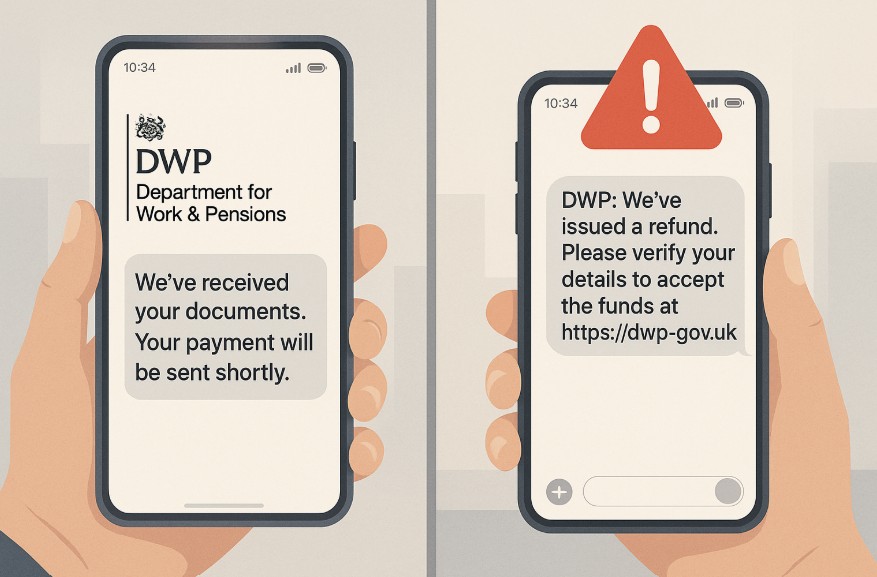

With the rise of digital communication, so too has there been a rise in fraudulent activity. Recently, the Department for Work and Pensions (DWP) has had to issue public warnings about scam text messages, some falsely claiming to offer energy support or financial aid.

These messages often appear legitimate, using branding, tone, and language that mimic official communication.

This blog investigates whether DWP sends text messages, how to recognise genuine messages, and what to do if you suspect a scam.

What Is the DWP and How Do They Usually Contact People?

The Department for Work and Pensions (DWP) is the UK government body responsible for administering state welfare and pension services. It oversees benefits like Universal Credit,

Jobseeker’s Allowance, Personal Independence Payment, and State Pension. Because of the sensitive nature of its communications, the DWP uses official and secure channels to contact the public.

DWP primarily contacts individuals through:

- Official letters by post containing reference numbers and identifiers

- Phone calls from known or recorded DWP numbers

- Emails using GOV.UK verified addresses

- Occasionally, text messages for confirmations or reminders

Text messages from the DWP are typically only sent when an individual has engaged with the department directly.

These include reminders about Jobcentre appointments or updates regarding benefit claims. Importantly, DWP messages do not request personal financial information, passwords, or log-in credentials.

Does the DWP Really Send Text Messages?

The DWP has confirmed that it does send text messages under certain circumstances.

These messages are most often used to provide helpful updates regarding existing claims or benefits, and are only sent when there is a clear connection between the recipient and a previous interaction with DWP.

Genuine DWP messages:

- May confirm a Universal Credit journal entry

- Might remind a claimant of a Jobcentre appointment

- Can provide a notification when a benefit has been approved or updated

However, DWP text messages will never:

- Offer cash support or benefits out of context

- Request personal details like full name, date of birth, bank details, or National Insurance number

- Contain shortened or unverified links

- Ask for payment or log-in credentials

The department has stated that it will not communicate about schemes such as energy bill support through unsolicited texts. Any such message should be treated with caution and verified independently.

What Are the Signs of a Scam Text Claiming to Be from the DWP?

Scam messages that claim to be from the Department for Work and Pensions (DWP) are increasingly common, and fraudsters are becoming more sophisticated in how they present these texts.

These messages often appear legitimate at first glance, which is exactly what scammers intend. They may use official-looking branding, formal language, and even mimic known DWP contact numbers.

However, there are clear warning signs that can help you determine whether a text message is genuine or fraudulent. Recognising these signs is key to protecting your personal and financial information.

1. Unexpected Message with No Prior Interaction

If you receive a text message from the DWP without having made a recent benefit claim, appointment booking, or communication with the department, this should be treated as a red flag.

The DWP does not initiate communication through text without a clear context or a prior request from the recipient.

2. Offers That Sound Too Good to Be True

Scam texts often try to lure recipients with promises of easy money or government-backed support.

A common example includes messages claiming you’re eligible for an “Energy Support Scheme” or a one-off payment due to cost-of-living adjustments.

While such schemes may exist, they are not communicated through random unsolicited text messages.

3. Requests for Sensitive Information

Legitimate DWP messages will never ask you to provide or confirm personal or financial information via text. This includes:

- Bank account numbers

- Sort codes

- National Insurance numbers

- Passwords or PINs

- One-time passcodes

Any message asking for these details should be assumed fraudulent and deleted immediately.

4. Suspicious or Unverified Web Links

Many scam texts include a hyperlink, often shortened or disguised, directing the recipient to a fraudulent website that mimics GOV.UK or DWP portals. These websites are designed to harvest personal information or distribute malware.

To stay safe:

- Avoid clicking any links in unsolicited messages

- Check that web addresses end in .gov.uk

- Navigate to GOV.UK manually by typing the URL into your browser rather than using a link in a message

5. Urgent or Threatening Language

Scammers frequently use emotional manipulation to create a sense of panic or urgency. A message may claim your benefits will be suspended, or your payment is delayed unless you respond immediately.

This pressure tactic is designed to reduce your ability to think clearly and verify the information.

Phrases like:

- “Act now to avoid suspension”

- “Final notice: respond within 24 hours”

- “Your payment is at risk”

are typical of scam messages and not part of standard DWP communication.

6. Grammar or Spelling Mistakes

Professional government communication goes through thorough quality checks and is unlikely to contain poor grammar or spelling errors.

Scam messages, on the other hand, often originate from overseas and may feature awkward phrasing, missing punctuation, or capitalisation issues.

Examples of suspicious phrases include:

- “You are eligible to recieve suport payment”

- “Gov-dept needs your info URGENT”

- “Click hear to verify benefits”

These kinds of errors are often subtle, but they’re reliable indicators that the message is not legitimate.

7. Unfamiliar or International Numbers

DWP messages typically originate from short codes, or in some cases, named sender IDs like “DWP” or “Jobcentre.”

Scam messages, however, may come from long mobile numbers, spoofed caller IDs, or numbers that include international dialling codes.

If you do not recognise the number and it doesn’t align with previous DWP contact, it should raise suspicion.

Table: Comparison of Genuine vs Scam DWP Text Messages

| Criteria | Genuine DWP Message | Scam Text Message |

| Source | Official DWP short code or verified mobile number | Unknown or spoofed number |

| Language and Tone | Professional and informative | Urgent, threatening, or overly persuasive |

| Links | To gov.uk or no links at all | Shortened or strange-looking URLs |

| Requests for Information | None via text | Asks for personal or financial details |

| Context | Related to a known benefit claim or contact | Out of the blue with no prior engagement |

Always assess whether the message relates to something you’re expecting. If not, do not engage.

How Can You Verify If a DWP Text Message Is Genuine?

There are several steps that can help determine whether a message from the DWP is authentic. These verification methods help safeguard against fraud and phishing attempts.

- Visit the GOV.UK website and search for any information relating to the message you received. Official alerts are often published for common scams.

- Contact the DWP directly using a verified number found on official letters or the GOV.UK website.

- Avoid clicking any link in a suspicious message. If a URL looks odd or leads to a site asking for personal details, it’s likely fraudulent.

- Check the message’s tone. Legitimate DWP messages are straightforward and lack emotional or high-pressure language.

Additionally, if a message mentions a claim or service you haven’t recently interacted with, it should immediately raise suspicion.

What Should You Do If You Receive a Suspicious DWP Message?

Acting promptly and cautiously can make a significant difference when dealing with a potential scam message.

If you believe you’ve received a suspicious text:

- Do not reply to the message under any circumstances

- Do not click on any links contained within it

- Forward the message to 7726, the spam text reporting service used by UK mobile networks

- Report the message to the National Cyber Security Centre via their suspicious email reporting form

- Contact your bank or financial institution if you suspect any details may have been compromised

These steps help the authorities track scams and reduce their reach. Reporting suspected fraud can also help protect others.

What Is “Stop! Think Fraud” and How Does It Help Protect You?

“Stop! Think Fraud” is a UK government-backed initiative aimed at educating the public about fraud prevention.

It focuses on the importance of pausing before acting on any unexpected message, whether by email, phone or text.

Key components of the campaign include:

- Encouraging individuals to take a moment before responding to urgent requests

- Highlighting the signs of phishing, spoofing, and deepfakes

- Promoting the use of two-step verification (2SV) on email and bank accounts

The campaign website explains that no one is immune from fraud. Criminals often use impersonation and emotional triggers to manipulate people into revealing personal information or making quick decisions.

How Can You Protect Yourself from DWP-Related Scams?

Preventative measures are the most effective defence against scams. These steps reduce your vulnerability to digital fraud and make it more difficult for cybercriminals to access sensitive data.

Recommended steps include:

- Activating two-step verification (2SV) or multi-factor authentication (MFA) on key accounts

- Creating strong, unique passwords and updating them regularly

- Limiting the amount of personal information shared online

- Being sceptical of any message that requests immediate action, especially involving money

Online security settings, particularly on banking and government-related platforms, often include tools that allow users to be notified of any attempted login or unusual activity. Make sure these are turned on.

Is Fraud in the UK Really That Common?

Fraud has become one of the most significant criminal issues facing the UK. The digitisation of services and communication has made it easier for scammers to reach large numbers of people quickly.

According to the Crime Survey for England and Wales, ending June 2024:

- Fraud accounted for nearly 41% of all crime reported

- 1 in 15 adults were victims of fraud within a one-year period

- The majority of these frauds occurred online or via digital channels

This data underscores the importance of awareness campaigns and enhanced digital literacy. It is not just elderly or vulnerable individuals being targeted.

Scammers now use advanced technology to exploit users across all age groups and demographics.

What Are the Most Common Tactics Used by DWP Text Scammers?

DWP-related scams employ various social engineering techniques. Recognising these methods makes it easier to spot fraudulent messages before damage is done.

Table: Scam Tactics and Their Typical Usage

| Tactic | Description |

| Impersonation | Criminals pose as government officials using DWP logos and wording |

| Urgency and Deadlines | Recipients are told to act quickly or risk losing benefits |

| Emotional Triggers | Messages may exploit fear or promise help to manipulate victims |

| Scarcity Claims | Fraudsters suggest limited-time offers to increase panic and fast action |

| Redirected Payments | Instructions to send money to an alternate account before receiving support |

Other common tactics include the use of hyperlinks that mimic GOV.UK domains or fake phone calls claiming to follow up on a message.

Understanding these behaviours and the red flags they raise is crucial in preventing fraud. The more informed individuals are, the less likely they are to fall victim to such tactics.

Conclusion

While the Department for Work and Pensions does send legitimate text messages under certain circumstances, it never asks for personal or financial information via text.

If you receive a message that seems suspicious, especially if it promises money or demands urgency it is likely a scam.

The best protection is vigilance. Always verify the source, avoid clicking links, and report suspicious activity.

By following guidance from the “Stop! Think Fraud” campaign, individuals can stay informed and significantly reduce the risk of falling victim to fraud.

FAQs About DWP Text Messages and Scams

How can I tell a DWP message is real?

Genuine DWP messages are usually linked to an existing benefit claim or appointment and will never ask for bank or personal details.

What does a genuine DWP text message look like?

It may include appointment reminders or claim status updates and will reference known information relevant to your case.

Is it safe to click links in a DWP text message?

It is best not to click on links. Instead, visit GOV.UK directly and search for relevant information to confirm the message.

Can I call the DWP to confirm if a message is real?

Yes, contact the DWP using the numbers listed on their official GOV.UK pages to verify any communication.

What do I do if I clicked on a scam DWP text?

Run antivirus scans on your device, update passwords, and contact your bank. Also report the incident to Action Fraud and the NCSC.

Are energy support texts from DWP legitimate?

No. DWP has confirmed it is not sending text messages offering energy support. These are scams.

What steps should I take to secure my accounts after a scam?

Enable 2-step verification, update your passwords, and monitor your financial accounts for unusual activity.