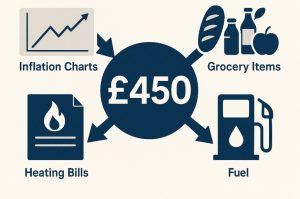

The UK Government has announced a new £450 Cost of Living Payment for 2025 to support low-income households amid ongoing financial pressures.

Delivered by the Department for Work and Pensions (DWP), this one-off payment will be made automatically to millions of eligible benefit claimants. As with previous cost of living support, no application is necessary.

Understanding who qualifies, how and when the payment is made, and why it matters is essential for anyone relying on government assistance.

What Is The DWP £450 Cost Of Living Payment And Why Is It Being Issued In 2025?

The DWP £450 Cost of Living Payment is a one-time financial support initiative from the UK Government that aims to assist individuals and households affected by rising living costs.

This payment is part of a continued effort to provide relief to those receiving low-income or means-tested benefits.

The cost of living crisis has persisted through inflationary pressures and high energy costs, and the government has responded with phased financial support since 2022.

The 2025 payment builds on this framework, offering a direct payment to eligible individuals without requiring a new application.

The £450 payment will be disbursed by the Department for Work and Pensions, directly into the bank accounts of those who meet the qualifying criteria during a specific eligibility window. It will not be taxed and does not affect other benefit entitlements.

Who Is Eligible For The £450 DWP Cost Of Living Payment In 2025?

Eligibility for the 2025 payment is linked to the receipt of one or more of the following income-based benefits:

- Universal Credit

- Income-Based Jobseeker’s Allowance (JSA)

- Income-Related Employment And Support Allowance (ESA)

- Income Support

- Pension Credit

- Working Tax Credit (in some cases)

- Child Tax Credit (in some cases)

Recipients of contributory or New Style ESA or JSA alone are not eligible unless they also receive a qualifying income-related benefit.

In households where benefits are claimed jointly, only one payment of £450 will be made. Eligibility is determined by entitlement during the specified qualifying dates, which the government announces before the payment rollout.

When Will The £450 Cost Of Living Payment Be Paid And How Will It Be Received?

The Department for Work and Pensions has confirmed that the £450 cost of living payment will begin distribution from 6 May 2025.

Payments will not be issued all at once but will be processed in batches to ensure system stability and accurate delivery.

The payment will be:

- Deposited automatically into the bank or building society account used for regular benefit payments

- Identified on bank statements using a reference such as “DWP COL”

- Non-taxable and excluded from income calculations for other benefits

No application is required. Anyone who qualifies will receive the payment directly as long as their benefit was active during the eligibility window.

What Benefits Qualified For Cost Of Living Payments From 2022 To 2024?

From 2022 to 2024, the government issued multiple cost of living payments in response to inflation and energy price hikes. Each round of payments had specific eligibility periods linked to benefit entitlements.

The table below outlines these past payments for Universal Credit recipients:

Universal Credit Cost Of Living Payments (2022–2024)

| Amount | Eligibility Period | Payment Dates |

| £326 | 26 April – 25 May 2022 | 14 – 31 July 2022 |

| £324 | 26 August – 25 September 2022 | 8 – 23 November 2022 |

| £301 | 26 January – 25 February 2023 | 25 April – 17 May 2023 |

| £300 | 18 August – 17 September 2023 | 31 October – 19 November 2023 |

| £299 | 13 November – 12 December 2023 | 6 – 22 February 2024 |

For recipients of income-based JSA, ESA, Income Support and Pension Credit, the eligibility periods were the same, but the payment timing might have varied slightly.

Tax Credit claimants who did not receive qualifying benefits from DWP were paid separately by HMRC. If an individual received both tax credits and a DWP benefit, payment was generally made by DWP only.

Why Some People Might Not Receive The £450 Cost Of Living Payment?

Not every benefit recipient automatically qualifies. The most common reason for ineligibility is what is known as a nil award, where the benefit amount is reduced to zero during the qualifying period.

This might occur due to:

- An increase in earnings or savings

- A temporary change in household circumstances

- Receipt of overlapping benefits

- A sanction for breaching a claimant commitment

In some situations, a person may still be eligible despite receiving no payment during the window. For example, if deductions were made from benefits for rent arrears or loan repayments, or if they received a hardship payment, eligibility might still apply.

For tax credits, a person is ineligible if their entitlement for the year was below £26.

What Should You Do If You Think Your Cost Of Living Payment Is Missing?

While the majority of payments will be processed smoothly, there may be instances where eligible individuals do not receive the £450 Cost of Living Payment within the expected timeframe. If you believe you qualify but haven’t seen the payment appear in your bank account, it is important to follow a structured approach to identify and resolve the issue.

Check Your Eligibility Status Carefully

Before taking any action, it’s important to confirm that you met all the criteria during the qualifying period. The most common reason for not receiving a payment is ineligibility due to a nil award, a change in circumstances, or timing of a benefit award.

You should:

- Review the qualifying dates and compare them with your benefit statements.

- Confirm that your benefits were active during the required assessment period.

- Ensure your entitlement wasn’t reduced to zero due to changes in income, savings, or sanctions.

If you only became entitled to a benefit after the qualifying dates, or if your benefit was awarded retrospectively, the payment may be issued at a later stage.

Review Your Bank Or Building Society Account

Sometimes, payments are received but may not be recognised due to unfamiliar transaction references. The Department for Work and Pensions (DWP) typically includes references like “DWP COL” or “HMRC COL” for Cost of Living Payments.

Steps to follow:

- Check your account activity from the date payments started (from 6 May 2025).

- Search for any unfamiliar deposits around the expected amount.

- Look into your benefit statement history for payment confirmation notices.

If you recently changed your bank account and did not update it with DWP or HMRC, the payment may have failed or been delayed.

Wait Until The Full Payment Window Has Passed

Payments are staggered, meaning not everyone will receive them on the first day. This is normal and helps the DWP manage high transaction volumes across millions of claimants.

You should:

- Allow a minimum of two weeks after the payment start date (6 May 2025).

- Avoid panicking if others receive their payment earlier than you.

In most past cases, the majority of eligible claimants received their payments within 14 to 21 days from the official launch.

Contact The Appropriate Benefit Office

If you’ve reviewed your eligibility and waited beyond the stated payment window, the next step is to contact the government department responsible for your benefits. This will vary depending on whether you receive Universal Credit, Pension Credit, or Tax Credits.

You should:

- Reach out to DWP if your qualifying benefit is Universal Credit, Income Support, Pension Credit, ESA, or JSA.

- Contact HMRC if you receive Working Tax Credit or Child Tax Credit and do not receive DWP-administered benefits.

Before contacting support:

- Have your National Insurance number, benefit claim details, and bank statement ready.

- Be prepared to confirm personal information for security reasons.

Stay Alert To Scams And Fraudulent Messages

Cost of Living Payments are made automatically, and neither DWP nor HMRC will ever contact you to request bank details, make payments manually, or charge a processing fee.

To stay safe:

- Do not respond to emails, texts, or phone calls asking for personal or financial details.

- Always verify messages through the official GOV.UK website.

- Report suspicious communications to Action Fraud UK.

Scammers often exploit government support announcements, so maintaining vigilance is essential during the payment period.

Consider Recent Changes In Circumstances

If you have recently:

- Moved to a new address

- Changed your bank account

- Reported changes in income or employment status

- Added or removed household members from your benefit claim

Any of these changes may temporarily disrupt payment schedules. It’s advisable to update your benefit office with your latest personal and financial details to ensure accurate and timely processing.

Use Online Tracking Or Enquiry Tools Where Available

HMRC and DWP sometimes offer tracking or enquiry tools through the GOV.UK portal for payment status updates. While these are not always available for every benefit type, they may assist in confirming:

- Whether the payment was issued

- If there are any known processing delays

- Next steps if the payment is still pending

These tools are accessible through your Universal Credit online journal or through your HMRC online account if you’re a tax credit recipient.

What Are The Additional Cost Of Living Payments For Disabled Individuals?

In addition to general support, the government provided two separate £150 Disability Cost of Living Payments between 2022 and 2023. These were issued to individuals receiving certain disability-related benefits.

Eligible benefits included:

- Disability Living Allowance (Child or Adult)

- Personal Independence Payment

- Attendance Allowance

- Armed Forces Independence Payment

- War Pension Mobility Supplement

- Adult or Child Disability Payment in Scotland

- Constant Attendance Allowance

These payments were made automatically to those who had received a qualifying benefit by the specified cut-off date. Even if the benefit was awarded after the date but was backdated, the payment would still be processed.

Disability Cost Of Living Payment Schedule

| Payment Date Range | Eligibility Date | Notes |

| 20 June – 4 July 2023 | 1 April 2023 | Paid by DWP |

| 20 Sept – Early Oct 2022 | 25 May 2022 | Paid automatically to qualifying cases |

If a person was eligible under both DWP and Ministry of Defence systems, the payment was typically made by DWP only.

How Does The Pensioner Cost Of Living Payment Differ From Other Support Payments?

Pensioners have received separate cost of living assistance in the form of an additional top-up to their Winter Fuel Payment during the winters of 2022–2023 and 2023–2024.

This payment did not affect the eligibility or amount of the standard £450 cost of living payment. It was an added financial buffer for elderly individuals during colder months, especially important due to increased energy costs.

The exact amount received depended on:

- The age of the pensioner

- Whether they lived alone or with others

- Whether others in the household also qualified

The full amount was issued alongside the standard Winter Fuel Payment.

Winter Fuel And Pensioner Support Breakdown (2023–2024)

| Circumstance | Total Payment Amount |

| Born before 26 Sept 1942, living alone | Up to £600 |

| Born between 26 Sept 1942 and 24 Sept 1957 | £500 – £600 |

| Living with another qualifying pensioner | £250 – £350 each |

The amounts varied slightly depending on individual or household configurations. Like other support payments, this was also automatic and non-taxable.

Conclusion

The DWP £450 Cost of Living Payment in 2025 is a vital part of the government’s continued commitment to easing financial burdens on low-income households across the UK.

With payments starting from 6 May 2025, and automatic eligibility for those on key benefits, millions stand to benefit from this one-off support measure.

As with previous payments, there is no application process, and claimants should be vigilant against scams.

Anyone concerned about eligibility or delayed payments should contact the office responsible for their benefits using official GOV.UK channels.

FAQs

Can I receive the £450 payment if I recently started receiving Universal Credit?

If your Universal Credit claim includes the eligibility period for the payment, you may still receive it. If awarded after the official window, the payment may be delayed but will still be processed automatically.

Is the £450 payment taxable or reportable for other benefits?

No, the payment is not taxable and does not count towards income when calculating entitlement for other benefits.

What should I do if I changed my bank account recently?

If you’ve changed the account into which you receive benefits, ensure DWP or HMRC has your updated details to avoid delays. Payments will go to the last account on record.

Will I receive multiple £450 payments for multiple qualifying benefits?

No, you will receive only one £450 payment even if you qualify under more than one benefit.

What if I live abroad but receive a UK benefit?

Generally, the cost of living payment is for UK residents. If you live abroad, you may not qualify unless specific circumstances apply.

Are students eligible for the cost of living payment?

Students can qualify if they receive one of the eligible benefits, such as Universal Credit, during the qualifying period.

How can I confirm if a payment I received is the £450 support payment?

You can check your bank statement for a payment reference that usually includes “DWP COL” or “HMRC COL.” If unclear, contact your benefit office.