Road tax, officially known as Vehicle Excise Duty (VED), is a legal requirement for most vehicles used or parked on public roads in the UK.

While the Driver and Vehicle Licensing Agency (DVLA) sends out reminder letters, it’s ultimately every vehicle owner’s responsibility to know when their road tax expires and to ensure it is renewed on time. Failure to do so can result in penalties, fines, or even vehicle impoundment.

This guide outlines when your road tax is due, how to check it, and what to do if it’s expired — all using official resources and tools.

What Is Road Tax And Who Needs To Pay It In The UK?

Road tax, officially known as Vehicle Excise Duty (VED), is a legal requirement for most vehicles operated or parked on public roads in the United Kingdom.

It is administered by the Driver and Vehicle Licensing Agency (DVLA) and must be paid annually or semi-annually depending on the chosen payment plan.

Every vehicle owner in the UK is expected to pay road tax unless their vehicle qualifies for an exemption. Some examples of vehicles that are exempt include:

- Electric vehicles (fully electric and registered before April 2025)

- Classic vehicles over 40 years old

- Vehicles used by disabled individuals

- Certain agricultural and mobility vehicles

It is still necessary to apply for and renew the exemption even if no payment is due. Failure to do so could result in the vehicle being classed as untaxed.

Road tax contributions go into the central government fund and are not ring-fenced for road maintenance. Despite this, paying VED remains a legal obligation for all applicable vehicle owners.

When Does My Road Tax Expire?

In most cases, road tax expires exactly 12 months after the last payment date. For those who choose a six-month payment plan, the expiry date will reflect that period.

The expiration date does not automatically update with vehicle transfers. When someone purchases a used vehicle, the road tax does not carry over.

The new owner must tax the vehicle immediately, even if the previous owner had time remaining on their tax.

If a vehicle is declared as off the road using a Statutory Off Road Notification (SORN), the road tax becomes inactive.

A vehicle with an active SORN cannot be driven or parked on public roads, and it does not need to be taxed until the SORN is cancelled.

The most accurate way to confirm your road tax expiry date is by checking online using the vehicle’s registration number.

How Will I Be Notified That My Road Tax Is Expiring?

The Driver and Vehicle Licensing Agency (DVLA) takes the lead in notifying vehicle owners when their road tax is due to expire. The most common method of notification is the V11 reminder letter, which is sent by post to the registered keeper’s address approximately three to four weeks before the road tax runs out.

What Is the V11 Reminder

The V11 is a paper notification that includes:

- The expiry date of your current road tax

- Your vehicle details (such as make, model, and registration number)

- An 11-digit reference number which can be used to renew the tax online, over the phone, or at a Post Office

The DVLA issues this notice to encourage timely renewal and to help car drivers stay compliant with UK road tax laws. However, the V11 is a courtesy reminder, not a legal requirement. If you do not receive it, you are still responsible for taxing your vehicle on time.

Why You Shouldn’t Rely Solely on the V11?

There are several reasons why relying only on the V11 reminder could be risky:

- Postal delays: Royal Mail delivery timelines can be unpredictable, especially during peak periods or industrial action.

- Lost or misdelivered post: The letter may never reach you due to a wrong address or household mix-up.

- Change of address: If you’ve moved and not updated your V5C log book (vehicle registration document), the reminder will go to your old address.

- Digital preference: In an increasingly paperless world, many vehicle owners prefer to receive notifications electronically.

Alternative Reminder Options

To ensure you never miss a tax renewal deadline, there are several proactive steps you can take:

- Sign up for DVLA email or text reminders: These can be arranged online and are delivered directly to your inbox or phone.

- Enable direct debit: When you pay your road tax by direct debit, the DVLA automatically collects future payments and sends you a confirmation message before each renewal.

- Use digital calendars: Add your tax expiry date to your phone or email calendar with a reminder set a few weeks before the due date.

- Vehicle management apps: Several apps, such as “MyCar” or “Car Minder,” track your vehicle tax, MOT, and insurance in one place.

What Happens If You Don’t Receive the Reminder?

Even if you don’t receive a V11 reminder, you can still renew your vehicle tax using:

- Your V5C log book, which contains the necessary 11-digit reference number

- Your vehicle’s registration number, if checking online for the current status

The absence of a reminder does not excuse non-payment. Enforcement is automated, and driving without valid road tax can lead to fines, clamping, or legal action.

Best Practices to Stay Informed

To stay ahead of your road tax renewal, consider:

- Keeping your contact details updated with the DVLA

- Checking your tax status online periodically

- Keeping a physical or digital record of your last tax payment date

- Avoiding last-minute renewals, especially near weekends or public holidays when processing may be delayed

By combining official reminders with personal systems, vehicle owners can ensure continuous compliance with road tax obligations and avoid potential penalties.

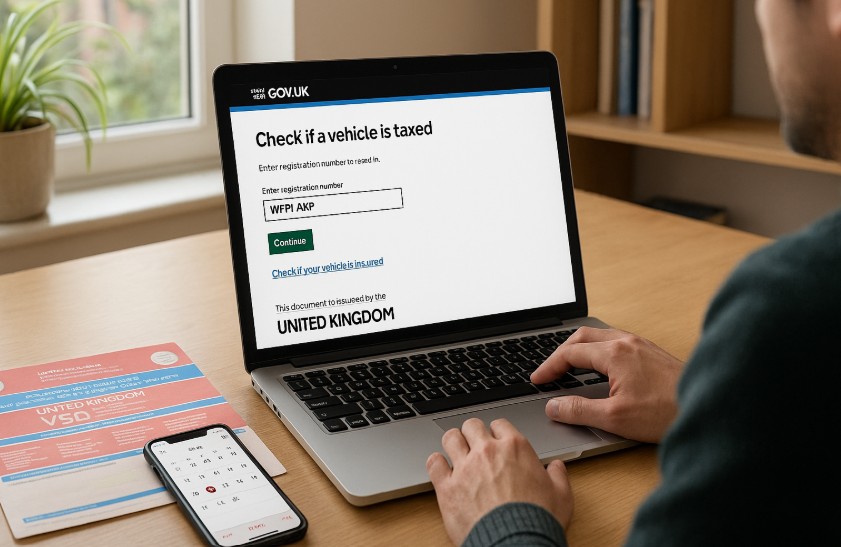

How Can I Check If My Car Is Taxed?

The most reliable way to check whether your vehicle is currently taxed is through the government’s official vehicle enquiry service.

You will need:

- The vehicle’s registration number (number plate)

This service provides real-time data directly from the DVLA database and confirms both the tax and MOT status of the vehicle.

| Step | Action |

| 1 | Visit gov.uk/check-vehicle-tax |

| 2 | Enter the registration number of your vehicle |

| 3 | Review the displayed information on tax and MOT status |

It is important to note that if you recently renewed your tax or declared a SORN, it may take up to two working days for the system to reflect these changes.

Can I Check Someone Else’s Vehicle Tax Status?

Yes, the DVLA allows anyone to check the tax and MOT status of a UK-registered vehicle using the publicly accessible enquiry tool. This can be particularly useful in situations such as purchasing a second-hand car, verifying a company vehicle, or confirming compliance before hiring or lending a vehicle.

However, this tool only reveals limited information. It does not include owner details or any private information associated with the vehicle.

When using the service for another vehicle, ensure you have legal reasons to do so and always follow proper data usage practices.

What Happens If I Forget To Renew My Road Tax?

Failure to renew your road tax on time can result in immediate and automatic penalties. The DVLA runs enforcement checks regularly and uses automated number plate recognition (ANPR) technology to identify untaxed vehicles on public roads.

Consequences of driving or keeping an untaxed vehicle include:

- A fine of up to £1,000 or a fixed penalty of £80

- Vehicle clamping or impoundment by enforcement officers

- Potential prosecution in court for repeat offences

- Additional recovery charges if the vehicle is removed and stored

If your vehicle is not in use, you must officially declare it as off the road by submitting a SORN. This avoids the requirement to pay tax, but also legally restricts the vehicle from public use.

How Do I Tax My Vehicle Once It Expires?

Renewing vehicle tax can be done through three primary methods:

- Online: The quickest method via gov.uk/vehicle-tax

- Post Office: For those who prefer to pay in person

- By Phone: Using the DVLA’s automated service

You will need one of the following documents:

- V11 reminder letter

- V5C log book (registration certificate)

- V62 form if applying for a new V5C

Payment options include:

- A single payment for 6 or 12 months

- Monthly direct debit, which spreads the cost and helps avoid missed renewals

Vehicle Tax Renewal Methods

| Method | Requirements | Processing Time | Payment Options |

| Online | V11 or V5C with reference number | Immediate | Debit/Credit Card, DD |

| Post Office | V11 or V5C + insurance + MOT proof | Immediate | Card or Cash |

| Phone | V11 or V5C reference | Immediate | Debit/Credit Card |

Direct debit renewals are processed automatically, but you must ensure your bank details remain current.

What Are The Current Road Tax Rates In The UK?

Road tax rates in the UK are determined by several key factors, including:

- Date of first vehicle registration

- CO₂ emissions rating

- Type of fuel used

- Vehicle list price (for cars over £40,000)

For vehicles registered after 1 April 2017, a standard flat rate applies after the first year, although additional supplements may apply for expensive vehicles. Vehicles with zero emissions currently benefit from a tax exemption until April 2025.

Sample Road Tax Rates For 2025

| CO₂ Emissions (g/km) | First Year Rate | Standard Rate |

| 0 | £0 | £0 |

| 1–50 | £10 – £25 | £180 |

| 51–75 | £120 | £180 |

| 76–150 | £180 | £180 |

| 151–170 | £645 | £180 |

| 171–190 | £1,040 | £180 |

| Over 190 | £2,365+ | £180 |

These rates may change annually with the government’s budget announcements, so it is advisable to consult the official DVLA website for the most current figures.

Is Road Tax The Same As MOT And Insurance?

Road tax is often confused with MOT testing and vehicle insurance, but these are separate legal requirements in the UK.

- Road Tax: Confirms the vehicle is legally allowed on public roads

- MOT Certificate: Confirms the vehicle meets safety and environmental standards

- Insurance: Provides financial protection in case of accidents or theft

Each element serves a distinct purpose, and all must be valid at all times. A vehicle without any one of these could be subject to fines, invalid claims, or legal action.

You can verify each using official platforms:

- Vehicle tax and MOT: GOV.UK Check Vehicle

- Insurance status: askMID

What Tools Can Help Me Stay On Top Of My Road Tax?

Given the legal importance of maintaining current vehicle tax, various tools and strategies can help vehicle owners remain compliant:

- DVLA Email Reminders: Sign up online for free reminders

- Mobile Apps: Vehicle tracking apps like Car Minder or My Car keep track of renewals

- Calendar Alerts: Set reminders on digital calendars or task management tools

- Direct Debit: Automatically renews your road tax and sends email confirmation

- V11 Letter: Keep a physical or scanned copy for reference

Using one or more of these methods can ensure you never forget to renew your vehicle tax and avoid unnecessary fines.

Conclusion

Knowing when your road tax expires is essential for staying compliant with UK road laws. While the DVLA provides reminders, it’s up to each vehicle owner to check and renew their road tax before it lapses.

Use official GOV.UK tools, maintain accurate records, and set digital reminders to avoid fines and ensure your vehicle remains road-legal.

Frequently Asked Questions

How early can I renew my road tax?

You can renew your road tax up to one month before it expires using the V11 reminder or your log book.

Can I drive if my road tax has expired?

No. Driving without valid road tax is illegal and can lead to fines, clamping, or prosecution.

Do electric vehicles need road tax in the UK?

Currently, EVs are exempt from road tax, but this exemption is set to end in April 2025.

What if I never received my V11 reminder?

You can still renew using your V5C log book online or at a Post Office. The reminder is helpful, but not required.

How do I check if my vehicle is SORN?

You can use the same GOV.UK tax check service. It will display if your vehicle is registered as SORN.

Is my road tax transferable when I sell my car?

No. The new owner must tax the vehicle in their name immediately after purchase.

Can I tax a car without a V5C log book?

Yes, if you have the V11 reminder letter. If neither is available, you must apply for a replacement V5C before taxing.