The NHS car lease scheme offers a cost-effective and convenient way for healthcare staff to access new vehicles through a salary sacrifice arrangement.

With no upfront costs, inclusive insurance, and maintenance services, the scheme is designed to support NHS employees both professionally and personally.

It provides significant financial benefits compared to private leasing, while simplifying the entire process.

Understanding how the scheme works, who qualifies, and what’s included can help staff make informed decisions about their vehicle options.

What is the NHS Car Lease Scheme and How Does It Work?

The NHS car lease scheme allows eligible employees to lease a brand-new vehicle over a fixed three-year term. Instead of paying for the car directly from post-tax income, payments are deducted from the employee’s gross salary through a salary sacrifice agreement.

This reduces taxable income, which in turn leads to significant savings on income tax, National Insurance, and pension contributions.

The scheme is typically administered by NHS Fleet Solutions or approved leasing providers working in partnership with NHS Trusts. Vehicles are ordered directly from manufacturers and are built to include any specifications requested by the employee.

When the lease ends, the vehicle is returned to the leasing company and the employee has the option to begin a new lease or purchase the car at its current market value.

Unlike traditional leasing agreements, there are no credit checks, deposits, or upfront fees. All running costs are bundled into a single monthly payment, offering convenience and predictability in budgeting.

Who Can Apply for the NHS Car Lease Scheme?

Eligibility is generally extended to all permanent NHS employees. In many cases, immediate family members may also use the vehicle as long as they are covered under the Trust’s insurance policy.

Applicants must meet the following criteria:

- Hold a permanent contract with the NHS

- Possess a full or provisional UK driving licence

- Meet the minimum wage threshold after salary sacrifice deductions

- Comply with the Trust’s insurance and vehicle usage policies

Each Trust might have variations in policy regarding young or learner drivers. For example, some Trusts may allow learner drivers, while others such as Mid Yorkshire Hospitals exclude them from coverage.

Employees are advised to check with their HR or fleet management department for Trust-specific eligibility rules.

What Are the Benefits of the NHS Car Scheme?

The NHS car lease scheme provides a wide range of benefits designed to make vehicle access affordable, stress-free, and practical for healthcare staff. Unlike traditional car finance arrangements, the scheme simplifies ownership by bundling key motoring services into a single monthly payment while offering substantial financial advantages through salary sacrifice.

One of the standout benefits is the cost efficiency gained from reducing an employee’s gross salary. This approach means that less income tax, National Insurance, and pension contributions are paid, which can result in savings of hundreds to over a thousand pounds per year, depending on the employee’s salary band and the vehicle selected.

In addition, the NHS uses national procurement power to negotiate highly competitive vehicle prices with leasing companies, further driving down the cost for individual staff members.

Another key benefit is the inclusion of essential motoring services in the monthly lease cost. These include:

- Fully comprehensive insurance for personal and business use

- Road tax (tax disc)

- Servicing and mechanical repairs through approved dealerships

- Maintenance including tyres, battery, exhaust, bulbs, and wipers

- Breakdown cover and roadside assistance across the UK

The scheme also removes many of the typical barriers associated with leasing, such as credit checks, deposits, or complex financing agreements. Employees simply choose a vehicle, complete the necessary paperwork, and pay a fixed monthly fee directly from their salary. At the end of the three-year term, the car is returned with no further obligation unless the employee opts to renew or purchase it.

From a convenience perspective, the scheme saves staff valuable time by consolidating all costs into one predictable payment. Employees avoid dealing with multiple providers for insurance, tax, and maintenance, allowing them to focus on their work and personal lives without added stress.

Additional advantages include:

- Ability to choose from a wide range of vehicle models, including eco-friendly electric and hybrid options

- Option for family members to drive the car, depending on the Trust’s policy

- No depreciation concerns or vehicle resale responsibilities

- Opportunity to extend the lease or buy the car at the end of the term

The scheme also contributes positively to workplace wellbeing. A safe, reliable, and well-maintained vehicle supports punctuality, reduces commuting stress, and enhances the quality of life for busy NHS staff.

How Much Does Leasing a Car Through the NHS Cost?

The cost of leasing a vehicle through the NHS car lease scheme varies depending on multiple factors including the vehicle model, annual mileage, the employee’s tax band, and any optional extras selected.

However, due to the scheme’s structure and public sector bargaining power, employees typically pay less than they would for an equivalent private lease or hire purchase plan.

At the core of the scheme is the salary sacrifice mechanism. The monthly lease payment is deducted before income tax and National Insurance are calculated, which reduces overall tax liability.

As a result, an employee in a middle tax band can expect significant annual savings. These savings are even more substantial when compared to traditional leasing, where all costs are paid from post-tax income.

All essential motoring services are included in the monthly payment, such as:

- Fully comprehensive insurance

- Vehicle servicing and MOTs

- Road tax

- Breakdown recovery and roadside assistance

- Replacement of wear-and-tear items like tyres and wipers

There are no hidden extras unless the employee exceeds the agreed mileage, returns the car early, or causes damage not covered by insurance.

For a clearer picture of what this looks like in practice, consider the following table comparing monthly costs for leasing a Ford Fiesta through the NHS versus a commercial leasing option:

| Cost Item | NHS Car Lease Scheme | Commercial Lease Option |

| Vehicle Lease | £213 | £302 |

| Insurance | Included | £50 |

| Road Tax (Tax Disc) | Included | £2 |

| Maintenance and Servicing | Included | £20 |

| Tyre Replacement | Included | £5 |

| Breakdown Cover | Included | £10 |

| Company Car Tax | Included | £0 |

| Total Monthly Cost | £213 | £389 |

This comparison shows how the all-inclusive NHS package results in a much lower out-of-pocket monthly cost.

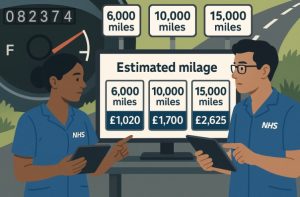

Additionally, pricing varies depending on the selected vehicle and mileage. Below is a sample of lease prices for different cars based on estimated annual mileage:

| Vehicle Model | 6,000 mi/year | 10,000 mi/year | 15,000 mi/year |

| Toyota Aygo 1.0 VVT-i | £151 | £156 | £168 |

| Peugeot 208 1.2 VTi | £200 | £206 | £214 |

| Fiat 500 1.2 Pop | £178 | £185 | £197 |

| Mini Cooper 1.5 D | £228 | £236 | £248 |

| Ford Focus 1.5 TDCi Zetec | £237 | £247 | £270 |

| Audi A4 2.0 TDI SE Saloon | £319 | £335 | £361 |

It’s important to remember that these are guideline figures. The actual cost may vary depending on factors such as the vehicle’s fuel type, optional features selected, and the employee’s salary band.

For NHS staff, the scheme offers an excellent balance of cost, coverage, and convenience, often delivering far greater value than private leasing alternatives.

Can Employees Choose Any Car and Customise It?

The scheme provides a high degree of flexibility. Employees can choose from a wide range of vehicle makes and models, including hybrid and electric vehicles. Optional extras such as upgraded infotainment systems, alloy wheels, and colour selections can be specified during the ordering process.

Although cosmetic modifications are discouraged, some practical fittings like roof racks or tow bars may be approved by the leasing provider. Any damage caused during installation or removal must be repaired before returning the vehicle.

Test drives can be arranged independently through dealerships to ensure the selected model meets personal and professional needs.

What Insurance Cover is Included in the NHS Car Scheme?

Fully comprehensive insurance is included in the monthly cost of the scheme. The policy typically covers:

- Business and personal use

- All drivers over the minimum age requirement

- Family members or named individuals, subject to policy terms

Excess amounts vary depending on the driver’s age and Trust. Below is an example breakdown:

| Trust | Under 21 | 21–25 | Over 25 | Provisional Licence |

| South West Yorkshire FT | £250 | £250 | £250 | £250 |

| Mid Yorkshire Hospitals | £500 | £500 | £500 | Not Covered |

| Spectrum CIC | £250 | £250 | £250 | £250 |

Insurance coverage may be denied for individuals with certain driving convictions within the past five years. Drivers must complete an insurance declaration form before approval.

What is Covered in Maintenance, Servicing and Breakdown?

All routine maintenance and servicing are covered in the monthly lease cost. This includes:

- Scheduled services at approved dealerships

- Mechanical and electrical repairs

- Replacement of tyres, exhausts, batteries, bulbs and wipers

- MOT tests once the vehicle is three years old

- Roadside assistance and national recovery service

The employee must ensure the vehicle remains roadworthy. Any damage caused by neglect or misuse will not be covered and may lead to additional charges.

What Happens When You Return the Vehicle?

At the end of the lease period, the vehicle must be returned in good condition. Employees can choose to:

- Lease a new car through the scheme

- Purchase the vehicle at market value

- Return the car without replacing it

Early termination of the lease agreement can result in a financial penalty. These penalties are calculated based on how long the vehicle has been in use:

- Less than 1 year: equivalent to 5 months’ payments

- Less than 2 years: equivalent to 3 months’ payments

- Less than 3 years: equivalent to 1 month’s payment

Repairs for excessive damage beyond fair wear and tear are the responsibility of the employee and assessed during vehicle return.

How Does Annual Mileage Affect the Lease Cost?

Lease pricing is partly based on expected annual mileage. The more miles driven, the higher the depreciation and maintenance requirements, which increases the lease cost. Employees are asked to estimate mileage at the beginning of the agreement.

Should mileage increase during the lease term, a revised estimate can be submitted to adjust the agreement. Exceeding the final agreed mileage will incur an excess mileage charge, usually calculated per additional mile driven.

To avoid unexpected charges, employees are encouraged to track their driving habits and inform the leasing provider of any significant changes.

Is the NHS Car Lease Scheme Beneficial for Everyone?

While the scheme is financially advantageous for many, it’s not ideal for all employees. The reduction in gross salary can affect various entitlements and benefits. Considerations include:

- NHS pension: those in the newer pension scheme may see a small reduction in final pension calculations

- Maternity, paternity, and adoption pay: statutory and occupational payments are based on reduced salary

- Mortgage applications: lower gross income could affect lending assessments

- State pension: unlikely to be impacted if income remains above the lower earnings limit

- National minimum wage: employees must still earn above the legal threshold after deductions

Employees who anticipate significant life events, such as retirement, maternity leave, or career changes, should consult their payroll or pensions department before joining the scheme.

What Is the Process for Ordering and Receiving the Vehicle?

Once an employee selects a vehicle and receives pricing quotes, the following steps are required:

- Completion of an order form

- Submission of an insurance declaration

- Provision of valid driving licence details

After all documentation is approved, a contract is sent for signing. The vehicle is then ordered directly from the manufacturer. Delivery times vary depending on vehicle availability. Factory-ordered vehicles can take between three to six months, although some models may be delivered sooner from dealer stock.

Employees are advised to plan ahead and allow sufficient lead time, particularly if they have a preferred vehicle configuration or urgent transport requirements.

How is Business Use and Reimbursement Handled?

If the leased vehicle is used for NHS business travel, employees are entitled to mileage reimbursement. The rates vary depending on the Trust and reflect the cost of fuel and usage.

Examples include:

- South West Yorkshire and Spectrum CIC: 14.5p per mile

- Wakefield CCG: 22p per mile

- Mid Yorkshire Hospitals: 12p per mile

These rates only apply to business-related journeys. All personal fuel costs are the responsibility of the employee.

What Fines or Additional Charges Should Drivers Be Aware Of?

While the monthly lease cost covers most motoring expenses, employees should be aware of potential additional charges, including:

- Excess mileage fees

- Lease termination penalties

- Damage beyond fair wear and tear

- Insurance policy excess

- Parking fines and congestion charges

- Charges resulting from poor vehicle maintenance

Any costs incurred by the Trust on behalf of the employee may be deducted directly from their salary.

Conclusion

The NHS car lease scheme provides a reliable and affordable motoring solution tailored for NHS employees. By combining essential services like insurance, maintenance, and breakdown cover into a single monthly cost, it reduces financial stress and simplifies vehicle management.

While the scheme offers notable savings and flexibility, it’s important to assess individual circumstances, especially regarding salary-related benefits.

For eligible staff, the scheme represents a practical and financially sound choice, delivering dependable transportation through a trusted public sector initiative.

Frequently Asked Questions

What happens if I exceed my estimated mileage?

Exceeding the mileage estimate can result in additional charges at the end of the lease. It’s important to re-estimate during the term if mileage increases significantly.

Can I use the lease vehicle outside the UK?

Most leasing companies allow EU travel with prior notification, but it’s best to confirm with the leasing provider.

Is breakdown cover included?

Yes, national breakdown and recovery services are included in the lease agreement.

What if I switch NHS Trusts during my lease?

The lease may be transferable to the new Trust with agreement from both the Trust and leasing provider.

What are the tax implications of salary sacrifice?

Salary sacrifice reduces taxable income, leading to savings on income tax and National Insurance contributions.

Can I choose an electric or hybrid car under the scheme?

Yes, many schemes support eco-friendly vehicles, which may offer even greater tax savings due to low emissions.

What should I do if the vehicle is damaged?

Report the damage immediately. If covered by insurance, repairs will be arranged via an approved repairer. You may be liable for excess charges.