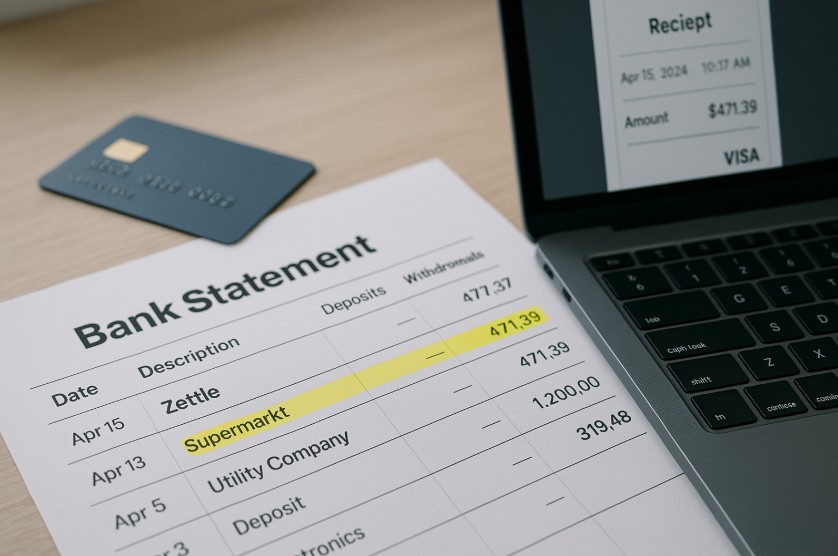

When checking your bank statement, you may come across a transaction labelled as “Zettle” followed by a business name.

This often raises concerns, especially if the name isn’t immediately recognisable. But what exactly is Zettle, and why is it showing up on your bank account?

Zettle by PayPal is a Point of Sale (POS) system used by thousands of small and medium-sized businesses across the UK to accept card and contactless payments.

If you’ve made a purchase from a shop, café, market stall, or even a service provider recently, there’s a strong chance they used a Zettle card reader to process the payment.

Why Does ‘Zettle’ Show Up on a Bank Statement?

A Zettle charge on a bank statement indicates a payment made through a business’s Zettle by PayPal point-of-sale (POS) system.

These transactions often appear with the label “Zettle * [Business Name]”, making it easier for consumers to identify the source of the charge.

Zettle acts as a third-party payment processor. When a business accepts a card payment using Zettle, the funds are collected by Zettle first, and then transferred to the merchant’s bank account.

The system provides both the hardware and software that facilitate seamless payments, primarily for small and medium-sized enterprises.

It’s common for consumers to forget a purchase or not associate the “Zettle” name with a business they visited. This confusion usually arises when:

- The business name is shortened or unfamiliar on the statement

- A purchase was made at a pop-up stall, local market, or mobile vendor

- A card was used to pay for services like grooming, home repair, or tuition

Understanding the way Zettle labels transactions helps consumers reconcile their statements quickly and avoid unnecessary bank disputes.

Who Typically Uses Zettle for Transactions in the UK?

Zettle has gained significant popularity across the UK, especially among small to medium-sized enterprises (SMEs) and self-employed professionals who need a reliable, flexible, and cost-effective point-of-sale (POS) system. It caters to a wide range of industries, from retail and hospitality to service-based businesses and mobile vendors.

The simplicity of Zettle’s setup, combined with its ability to process contactless, chip and PIN, and mobile wallet payments (like Apple Pay and Google Pay), has made it a go-to solution for thousands of independent businesses across the UK.

Retail Sector

Independent retailers form one of the largest groups using Zettle in the UK. These include:

- Boutique clothing stores

- Local gift shops

- Bookshops

- Pop-up retail stands

- Artisan food and drink vendors

For retailers, Zettle offers more than just payment collection. It provides inventory tracking, real-time sales analytics, and integration with accounting tools like QuickBooks and Xero. This makes it particularly useful for shops that want to manage both sales and stock from one system without investing in expensive POS infrastructure.

Hospitality and Food Services

Zettle is also widely adopted in the hospitality and food service sectors due to its portability and ease of use in busy environments. Some common examples include:

- Cafés and coffee shops

- Bakeries and patisseries

- Food trucks and street food vendors

- Casual restaurants and small eateries

- Market-based food stalls

These businesses benefit from Zettle’s ability to handle fast-paced transactions, support for tipping, and compatibility with receipt printers and cash drawers. Its intuitive interface also reduces the learning curve for staff, which is helpful in seasonal or high-turnover businesses.

Health and Beauty Services

Health and beauty professionals often work in fixed premises or travel to clients, making Zettle a practical solution for collecting payments wherever the service takes place. Frequent users include:

- Hairdressers and barbers

- Beauty therapists

- Nail technicians

- Massage therapists

- Personal trainers

Because Zettle operates through a mobile app, professionals can pair it with a smartphone or tablet and take payments immediately after a session. This eliminates the need to chase invoices or accept cash, streamlining the payment process for both client and provider.

Mobile and On-the-Go Professionals

Freelancers and tradespeople who operate on the move also benefit from Zettle’s compact design and functionality. This group includes:

- Plumbers, electricians, and handymen

- Cleaners and home service providers

- Gardeners and landscapers

- Pet groomers and trainers

- Driving instructors

Zettle allows these professionals to accept payments on-site, often directly after completing a job. Not only does this improve cash flow, but it also adds professionalism and convenience to their service offering. Additionally, customers often appreciate the flexibility of being able to pay by card without needing to visit an ATM.

Event-Based and Seasonal Vendors

Businesses and entrepreneurs who operate seasonally or during specific events have found Zettle to be a flexible solution that doesn’t require long-term contracts or ongoing maintenance. These users include:

- Festival and fair vendors

- Art and craft stallholders

- Farmers’ market sellers

- Charity fundraisers

- Christmas market businesses

Because Zettle has no monthly fees and charges only per transaction, it’s ideal for those who don’t operate year-round. Merchants can set up their card reader and start accepting payments with minimal technical expertise or upfront investment.

Non-Profit Organisations and Community Projects

Zettle is increasingly being adopted by non-profit organisations and community-based projects that collect donations or sell merchandise during events or campaigns. Its simple pricing structure and mobile compatibility make it ideal for organisations with limited resources or part-time volunteers.

Charities and fundraisers use Zettle for:

- Collecting on-the-spot donations

- Selling promotional goods or tickets

- Accepting membership fees or entry charges

Because the reader works with smartphones and tablets, volunteers can carry it around easily during walks, events, or pop-up fundraisers.

Startups and Entrepreneurial Ventures

Startups and newly launched ventures often opt for Zettle because it removes the barrier of costly hardware and software. Entrepreneurs with limited resources can accept payments from day one, track revenue, and begin growing their brand with a fully functional POS system.

Common startup use cases include:

- Subscription box businesses doing local events

- Tech product stalls

- Food startups testing new menu items

- New wellness brands selling direct to consumers

This flexibility supports business experimentation and growth without long-term financial commitments.

How Does Zettle Work with My Bank Account?

When you make a purchase using a debit or credit card through a Zettle card reader, the transaction is processed via Zettle’s secure payment system.

Your bank deducts the payment and routes it through Zettle, which temporarily holds the funds before forwarding them to the merchant’s bank account.

The full transaction process involves several steps:

- The customer pays using their card or mobile wallet on a Zettle terminal

- Zettle verifies and authorises the transaction

- The payment is deducted from the customer’s account

- Zettle initiates a payout to the merchant within one to two business days

For the customer, the transaction appears almost instantly on their bank account. However, the merchant may receive the funds after a short processing period.

Zettle’s ability to facilitate quick, secure payments is what makes it appealing for small business owners.

The table below outlines the key parties and processes involved in a Zettle transaction:

| Step | Party Involved | Action Taken |

| 1 | Customer | Makes a card payment |

| 2 | Zettle | Processes and authorises transaction |

| 3 | Customer’s Bank | Deducts amount from customer account |

| 4 | Zettle | Holds funds temporarily |

| 5 | Merchant’s Bank | Receives transferred payment |

In many cases, customers may not realise Zettle is involved because the payment experience is seamless and fast.

Is Zettle a Safe and Legitimate Payment Provider?

Zettle is a PayPal-owned company and operates under strict regulatory compliance, including authorisation by the Financial Conduct Authority (FCA) in the UK.

This means that both consumers and merchants are protected under existing financial laws.

Security features offered by Zettle include:

- End-to-end encryption during every transaction

- Tokenisation to protect card data

- Secure sign-in and two-factor authentication for business accounts

As a consumer, your bank will still provide standard protections, such as fraud monitoring and dispute resolution, in the event of an unauthorised charge.

Businesses using Zettle also benefit from secure merchant accounts, reliable payment reconciliation, and access to detailed reporting.

All hardware provided by Zettle is PCI-DSS compliant, ensuring a high level of data protection.

What Are the Common Fees Associated with Zettle?

Zettle charges a standard fee to merchants for each transaction, but consumers are not typically charged anything extra when making payments.

For businesses, this makes it simple to plan finances around sales, as there are no complex pricing models or hidden charges.

Here is an overview of the common fees related to Zettle for business users:

| Fee Type | Description | Cost (Approx.) |

| Card Transaction Fee | Charged per card or contactless payment | 1.75% |

| Refund Processing | Refunded amount returned to customer | Free for customers |

| Monthly Subscription | Not required for basic usage | £0 |

| Hardware Cost (Card Reader) | One-time purchase cost | Around £29–£59 |

Zettle may occasionally offer promotions or volume-based discounts for high-volume sellers. For the customer, the transaction is treated as a regular purchase, with no additional service or convenience charges applied.

How Can I Verify a Zettle Charge on My Statement?

If you find a Zettle charge that you don’t immediately recognise, a few steps can help confirm the payment:

- Look at the date and compare it with recent activity

- Check the amount and try to match it with any small businesses or vendors visited

- Review your receipts or emails for confirmation of payment

- Consider any one-off events like markets, expos, or fairs

Sometimes the business name listed after “Zettle” is abbreviated or appears differently from its branding. A café called “The Artisan Coffee Company” may show up as “Zettle * Artisan Co” or something similar.

If there’s still confusion, contacting your bank can help reveal more details about the transaction, such as merchant category or location. Banks may also assist in initiating a refund or dispute if necessary.

Can I Dispute or Refund a Zettle Transaction?

While most Zettle transactions are legitimate, there are situations where a dispute or refund may be required. This can happen if:

- A duplicate transaction occurs

- You are charged the wrong amount

- The product or service received is unsatisfactory

- You do not recognise the charge at all

Consumers can usually seek refunds by contacting the merchant directly. If the issue cannot be resolved, a formal dispute can be raised through the bank or card issuer.

The refund process for a Zettle payment follows the standard procedure for card transactions. Once a refund is issued, it may take several working days for the funds to reflect in your account. Businesses receive a notification within the Zettle dashboard when a refund is processed.

What Alternatives to Zettle Might Appear on Bank Statements?

Several other point-of-sale systems are commonly used by UK businesses. These may also result in unfamiliar entries on your statement.

Recognising the naming format of these providers can help reduce confusion when reviewing transactions.

Here’s a comparison of Zettle and its competitors:

| Provider | Statement Format | Popular Users | Fee Structure |

| Zettle | Zettle * Business Name | Market stalls, salons, cafés | 1.75% per transaction |

| Square | SQ * Merchant Name | Small retailers, service providers | 1.75% per transaction |

| SumUp | SumUp * Business Name | Freelancers, tradespeople | 1.69% per transaction |

| Stripe | STRIPE * Merchant | Online stores, tech startups | 1.4% + 20p UK cards |

All of these services operate similarly, but their branding and fee models may differ slightly. For consumers, the overall experience remains largely the same: fast, digital, and secure transactions.

How Can Businesses Remove Confusion About Zettle Charges?

To prevent customer disputes and chargebacks, businesses using Zettle should ensure their transaction details are clear and identifiable.

Many misunderstandings stem from generic or shortened merchant names in the transaction label.

Simple practices to improve transaction clarity include:

- Registering the full business name in the Zettle account

- Including contact details or website on digital and printed receipts

- Notifying customers that payments will appear as “Zettle * [Business Name]”

- Using consistent branding across digital and in-store channels

These steps can reduce confusion, increase trust, and minimise the risk of chargebacks or refund requests.

When Should I Be Concerned About a Zettle Transaction?

Although most Zettle transactions are routine, certain signs may indicate a problem or potential fraud:

- Multiple charges for a single transaction

- Payments appearing without your knowledge

- Purchases from unfamiliar businesses in unknown locations

If any of these occur, contact your bank immediately. They may place a hold on your account to prevent further transactions and help with investigating the charge. It’s also advisable to check if your card has been used elsewhere without authorisation.

Taking swift action ensures your funds remain protected and any misuse is addressed promptly.

Conclusion

A Zettle charge on your bank statement is usually nothing to worry about it simply means you paid a business that uses Zettle’s POS system.

It’s a secure, regulated service backed by PayPal and widely used across the UK.

However, if a charge seems unfamiliar, take steps to verify it. Check your recent purchases, look up the business, or speak to your bank.

Awareness of how payment processors like Zettle work can give you peace of mind and help avoid confusion in future.

FAQs About Zettle on Bank Statements

What is Zettle by PayPal and how does it function?

Zettle is a POS system that lets businesses accept card and contactless payments using mobile card readers. It processes payments securely and transfers funds to merchants’ accounts.

Why does Zettle take money from my account?

Because you’ve made a purchase with a business that uses Zettle, the amount is debited via their platform and will appear as a Zettle transaction.

How long does it take Zettle to deposit funds?

For businesses, Zettle deposits funds within 1–2 working days. For consumers, the payment is usually reflected in the account immediately.

What kind of businesses use Zettle in the UK?

Independent retailers, cafes, salons, market traders, and mobile professionals commonly use Zettle to accept payments.

Can a fraudulent transaction show as Zettle?

Yes, if someone uses your card with a Zettle terminal without your permission. Always monitor your account and report suspicious activity immediately.

How do I identify a legitimate Zettle payment?

Check the date, amount, and merchant name on your bank statement. Match it to any recent purchases or contact the business listed.

What do I do if I don’t recognise a Zettle charge?

Contact your bank to investigate. If needed, dispute the charge or freeze your card to prevent further issues.