Determining how old a car must be to qualify for tax exemption in the UK is an important consideration for classic vehicle owners.

With changing regulations and a reinstated rolling 40-year rule, understanding eligibility requirements is essential.

This guide outlines the Vehicle Excise Duty (VED) exemption process, how to apply for historic status with the DVLA, and what responsibilities remain even when a vehicle becomes tax exempt. Whether you own a vintage car or plan to buy one, this information is crucial.

What Is Vehicle Tax Exemption In The UK And How Does It Work?

In the UK, Vehicle Excise Duty (VED), often referred to as road tax, is a legal requirement for most vehicles using public roads.

However, certain vehicles can qualify for exemption from this tax, particularly those considered historic.

Historic vehicles are typically defined as being at least 40 years old and preserved in their original or near-original state.

Once approved as historic, the vehicle becomes exempt from paying road tax, although owners are still required to renew their tax status annually.

Tax exemption is not automatic. Vehicle owners must apply through the DVLA and meet specific criteria before being granted the “Historic” vehicle status.

When Did The 40-Year Tax Exemption Rule Come Into Effect?

Prior to 1997, vehicles manufactured before 1 January 1973 were eligible for tax exemption under a fixed system. This policy was frozen in 1997, leaving many classic car owners unable to claim exemptions.

In 2015, the UK Government reintroduced a rolling 40-year exemption policy. Under the new scheme, each financial year sees new vehicles becoming eligible based on the rule that the car must have been manufactured more than 40 years before 1 January of that year.

Here is how the rolling rule currently works:

| Tax Year | Vehicles Eligible for Exemption |

| 2024-2025 | Built before 1 January 1984 |

| 2025-2026 | Built before 1 January 1985 |

| 2026-2027 | Built before 1 January 1986 |

Owners must apply for tax exemption starting from 1 April of the relevant year.

How Do You Determine If Your Car Qualifies As A Historic Vehicle?

Determining whether a car qualifies as a historic vehicle in the UK depends on a combination of age, authenticity, and modification history.

The Driver and Vehicle Licensing Agency (DVLA) defines a historic vehicle as one that was manufactured more than 40 years ago and has not undergone substantial alterations. However, confirming eligibility involves more than simply checking the registration date.

Key Criteria For Qualification

Manufacture Date, Not Registration Date

The DVLA bases historic vehicle status on the date the vehicle was built, not the date it was first registered. This distinction is important, especially for cars that may have been imported or registered long after production. If your logbook (V5C) does not clearly state the manufacture date, you may be required to submit evidence from:

- The original manufacturer

- An approved vehicle owners’ club

- A heritage certificate or dating letter

Rolling 40-Year Rule

The rolling exemption means that each year on 1 April, vehicles built more than 40 years before 1 January of that same year become eligible for tax exemption. For example, in 2025, only vehicles manufactured before 1 January 1985 will qualify.

Substantial Modifications

To qualify as a historic vehicle, the car must not have been substantially modified in the last 30 years. According to DVLA guidelines, a vehicle is considered substantially changed if it no longer reflects its original technical characteristics. This could include:

- A different type or size of engine

- Major changes to suspension, brakes, or chassis

- Alterations to the bodywork or structure

The DVLA uses a point-based system to assess modifications, where exceeding certain thresholds may disqualify the vehicle from historic status.

Vehicle Type and Use

The rule applies to a variety of vehicle types, including:

- Cars

- Motorcycles

- Vans and light commercial vehicles

- Buses and coaches

However, the vehicle must be used in a manner consistent with its historic status. Using a historic vehicle for commercial purposes, for example, could lead to removal of the exemption.

Verification By The DVLA

If there is any uncertainty about your vehicle’s eligibility, the DVLA may request:

- Inspection of the vehicle

- Additional paperwork confirming originality

- Technical reports from specialists or clubs

Additional Considerations

- Imported Vehicles: Vehicles imported into the UK may face additional scrutiny. Owners must provide sufficient documentation to prove the manufacture date abroad and ensure that the vehicle complies with UK standards.

- Kit Cars and Rebuilds: These are evaluated on a case-by-case basis. Even if built from older components, kit cars often receive a new registration date, making them ineligible.

- Ongoing Requirements: Even if your vehicle qualifies, maintaining exemption status requires ongoing compliance, such as keeping the vehicle roadworthy and unmodified.

What Is The Process For Applying For Road Tax Exemption?

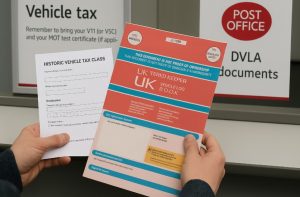

Applying for vehicle tax exemption involves submitting documentation to the DVLA, usually via a local post office that handles vehicle tax services. Owners must ensure all required paperwork is correctly filled and submitted.

Steps To Apply For Historic Vehicle Tax Exemption

| Step | Requirement | Description |

| 1 | V5C Document | Complete section 7 to change tax class to “Historic” |

| 2 | MOT Certificate (if required) | Some vehicles still need a valid MOT unless already exempt |

| 3 | V10 Form | Application form for vehicle tax |

| 4 | Post Office Submission | Take all documents to a Post Office that processes vehicle tax |

| 5 | DVLA Confirmation | Wait for DVLA to update vehicle status and approve exemption |

Once the application is approved, you will receive confirmation from the DVLA, and the vehicle will be recognised under the Historic vehicle tax class.

Is MOT Exemption Also Available For Classic Vehicles?

Alongside road tax exemption, many historic vehicles are also eligible for MOT exemption. This rule was updated in May 2018, bringing the MOT requirements in line with the 40-year rule applied to road tax exemption.

To qualify for MOT exemption:

- The vehicle must be over 40 years old

- It must not have been substantially altered in the last 30 years

- The vehicle must be declared as a “Vehicle of Historic Interest” (VHI) using Form V112

It is important to note that owners remain legally responsible for ensuring that the vehicle is roadworthy. Driving an unsafe or unfit vehicle, even if MOT exempt, can result in penalties, fines, or prosecution.

What Happens After You Register Your Car As Tax Exempt?

Once your application for tax exemption has been approved, the vehicle’s classification changes to “Historic” on the DVLA database. This affects how the DVLA communicates with you going forward.

Even though you no longer pay road tax, you will still receive a V11D reminder notice each year.

You must still declare whether your vehicle is in use or file a Statutory Off Road Notification (SORN) if it is not being driven.

Key things to keep in mind after registration:

- You must confirm vehicle usage status every year

- You must maintain valid insurance at all times

- If in use, the vehicle must remain roadworthy

Not responding to DVLA notices, even as an exempt vehicle owner, may lead to penalties.

Are There Any Exceptions Or Special Conditions For Exemption?

Certain categories of vehicles may not be eligible for exemption, even if they meet the 40-year age rule. The DVLA assesses eligibility based on the condition and originality of the vehicle.

Types of vehicles that may face issues include:

- Kit cars that were assembled more recently using older parts

- Vehicles imported into the UK without clear manufacturing records

- Classic vehicles with major modifications such as non-original engines or bodywork

- Vehicles registered under new plates despite being older builds

In such cases, additional documentation may be required, such as:

- Build date confirmation from the manufacturer

- Heritage certificates

- Club membership verification letters

Eligibility is assessed on a case-by-case basis, and incomplete or incorrect applications may be rejected.

How Does The DVLA Verify A Car’s Exemption Status?

The DVLA determines eligibility primarily through the V5C document, which typically lists the date of first registration and sometimes the date of manufacture. If the manufacturing date is missing or unclear, additional proof is required.

Accepted verification documents include:

- Certificate of authenticity from the manufacturer

- Records from approved classic car clubs

- Insurance valuations referencing build dates

- Workshop invoices or restoration logs

The DVLA may also request to inspect the vehicle if discrepancies arise in the documents provided. Ensuring accuracy during your application process will reduce delays and increase the likelihood of approval.

How Does Car Tax Exemption Impact Insurance And Valuation?

Registering a vehicle as historic does not only affect tax obligations. It can also influence insurance premiums and the vehicle’s market value.

Impacts on insurance:

- Classic car policies often offer reduced premiums

- Mileage limits and storage conditions may apply

- Some insurers may require proof of exemption or limited use

Impacts on vehicle valuation:

- Being classified as historic may improve resale value

- Originality and condition play a key role

- Documented history and DVLA recognition add credibility

While the cost savings are significant, the historic classification also enhances the vehicle’s status and appeal among collectors and enthusiasts.

What Are The Benefits And Responsibilities Of Owning A Tax-Exempt Vehicle?

Tax exemption offers several financial and administrative benefits, especially for owners of vintage and classic cars who may not use them daily.

Benefits:

- No annual Vehicle Excise Duty (VED)

- MOT exemption for qualifying vehicles

- Access to tailored classic car insurance

- Increased heritage and resale value

Responsibilities:

- Annual V11D declaration or SORN submission

- Proof of roadworthiness, even if MOT exempt

- Maintaining accurate DVLA records

- Compliance with insurance requirements

Owning a historic vehicle is a privilege that comes with responsibilities. Preserving the vehicle’s condition and ensuring compliance with UK motoring laws are essential parts of responsible classic car ownership.

Conclusion

For classic car enthusiasts, registering a vehicle as tax exempt under the 40-year rule offers both financial and sentimental rewards.

The cost savings from VED and MOT exemption, coupled with classic car insurance options, make ownership more accessible and enjoyable.

However, with these benefits come responsibilities, keeping the car roadworthy, properly insured, and accurately documented.

For those passionate about preserving the UK’s automotive history, the process is well worth the effort.

FAQs about Car Tax Exemption in the UK

What does the 40-year rolling exemption mean for classic car owners?

It means that each year, vehicles built more than 40 years ago become eligible for road tax exemption. This exemption begins from the 1 April following the qualifying year.

Is the date of registration the same as the date of manufacture for tax exemption?

No. The DVLA bases eligibility on the date of manufacture, not registration. You may need to supply proof if it’s not on the logbook.

Can I apply for tax exemption online or only via post office?

Currently, initial applications to change tax class to ‘Historic’ must be done at a Post Office that handles vehicle tax. Online services apply only for renewals or declarations.

What if my classic vehicle has been heavily modified will it still qualify?

Heavily modified or “substantially changed” vehicles may not be eligible. DVLA guidelines determine whether changes affect exemption eligibility.

Does a vehicle need to be insured before applying for tax exemption?

Yes. Insurance is still a legal requirement, even if the vehicle is MOT and tax exempt. You must declare valid insurance when submitting your application.

Is there a fee for applying for historic vehicle status?

No. There is no application fee to change the vehicle’s tax class to Historic, but postage or documentation requests may incur minor costs.

Can I drive my tax-exempt vehicle without an MOT?

Yes, if the vehicle is MOT exempt under the 40-year rule and not substantially changed. However, it must always remain roadworthy and safe to drive.