The UK’s wage landscape shifted significantly in August 2025 as the government pushed forward its plan to deliver fairer pay for millions of workers.

This reform is not just an isolated pay rise it is a milestone in an ongoing journey to align the National Minimum Wage (NMW) and National Living Wage (NLW) with the real cost of living, while addressing long-standing disparities between age groups.

What Changes Were Made To The UK Minimum Wage In August 2025?

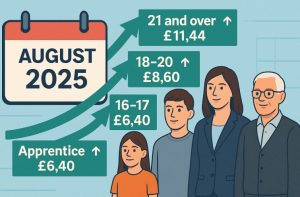

The UK’s August 2025 wage reforms introduced some of the most significant changes to the National Minimum Wage (NMW) and National Living Wage (NLW) in recent years.

One of the most notable adjustments is the removal of discriminatory age bands, signalling a move towards a single adult rate for all eligible workers.

This reform is designed to promote fairness and ensure that younger employees are not paid less purely because of their age.

The updated structure means that workers aged 18–20 have seen their hourly rates rise sharply, narrowing the gap with older colleagues.

Apprentices have also benefited from equal treatment with the 16–17 age group, marking a key step in equal pay policy.

Additionally, all wage categories have seen notable increases, with some groups experiencing their largest annual percentage rise in over a decade.

This is expected to boost take-home pay for millions and improve financial security for households across the UK.

How Much Is The National Minimum And Living Wage From April 2025?

From 1 April 2025, new statutory minimum rates came into effect for all qualifying workers. These changes impact millions of employees across various sectors.

Minimum Wage Rates Effective April 2025

| Category | Rate From April 2025 | Annual Increase (£) | Annual Increase (%) |

| National Living Wage (21 and over) | £12.21 | £0.77 | 6.7% |

| 18–20 Year Old Rate | £10.00 | £1.40 | 16.3% |

| 16–17 Year Old Rate | £7.55 | £1.15 | 18.0% |

| Apprentice Rate | £7.55 | £1.15 | 18.0% |

| Accommodation Offset | £10.66 | £0.67 | 6.7% |

For example, a full-time worker aged 21 or over, working 37.5 hours per week, will see their annual gross earnings rise by more than £1,400 compared to the previous year.

Why Did The Government Decide To Raise The Minimum Wage In 2025?

The decision to raise the minimum wage in 2025 is part of the government’s wider Plan for Change, aimed at improving living standards while maintaining a healthy economy. The government’s main reasons include:

- Meeting the commitment to align the NLW with two-thirds of median UK earnings.

- Addressing rising inflation and the cost-of-living crisis.

- Supporting low-income households and reducing wage inequality.

By linking wage growth to median earnings, the government seeks to ensure that pay levels remain competitive and fair, while balancing the needs of workers and businesses.

Who Benefits The Most From The 2025 Minimum Wage Increase?

While every worker on the minimum wage will receive a pay boost, the changes particularly benefit certain groups:

- Younger Workers: The narrowing of the gap between the 18–20 rate and the adult rate means a significant pay rise for this group.

- Apprentices: Matching the rate of 16–17-year-olds increases apprentices’ financial independence.

- Low-Paid Sector Employees: Industries such as hospitality, retail, and social care, where minimum wage employment is common, will see widespread benefits.

The impact is more pronounced in regions where average wages are lower, as the increase represents a larger proportion of typical earnings.

How Will The Removal Of Age Bands Affect Younger Workers?

Ending discriminatory age bands is a major reform that reshapes wage equality in the UK. For years, younger workers performing the same duties as older colleagues were paid significantly less. This change addresses that imbalance by:

- Ensuring fair pay for all adult workers regardless of age.

- Encouraging young people to join and remain in the workforce.

- Providing greater financial independence for those starting their careers.

The government’s goal is to fully transition to a single adult rate in the coming years, with further steps expected following consultation with the Low Pay Commission (LPC).

What Are The Government’s Plans For The Minimum Wage In 2026?

The government has made it clear that wage policy will continue to be guided by a commitment to fair pay and alignment with the UK’s median earnings.

For 2026, the Low Pay Commission (LPC) has been given a specific remit to ensure that the National Living Wage (NLW) for workers in the NLW category does not fall below two-thirds of median earnings.

This benchmark is widely recognised as a robust measure of low hourly pay and ensures that wages reflect real economic conditions.

The LPC’s latest estimates suggest that, from April 2026, the NLW will likely rise within the following range:

| Estimate Type | Projected Rate | Expected Increase (%) |

| Central Estimate | £12.71 | 4.1% |

| Lower Range | £12.55 | 2.8% |

| Upper Range | £12.86 | 5.3% |

These figures are not final and are intended as indicative projections, as the LPC’s recommendations are not set by a simple formula.

Instead, the Commission will weigh multiple factors before advising the government, including:

- Wage Growth Trends: The current projections assume strong wage growth in 2025, which is expected to moderate slightly in 2026. In May 2025, average wage growth stood at 5.1%, which was higher than earlier forecasts.

- Inflation Forecasts: The LPC will consider expected inflation rates between April 2026 and April 2027, ensuring that the NLW continues to maintain or improve its purchasing power.

- Economic Conditions: Wider macroeconomic trends, including productivity levels, employment rates, and GDP growth, will play a part in shaping the final recommendation.

- Impact on Businesses: The Commission will balance the need for fair pay with the ability of employers, particularly small businesses, to absorb higher wage costs without negative consequences such as job losses or reduced hours.

- Sector-Specific Pressures: Different industries face varying financial challenges, so the LPC will examine the effects of wage increases across sectors such as retail, hospitality, and social care.

One of the most significant ongoing policy developments is the planned removal of remaining age-based differences in pay rates. The government intends to make further progress towards establishing a single adult minimum wage rate for all workers aged 18 and over, ensuring equal pay for equal work.

The LPC will consult with employers, trade unions, and other stakeholders to determine the best pace for this transition while avoiding shocks to the labour market.

By October 2025, the LPC will deliver its final recommendations to the government. Once approved, the updated rates will come into effect from April 2026.

This means employers will have several months to prepare for the new pay rates, update payroll systems, and plan budgets accordingly.

The government’s approach aims to strike a balance between supporting workers’ living standards and maintaining a competitive economic environment.

If wage growth continues to outpace forecasts, there is a possibility that the 2026 NLW could end up at the higher end of the projected range or even exceed it making 2026 another year of substantial improvement for the UK’s lowest-paid workers.

How Does The UK’s Minimum Wage Compare To Other Countries?

When compared internationally, the UK ranks among the higher minimum wage countries once purchasing power is considered. However, it still falls short of the very top earners in Europe.

- Above Average: The UK’s NLW exceeds the EU average minimum wage when adjusted for living costs.

- Competitive Globally: The UK’s ranking in the OECD has improved in recent years due to consistent annual increases.

- Varied Cost Impact: The real value of the UK’s minimum wage depends heavily on regional living expenses.

What Challenges Could Employers Face With Higher Minimum Wages?

The 2025 increase in the minimum wage delivers clear benefits for workers, but it also presents a set of challenges for employers.

While many businesses support the principles of fair pay, the financial and operational impacts require careful management to avoid negative effects on profitability, staffing levels, or overall competitiveness.

Increased Payroll Costs

One of the most immediate impacts of a higher minimum wage is an increase in overall payroll expenses.

For businesses with a large proportion of minimum wage staff such as retail, hospitality, and care services—this rise can be substantial. The additional cost may affect:

- Annual budgets and cash flow management.

- Profit margins, particularly for small or independent businesses.

- Wage structures across the organisation, as raising the lowest pay rates may trigger demands for increases at higher pay grades.

Price Adjustments And Customer Reactions

To offset higher labour costs, some businesses may feel compelled to raise prices for goods or services. While this can help maintain profitability, it carries potential risks:

- Customers may be sensitive to even small price increases, especially in competitive markets.

- Price rises may reduce demand, particularly in industries such as food service or retail where consumers have many alternatives.

The challenge for employers is to implement adjustments without harming their customer base or brand reputation.

Potential Impact On Staffing Levels

In some cases, employers may consider reducing staffing levels to control costs. This could involve:

- Cutting hours for part-time staff.

- Limiting recruitment of new employees.

- Increasing the use of temporary or seasonal contracts to maintain flexibility.

However, reducing staff can create operational challenges, such as longer wait times for customers or lower productivity.

Pressure To Increase Efficiency

Higher wage bills can motivate businesses to find ways to operate more efficiently. This might involve:

- Investing in technology or automation to reduce reliance on manual labour.

- Restructuring roles and responsibilities to maximise productivity.

- Streamlining business processes to save time and resources.

While these steps can help balance wage increases, they often require upfront investment and careful change management.

Sector-Specific Challenges

The impact of higher minimum wages is not uniform across industries. For example:

- Hospitality and Retail: High reliance on minimum wage workers makes these sectors particularly sensitive to wage changes.

- Care Services: Funding constraints in publicly funded care can make absorbing wage increases more difficult.

- Small Businesses: Independent firms may lack the financial reserves to adjust quickly, compared to large corporations.

Employers in these sectors may require targeted government support or tax relief to manage the transition smoothly.

How Can Workers Check If They Are Being Paid Correctly?

Workers have a legal right to receive at least the minimum wage for their age group and employment status. They can verify compliance by:

- Checking their payslips and employment contracts.

- Using the UK government’s online wage calculator.

- Contacting HMRC if they believe they are underpaid.

Employers who fail to meet the legal minimum can face significant penalties, including repayment of arrears and financial fines.

Conclusion

The UK minimum wage increase in August 2025 represents more than just higher hourly rates it marks progress toward pay equality, improved living standards, and stronger economic resilience.

With further reforms expected in 2026, workers and employers alike will need to adapt to a wage system increasingly aligned with the real cost of living.

FAQs

What is the difference between the minimum wage and the living wage in the UK?

The minimum wage is the legally enforceable hourly rate set by the government, while the living wage is a voluntary benchmark calculated by independent organisations based on actual living costs.

Can employers pay less than the minimum wage?

No. It is unlawful for employers to pay less than the statutory minimum, and violations can result in significant fines.

Does the minimum wage apply to zero-hour contracts?

Yes. Workers on zero-hour contracts are entitled to the minimum wage for every hour worked.

How often is the minimum wage reviewed in the UK?

The Low Pay Commission reviews rates annually and recommends changes for implementation each April.

What sectors have the highest proportion of minimum wage workers?

Hospitality, retail, and social care sectors employ the largest numbers of minimum wage workers.

How does inflation affect the minimum wage?

Inflation erodes the purchasing power of wages, making regular increases important to maintain real income levels.

What penalties can employers face for not paying the minimum wage?

Penalties include repayment of arrears to workers, fines up to 200% of the underpayment, and public listing as a non-compliant employer.