The UK Government has announced major reforms to Vehicle Excise Duty (VED), set to take effect from April 2025. These changes are particularly significant for older drivers, many of whom own petrol or diesel vehicles that now fall into higher tax bands.

With first-year tax rates doubling for several emission levels and electric vehicles losing their exemption, it’s crucial for motorists to understand how these updates will affect car ownership costs and future buying decisions.

What Are the New 2025 Road Tax Changes in the UK?

From 1 April 2025, a significant update to Vehicle Excise Duty (VED) will affect drivers across the UK. The changes are aimed at modernising the tax system to better reflect a vehicle’s environmental impact.

The government is encouraging a shift toward zero and low-emission vehicles through higher first-year tax rates and the removal of exemptions previously offered to electric cars.

Vehicle Excise Duty, commonly known as road tax, will now follow updated emission-based brackets with increased charges across nearly all bands. In addition to the first-year “showroom tax” hikes, annual standard rates will also rise, as they are linked to inflation and the Retail Price Index.

Drivers of newly registered cars will feel the most financial impact, especially those opting for models with higher carbon dioxide emissions. The changes are part of the UK’s broader environmental strategy, aligning transport taxation with carbon-reduction targets.

Why Will Older Drivers Be Most Affected by the 2025 Car Tax Rules?

Drivers aged 60 and above, particularly those born between 1946 and 1964, are more likely to be driving petrol or diesel vehicles registered several years ago. These vehicles tend to emit more carbon dioxide, placing them in higher VED brackets under the 2025 rules.

Many older drivers are not early adopters of electric or hybrid technology, which means they are less likely to benefit from the lower VED rates associated with low-emission cars. Additionally, older motorists often keep their vehicles for longer periods, which results in sustained exposure to the rising annual standard tax rates.

Some of the main reasons older drivers will face higher bills include:

- Ownership of older, higher-emission petrol or diesel cars

- Lower adoption of hybrid or electric vehicles

- Limited vehicle turnover, leading to long-term higher tax obligations

What Does the End of EV Tax Exemption Mean for Drivers?

Electric vehicle owners have long enjoyed exemption from VED, but this advantage will disappear from April 2025. As part of the updated tax framework, all electric vehicles will now incur both first-year and annual road tax charges.

The changes for electric vehicles include:

- A new £10 first-year VED charge, applied to all zero-emission vehicles

- An annual standard rate of £195, equal to that of petrol and diesel cars

- A £425 annual supplement for cars with a list price above £40,000, charged from the second to sixth year after registration

These measures remove a key financial incentive for choosing electric vehicles and may affect purchasing decisions for drivers evaluating total cost of ownership.

How Will the New VED Rates Be Calculated for New Vehicles?

Under the new VED structure, the amount a driver pays is directly linked to the carbon dioxide emissions of the vehicle. The more a car pollutes, the higher the first-year tax.

The government has structured the VED system to create financial motivation for choosing cars with lower emissions. This includes graduated bands of CO2 output that correspond to specific tax rates. Plug-in hybrids, despite being more efficient than traditional combustion engines, will also see increased taxation.

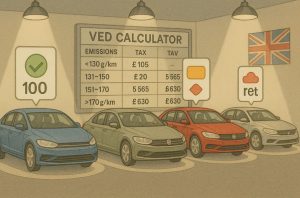

Here is a table outlining the revised VED structure based on carbon emissions:

| CO2 Emissions (g/km) | First-Year VED (2025) | Previous Rate | Increase |

| 0 | £10 | £0 | +£10 |

| 1–50 | £110 | £10 | +£100 |

| 51–75 | £130 | £30 | +£100 |

| 76–90 | £270 | £135 | +£135 |

| 91–100 | £350 | £175 | +£175 |

| 101–110 | £390 | £195 | +£195 |

| 111–130 | £440 | £220 | +£220 |

| 131–150 | £540 | £270 | +£270 |

| 151–170 | £1,360 | £680 | +£680 |

| 171–190 | £2,190 | £1,095 | +£1,095 |

| 191–225 | £3,300 | £1,650 | +£1,650 |

| 226–255 | £4,680 | £2,340 | +£2,340 |

| Over 255 | £5,490 | £2,745 | +£2,745 |

The steep increase in first-year costs, especially for high-polluting vehicles, underscores the government’s approach to environmental accountability through taxation.

How Will the Changes Affect Hybrid, Petrol, and Diesel Vehicle Buyers?

The new VED bands are likely to influence purchasing decisions across all fuel types, particularly for drivers planning to buy petrol, diesel, or plug-in hybrid vehicles in 2025.

For hybrids, the increase in first-year tax makes them less financially attractive than in previous years. Although they remain more efficient than traditional vehicles, the cost advantage is shrinking.

Petrol and diesel vehicles are most heavily impacted. Many popular car models have moved into higher tax brackets due to moderate CO2 emissions, making ownership more expensive from the outset.

Consider the following comparative table showing how tax applies to two commonly purchased cars:

| Car Model | CO2 Emissions (g/km) | First-Year VED (2024) | First-Year VED (2025) | Difference |

| Vauxhall Corsa 1.2 Turbo | 120 | £220 | £440 | +£220 |

| Toyota Aygo X | 114 | £220 | £440 | +£220 |

This shift in cost highlights how mid-range vehicles, often considered economical, are also being caught by the VED updates due to emission-based tax recalculations.

Cars emitting over 255g/km of CO2 are subjected to the highest charge. Buyers of performance vehicles, such as certain supercars or large SUVs, will now pay £5,490 in first-year tax, a substantial increase from the previous rate of £2,745.

What Should Older Drivers Consider Before Buying a New Vehicle?

For older drivers planning a vehicle purchase after April 2025, understanding the financial and practical implications of the new VED rules is essential. With road tax rates rising and long-term costs shifting, choosing the right car can significantly affect household budgets, especially for those on fixed or retirement incomes.

Below are several key considerations older motorists should weigh before making a decision.

Assessing Total Cost of Ownership

While the purchase price of a car is a major factor, older drivers should evaluate the total cost of ownership over the vehicle’s lifespan. This includes:

- First-year and annual Vehicle Excise Duty charges

- Fuel consumption or charging costs

- Insurance premiums for different vehicle types

- Routine maintenance and repair costs

Even if an electric vehicle incurs road tax, its long-term cost may still be lower due to reduced fuel and servicing expenses.

Understanding Emission-Based Tax Bands

Older drivers should be aware of how CO2 emissions affect VED under the 2025 regulations. Each car is categorised into a tax band based on its emissions, which determines how much will be paid initially and annually.

Vehicles with emissions above 130g/km are subject to particularly steep increases in first-year VED. For drivers who prefer traditional engines, models with lower CO2 output can still provide a compromise between performance and cost.

It is advisable to check the official CO2 rating of any potential vehicle and match it against the updated tax band tables before purchase.

Considering Vehicle Usage Habits

How and where the vehicle is used can impact whether certain types of cars are more practical or cost-efficient. For example:

- Drivers covering short distances or making infrequent journeys may benefit from electric or hybrid vehicles with lower running costs.

- Those living in urban areas with Clean Air Zones (CAZ) or Ultra Low Emission Zones (ULEZ) may incur additional charges for petrol or diesel vehicles, making low-emission cars more economical.

- Motorists regularly driving long distances may prefer efficient petrol or diesel models, but should consider fuel economy ratings and VED bands carefully.

Assessing lifestyle and usage patterns helps older drivers choose a vehicle that suits their mobility needs without incurring unnecessary expenses.

Evaluating Long-Term Ownership Plans

Older drivers often keep cars for extended periods rather than upgrading frequently. While this strategy reduces upfront costs associated with frequent purchases, it also increases exposure to rising annual tax rates if the vehicle remains high in emissions.

Therefore, it is worth considering whether investing slightly more in a lower-emission car now could result in cumulative savings over five to ten years.

For example, although a hybrid or EV may cost more initially, the combined reduction in fuel, VED, and maintenance costs could offset the difference over time.

Checking Eligibility for Exemptions or Assistance

Though older age alone doesn’t qualify for VED discounts, other factors might help reduce costs:

- Classic car status (vehicles over 40 years old) still grants tax exemption.

- Those receiving qualifying disability benefits may apply for VED exemption.

- Regional schemes from local councils or mobility organisations may offer grants or discounts for electric vehicles.

Before finalising a purchase, it’s important to explore all available support options or special schemes that may apply.

Choosing Vehicles Below the Expensive Car Threshold

If an electric vehicle or hybrid model is being considered, the purchase price becomes particularly relevant. Cars with a list price above £40,000 are subject to an additional annual supplement of £425 from the second to sixth year of registration.

Older buyers should look for models that fall below this threshold to avoid long-term tax penalties. Many efficient and practical electric cars are available under this price point and still offer excellent features and performance.

Are There Any Exemptions or Discounts Still Available for Older Drivers?

While the 2025 changes remove several nationwide exemptions, certain groups of drivers can still qualify for relief. Classic vehicles that are more than 40 years old continue to be exempt from VED, which may benefit collectors or long-term owners.

Disabled drivers may also qualify for VED exemptions or reductions, depending on the benefits they receive. Additionally, some vehicles leased through mobility support programmes may come with reduced tax obligations.

It is important for drivers to check with local councils for any regional schemes or discounts that apply to electric vehicles, low-income households, or people with specific accessibility needs.

Conclusion

The 2025 road tax changes mark a pivotal shift in how the UK approaches vehicle taxation and environmental accountability. Older drivers, often reliant on older and higher-emission vehicles, are expected to face the steepest increases. As the government promotes a transition to greener transport, staying informed and considering low-emission or electric alternatives may help mitigate the impact. Understanding the new VED structure is essential for making financially sound decisions in an evolving motoring landscape.

FAQs About Older Drivers and the 2025 Car Tax Rules

Will electric cars still be cheaper to run despite the new tax?

Yes, even with the introduction of road tax, electric vehicles generally remain more cost-effective due to lower fuel and maintenance costs.

Are there any age-specific discounts for road tax in the UK?

Currently, there are no age-specific VED discounts solely for older drivers. However, exemptions for classic vehicles and disability allowances still apply.

How can older drivers reduce their car tax bills?

Switching to a low-emission or electric vehicle, or downsizing to a smaller engine car, can significantly reduce both first-year and annual VED rates.

Will hybrid cars become more expensive to tax in 2025?

Yes, plug-in hybrids will face increased first-year VED, though they remain cheaper than many traditional petrol or diesel vehicles.

Are second-hand cars also affected by the new tax rates?

The 2025 tax changes primarily affect new vehicles, but annual rates for older, high-emission vehicles will also rise.

How do I find out my vehicle’s CO2 emissions?

You can check your vehicle’s CO2 emissions on the DVLA website using your registration number or consult the manufacturer’s specifications.

Will pensioners on a low income get help with car tax?

While there are no direct pensioner discounts, some low-income drivers may qualify for council support or mobility-related schemes.