Understanding how to work out the break-even point in business is crucial for any entrepreneur aiming for profitability. The break-even point is the stage at which a business’s total revenue equals its total costs, resulting in neither profit nor loss.

Calculating this point allows you to understand how much you need to sell to cover your costs, helping you set sales targets and pricing strategies.

Whether you’re launching a new startup or managing an established company, knowing your break-even point can guide financial planning, minimise risks, and enhance business stability.

In this guide, we will explore what the break-even point is, how to calculate it, and strategies to reduce it effectively.

What Is the Break-Even Point?

The break-even point (BEP) is a financial calculation that determines the amount of revenue needed to cover a business’s fixed and variable costs.

At this point, the business neither makes a profit nor incurs a loss, it simply “breaks even.” The concept is fundamental for startups and established companies alike, as it sets the minimum performance threshold for survival.

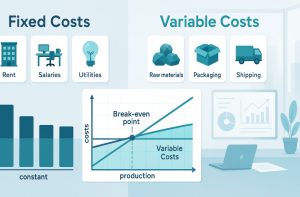

At the break-even point, total revenue generated from sales matches the total expenses of the business. These expenses are divided into two categories: fixed costs (such as rent, salaries, and insurance) and variable costs (like raw materials and production costs). Unlike variable costs, fixed costs remain constant regardless of production levels.

For example, if your fixed costs are £10,000, and your contribution margin per unit is £8, you would need to sell 1,250 units to reach your break-even point. Calculating this point helps you identify the minimum output required to avoid losses and start generating profits.

Why Break Even Point Important for Your Business?

The break-even point is a critical metric for business planning and financial health. Knowing when your business will start making a profit allows you to set realistic sales targets and make informed decisions.

Reasons Why Break-Even Point is Important

- Financial Planning: Understanding your break-even point helps you forecast revenue and expenses more accurately, allowing for better budget management.

- Pricing Strategy: It helps in setting appropriate prices for your products or services to ensure costs are covered.

- Cost Control: Identifying your fixed and variable costs enables you to manage them effectively, reducing unnecessary expenditures.

- Risk Assessment: Calculating your break-even point allows you to assess financial risks and adjust strategies before losses occur.

- Investment Decisions: Investors often look for break-even analysis to understand business viability and profitability timelines.

For instance, if your break-even point is 1,000 units per month, you know exactly how many sales are required to avoid losses. This clarity in financial expectations allows you to adjust marketing, pricing, and production strategies to achieve profitability faster.

How Do Fixed and Variable Costs Affect the Break-Even Point?

Fixed and variable costs are key components in calculating the break-even point. Fixed costs are expenses that do not change with the level of output, such as rent, salaries, and insurance. These costs remain constant regardless of how many products are sold.

In contrast, variable costs fluctuate with production volume, such as raw materials, packaging, and shipping expenses.

To better understand, here is a breakdown:

| Cost Type | Description | Examples |

| Fixed Costs | Costs that remain the same regardless of sales volume | Rent, salaries, utilities, insurance |

| Variable Costs | Costs that vary with the level of production | Raw materials, packaging, distribution |

Fixed costs impact the total amount of revenue needed to break even. If fixed costs are high, the business must sell more products to cover these expenses.

Variable costs affect the contribution margin, which is the difference between the selling price per unit and the variable cost per unit.

A higher variable cost reduces the contribution margin, increasing the number of units needed to break even. Managing both cost types efficiently is crucial for reaching profitability faster.

What Is the Formula for Calculating the Break-Even Point?

To calculate the break-even point, you can use the following formula:

Break-Even Point (Units)=Fixed Costs/Selling Price per Unit − Variable Cost per Unit

In this formula:

- Fixed Costs are expenses that do not change with sales volume.

- Selling Price per Unit is the amount charged for each product or service.

- Variable Cost per Unit includes costs directly associated with producing each unit.

How to Work Out Break Even Point?

Working out the break-even point involves understanding your cost structure and applying the break-even formula. Begin by listing all your fixed costs, such as rent, salaries, and utilities.

Next, calculate your variable costs per unit, including raw materials and production expenses. Once you have these figures, determine your contribution margin by subtracting the variable cost per unit from the selling price. Finally, divide your total fixed costs by the contribution margin to find the number of units required to break even.

Break Even Point Examples

Suppose your fixed costs are £15,000, your selling price per unit is £25, and your variable cost per unit is £10.

- Contribution Margin = £25 – £10 = £15

- Break-Even Point = £15,000 / £15 = 1,000 units

You need to sell 1,000 units to reach your break-even point.

How Often Should You Calculate Your Break-Even Point?

Calculating your break-even point should be a regular part of your business’s financial analysis. Most experts recommend conducting this analysis annually or whenever significant changes occur, such as:

- Launching a new product line

- Adjusting pricing strategies

- Changing suppliers or production methods

- Experiencing fluctuations in fixed or variable costs

For startups and rapidly growing businesses, quarterly or even monthly calculations are advisable. This frequent analysis helps identify potential risks early, allowing for timely adjustments to pricing, production, or sales strategies.

Regularly assessing your break-even point ensures that your business remains financially sustainable and can adapt to market changes effectively.

What Are the Limitations of Break-Even Analysis?

While break-even analysis is a valuable tool, it has certain limitations:

- Static Assumptions: It assumes fixed costs and variable costs remain constant, which may not be realistic over time.

- Linear Revenue Assumption: The model presumes that all units are sold at the same price, ignoring bulk discounts or price fluctuations.

- Ignores External Factors: Market changes, economic conditions, and competition are not factored into the analysis.

- Single Product Focus: The formula is straightforward for one product but becomes complex with multiple product lines.

Despite these limitations, break-even analysis remains an essential tool for financial planning and risk assessment. Understanding its constraints helps business owners interpret results more accurately and make informed adjustments.

How Do Price Changes Impact Your Break-Even Point?

Price changes have a significant impact on your break-even point. When you increase the selling price of your product or service, your contribution margin grows, which means you need to sell fewer units to cover your fixed costs.

Conversely, if you lower the selling price, your contribution margin shrinks, and you must sell more units to break even. This relationship is crucial for pricing strategies, especially during competitive market conditions or promotional periods.

Impacts of Price Increases

- Higher contribution margins per unit

- Fewer sales required to reach break-even

- Potential for higher profit margins

Example:

If your fixed costs are £10,000, your initial selling price is £20, and your variable cost per unit is £12, your contribution margin is £8. You need to sell 1,250 units to break even (£10,000 / £8). If you increase the selling price to £22 while costs remain unchanged, the contribution margin rises to £10, lowering your break-even point to 1,000 units.

Impacts of Price Decreases

- Lower contribution margins per unit

- Higher sales volume required to break even

- Risk of extended time to profitability

Example:

Using the same scenario, if you reduce the price to £18, your contribution margin drops to £6 (£18 – £12), increasing your break-even requirement to 1,667 units (£10,000 / £6).

This demonstrates how even slight changes in price can substantially affect the number of units you need to sell to cover costs.

Being strategic with pricing adjustments and understanding their impact on your break-even analysis can help you make informed decisions that enhance profitability while managing financial risks.

How to Reduce Your Break Even Point?

Reducing your break-even point is an effective way to achieve profitability faster and enhance business sustainability. Here are the primary methods to lower your break-even point:

1. Decrease Fixed Costs

One of the simplest ways to reduce your break-even point is by cutting down on fixed costs. This includes renegotiating rental agreements, reducing utility expenses, or outsourcing non-essential business processes.

For example, moving to a smaller office space or shifting to a more cost-effective supplier can substantially lower your fixed expenses.

2. Lower Variable Costs

Reducing variable costs improves your contribution margin, allowing you to break even with fewer units sold.

Strategies include sourcing cheaper raw materials, streamlining production processes, and negotiating better rates with suppliers. Efficient use of materials and reducing waste can also contribute to lower variable costs.

3. Increase Selling Prices

If market conditions allow, increasing your selling price can significantly impact your contribution margin.

Even a modest price increase can reduce the number of units needed to break even. However, it’s essential to balance this with customer expectations and competitor pricing to avoid losing market share.

4. Improve Operational Efficiency

Enhancing efficiency in your operations can help lower both fixed and variable costs. This includes investing in technology that automates repetitive tasks, optimising inventory management, and reducing overhead costs. Efficient production not only reduces costs but also boosts overall profitability.

By focusing on these strategies, businesses can effectively reduce their break-even point, making it easier to achieve profitability and maintain financial stability.

Conclusion

Understanding how to work out your break-even point is crucial for running a successful business. It allows you to determine the minimum sales required to cover your costs, providing clarity in financial planning and decision-making.

By regularly calculating your break-even point, you can set realistic sales targets, adjust pricing strategies, and control costs more effectively.

This analysis also helps you identify opportunities to reduce costs and improve efficiency, ultimately enhancing your path to profitability.

Whether you are a startup or an established company, mastering break-even analysis is a key step towards sustainable business growth.

FAQs About Break Even Point

What are the main limitations of break-even analysis?

Break-even analysis assumes costs and sales are constant, which may not reflect real market conditions. It also overlooks external factors like competition and market demand.

Can break-even analysis be used for non-profit organisations?

Yes, non-profit organisations can use break-even analysis to understand the revenue needed to cover operational costs, even though their goals are not profit-driven.

What happens if a business never reaches its break-even point?

If a business fails to reach its break-even point, it consistently operates at a loss, which can lead to financial instability and potential closure.

How does inflation affect the break-even point?

Inflation increases the costs of raw materials and fixed expenses, raising the break-even point unless prices are adjusted accordingly.

Is break-even analysis effective for small businesses?

Yes, it helps small businesses understand their cost structure and sales targets, making it easier to plan for profitability.

Can break-even analysis predict future profits?

No, it only determines the sales volume needed to cover costs, but it doesn’t account for market changes or future business growth.

What adjustments are needed for seasonal businesses?

Seasonal businesses need to adjust their break-even analysis to account for fluctuating sales volumes and higher costs during peak seasons.