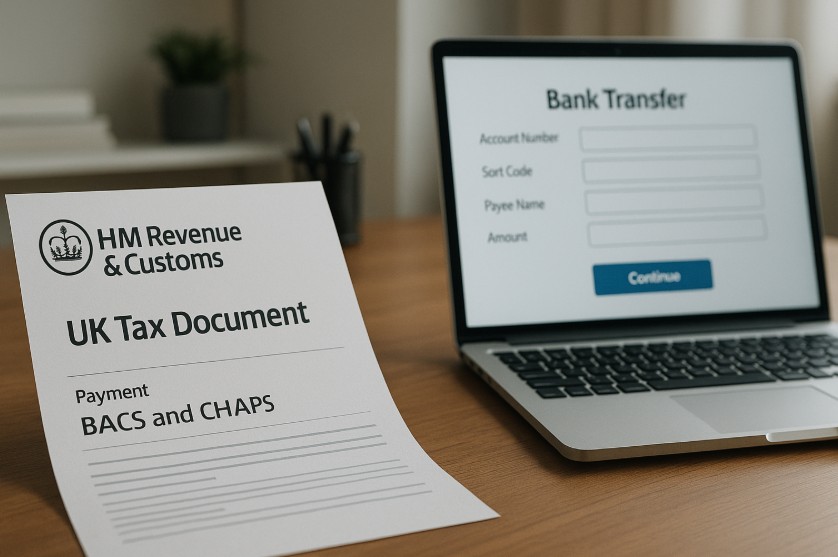

When paying HM Revenue and Customs (HMRC), especially for Self Assessment tax, using the correct bank details is essential. A simple error in account number, sort code, or reference could delay your payment, resulting in penalties or interest charges.

For individuals and businesses submitting payments via BACS, CHAPS, or Faster Payments, understanding which HMRC bank account to use such as the Cumbernauld or Shipley account, is critical.

This guide provides verified bank details for the HMRC Cumbernauld account and explains the differences between payment methods, timelines, and references required for smooth processing.

What Are The Correct HMRC Cumbernauld Bank Details For BACS And CHAPS?

When paying HM Revenue and Customs (HMRC), using the correct bank details is crucial to ensure your payment reaches the right account quickly and without delays. For taxpayers paying into the HMRC Cumbernauld account, the following details must be used:

HMRC Cumbernauld (UK Payments)

- Sort code: 08 32 10

- Account number: 12001039

- Account name: HMRC Cumbernauld

HMRC Shipley (Alternate UK Payments)

- Sort code: 08 32 10

- Account number: 12001020

- Account name: HMRC Shipley

If your HMRC bill does not specify which account to use, you may pay into either account. Including the correct reference is more important than which account you choose.

Your 11-character payment reference is required for all transactions. This is your 10-digit Unique Taxpayer Reference (UTR) followed by the letter K.

How Do You Pay HMRC Using BACS, CHAPS, Or Faster Payments?

UK taxpayers can make HMRC payments directly from their bank using the following methods:

- Online bank transfer through your banking app or website

- Telephone banking with your bank

- In-branch bank transfer

Each payment method varies in processing times and is suitable for different situations.

Comparison Of HMRC Payment Methods

| Payment Method | Processing Time | Suitable For | Notes |

| Faster Payments | Same day or next day | Most personal tax payments | Available 24/7 including weekends |

| CHAPS | Same working day | Large or urgent tax payments | Must be sent during bank working hours |

| BACS | 3 working days | Employers or scheduled payments | Best used ahead of deadlines |

Faster Payments is the most common and efficient option, while CHAPS is often used for high-value or urgent transfers.

Can You Make Multiple Payments Towards Your Self Assessment Bill?

Taxpayers may make multiple payments towards their Self Assessment bill before the deadline. This helps with managing cash flow and spreading payments over time.

When splitting payments:

- Ensure each payment has the correct 11-character payment reference

- Check your HMRC online account to confirm allocations

- Keep payment confirmations for your records

Multiple payments without correct references can delay the processing of your tax account.

What Is The Processing Time For Each HMRC Payment Method?

Understanding how long it takes for HMRC to receive and process your payment is crucial to avoid unnecessary penalties or interest charges. The processing time depends heavily on the payment method used and whether it was made during standard banking hours.

HMRC recognises several types of bank payments for settling Self Assessment tax bills, including Faster Payments, CHAPS, BACS, and international bank transfers. Each has a distinct processing timeframe, and choosing the wrong method close to a deadline could result in your payment being considered late.

1. Faster Payments

Faster Payments is a widely used method among individual taxpayers due to its speed and flexibility. Most major UK banks support Faster Payments, and they are typically processed:

- On the same day or next day

- 24/7 availability, including weekends and bank holidays

- Funds are usually received by HMRC within 2 hours

Because of its efficiency and availability, Faster Payments is often recommended when making payments close to the Self Assessment deadline. However, some banks impose limits on the amount that can be transferred via Faster Payments.

2. CHAPS (Clearing House Automated Payment System)

CHAPS is designed for high-value or time-sensitive payments. It guarantees same-day delivery of funds, but only if the payment is made before the bank’s daily cut-off time, which typically ranges between 2 pm and 4 pm.

- Same-day delivery if submitted during working hours

- Not available on weekends or bank holidays

- Often used by businesses or accountants handling large sums

- May incur higher banking fees

CHAPS is a reliable option for urgent payments, but it’s important to confirm your bank’s internal deadline and charges before initiating a transfer.

3. BACS (Bankers’ Automated Clearing Services)

BACS payments are primarily used by employers and businesses for payroll and regular payments. While secure, BACS is the slowest of the standard UK payment methods:

- Takes 3 full working days from submission to processing

- Not recommended close to tax payment deadlines

- Ideal for scheduled payments made well in advance

If you opt for BACS, plan ahead to avoid late fees. It’s best used by those who manage tax payments as part of a broader financial workflow.

4. International Bank Transfers

For overseas taxpayers, international transfers may take longer depending on the country of origin, banking systems involved, and the currency exchange process:

- Typically takes 3 to 7 working days

- May be subject to intermediary bank delays

- Time zone differences can also impact processing time

- Some international payments are routed through multiple banks, adding to potential delays

To avoid missed deadlines, it’s advisable to send international payments at least one week before the tax due date. Also, confirm with your bank whether the amount will be sent and received in pounds sterling (GBP), as this is required by HMRC.

Processing Times For HMRC Payment Methods

| Payment Type | Typical Timeframe | Available On Weekends |

| Faster Payments | Same day or next day | Yes |

| CHAPS | Same working day | No |

| BACS | 3 working days | No |

| International Transfers | 3 to 7 working days | Depends on origin |

If you’re ever in doubt about whether your payment will reach HMRC on time, use Faster Payments or CHAPS for a more predictable and timely delivery. Always retain payment confirmation and check your HMRC online account for receipt verification.

What Are The HMRC Bank Details For Overseas Payments?

When making payments from outside the UK, use the following international bank details. Payments must be made in pounds sterling (GBP).

HMRC Cumbernauld (International Payments)

- IBAN: GB62 BARC 2011 4770 2976 90

- BIC (SWIFT code): BARCGB22

- Account name: HMRC Cumbernauld

HMRC Shipley (International Payments)

- IBAN: GB03 BARC 2011 4783 9776 92

- BIC (SWIFT code): BARCGB22

- Account name: HMRC Shipley

Some overseas banks charge additional fees for currency conversion or international transfers. Confirm these costs with your provider to ensure the full tax amount is received by HMRC.

What Should You Include As Your Payment Reference To HMRC?

When making a payment to HMRC, the payment reference is one of the most important elements of the transaction. Without the correct reference, your payment may not be applied to your account, which can lead to penalties, confusion, or a notice of unpaid tax.

What Is The Correct Reference Format?

For Self Assessment tax payments, your reference should be:

- Your 10-digit Unique Taxpayer Reference (UTR)

- Followed by the letter “K”

Example: If your UTR is 1234567890, your reference should be:

1234567890K

This 11-character reference must be entered exactly as shown, with no spaces, dashes, or additional characters.

Where Can You Find Your UTR?

Your UTR is issued by HMRC when you register for Self Assessment. It can be found in several places:

- Your HMRC online account (under the Self Assessment section)

- Your welcome letter from HMRC

- On any previous Self Assessment tax return documents

- On paper payment slips issued by HMRC

- On correspondence or notices to file a return

If you cannot find your UTR, you can retrieve it by logging into your HMRC account or contacting HMRC directly. It’s important not to guess or use a temporary number.

Why Is The Payment Reference So Important?

Using the correct payment reference ensures:

- HMRC applies the payment to the correct tax year and correct individual or business

- You avoid penalties for non-payment or underpayment

- Your tax account remains up to date in real-time

If the reference is missing or incorrect, the payment may go into HMRC’s suspense account. This means it is not linked to your tax account until you contact HMRC and provide supporting information, which can delay resolution.

Common Mistakes To Avoid

To prevent issues, be careful not to:

- Use the wrong UTR (for example, a VAT UTR instead of a Self Assessment UTR)

- Leave out the K at the end

- Include spaces or punctuation in the reference

- Use someone else’s UTR if paying on their behalf

If you’re making a payment on behalf of someone else, such as a spouse or client, ensure you use their UTR reference, not your own.

What If You Made A Mistake?

If you’ve already sent a payment with the wrong or missing reference, you should:

- Call HMRC’s Self Assessment payment helpline

- Provide details of the payment including date, amount, and bank details used

- Have proof of the transaction ready (bank statement or payment confirmation)

In most cases, HMRC can reassign the payment, but this may take time and could affect your payment history.

How Do You Make A CHAPS Payment For Multiple Self Assessment Bills?

Taxpayers or businesses needing to pay several Self Assessment bills at once can use CHAPS to send a single transfer. HMRC provides a CHAPS Enquiry Form to allocate funds across multiple references.

Guidelines:

- Fill in all relevant UTRs and amounts

- Submit the CHAPS Enquiry Form through HMRC’s official website

- Keep records of submission and transfer confirmations

This process ensures payments are allocated correctly across multiple tax accounts.

What Is The Full Banking Address For HMRC Payments?

Some banks, especially overseas institutions, may require the full bank address to set up a transfer. HMRC uses Barclays Bank for its Cumbernauld and Shipley accounts.

Barclays Bank PLC

1 Churchill Place

London

United Kingdom

E14 5HP

Providing this address helps ensure international payments are processed smoothly.

What Happens If You Send Your HMRC Payment Late Or To The Wrong Account?

Late or misdirected payments can result in:

- Penalty charges

- Interest on unpaid amounts

- Delays in processing your tax account

If an error occurs, contact HMRC immediately and provide:

- Proof of payment

- Bank details used

- Reference number included

HMRC can manually allocate payments in some cases, but this may take time and does not guarantee avoidance of penalties.

How Do You Contact HMRC For Payment-Related Queries?

Taxpayers can contact HMRC for help with payments through several channels:

- Self Assessment Payment Helpline: 0300 200 3822

- Online support forms via GOV.UK

- Webchat available on the HMRC website

Phone lines tend to be busiest near deadlines, so online contact methods are often faster.

Conclusion

Making a payment to HMRC whether via BACS, CHAPS, or Faster Payments requires attention to detail. From choosing the right account (Cumbernauld or Shipley) to using the correct UTR and understanding processing times, each step ensures your tax obligations are met without unnecessary penalties.

Always refer to GOV.UK for the latest bank details and instructions, and ensure your payment is made on time and accurately.

FAQs about Paying HMRC via Bank Transfer

How do I know which HMRC account to pay Cumbernauld or Shipley?

If your HMRC bill specifies a location, use the details for that office. If it doesn’t, you may use either Cumbernauld or Shipley accounts. The payment will still be processed correctly with the right reference.

Can I pay HMRC by debit card or credit card?

HMRC no longer accepts personal credit card payments. You can pay by debit card or corporate credit card through their online portal, but bank transfer is preferred for high-value payments.

What is the best time to make a Faster Payment to HMRC?

You can make a Faster Payment any time, including weekends and holidays. However, if you’re close to the deadline, aim for early in the day to avoid same-day processing cut-offs.

How do I correct a wrong payment reference?

If you’ve used the wrong reference, contact HMRC with your payment details. They may be able to manually allocate the payment to your account after verification.

Can I set up a standing order to pay HMRC?

Yes, particularly useful for spreading your tax bill across the year. Ensure each payment includes your correct reference and is timed well ahead of the Self Assessment deadline.

Do I get a confirmation when HMRC receives my payment?

Not automatically. You can check your payment status in your HMRC online account. Some banks offer confirmation of receipt, but HMRC doesn’t send separate notifications.

Can I pay from a joint bank account?

Yes. As long as the correct payment reference is used, HMRC does not require the bank account to be in the taxpayer’s name.