conclusion

Living with your parents doesn’t automatically disqualify you from claiming Universal Credit. Your eligibility depends on factors like your age, employment status, education, health, and financial independence.

If you’re not financially supported by your parents and meet the basic eligibility criteria, you can still claim Universal Credit — although you may not receive housing support.

It’s always wise to use a benefits calculator or speak with a welfare advisor to fully understand your entitlements.

Frequently Asked Questions

Can I claim Universal Credit if my parents are supporting me financially?

If your parents are covering your expenses, this could reduce or negate your eligibility. Universal Credit is designed to support those in financial need, so parental support may be considered.

Do I need to pay rent to claim Universal Credit while living at home?

Only if you have a formal tenancy agreement. Informal contributions don’t qualify for the housing element.

Will my Universal Credit be higher if I move out from my parents’ house?

Possibly. If you move into rented accommodation and pay rent, you may be eligible for the housing element, which can increase your Universal Credit payment.

Can I claim Universal Credit as a student if I don’t get parental support?

Yes, especially if you’re under 21 and studying below university level, or if you have children or a disability.

What happens to my Universal Credit if I live with a partner?

You must make a joint claim. Your combined income and savings will determine the amount you’re eligible for.

Do 16- and 17-year-olds qualify for Universal Credit?

Yes, but only in specific cases such as having a child, a disability, or lacking parental support.

Can I still claim other benefits while on Universal Credit?

Some benefits like PIP or Carer’s Allowance can be claimed alongside Universal Credit, but others may be replaced by it. Check individual benefit compatibility.