Understanding when the Bank of England will next review its base interest rate is vital for anyone managing a mortgage, savings account, or broader financial planning.

The base rate plays a central role in the UK economy, influencing everything from inflation control to consumer spending and borrowing.

In this comprehensive guide, we’ll explore the date of the next review, what changes might occur, and how these decisions affect UK residents and the economy overall.

What Is the Current Bank of England Base Rate?

The Bank of England’s base interest rate is currently set at 4.25%, following the decision made at the Monetary Policy Committee (MPC) meeting on 19 June 2025.

This rate reflects the cost at which the Bank of England lends money to commercial banks and building societies. As a result, it plays a critical role in determining the interest rates these institutions set for mortgages, business loans, and savings products.

The current rate represents a balancing act between curbing inflation and supporting economic growth. Though inflation has started to ease, rates remain higher than they were just a few years ago, largely due to the economic aftermath of global events and domestic fiscal challenges.

When Is the Next Interest Rate Decision by the Monetary Policy Committee?

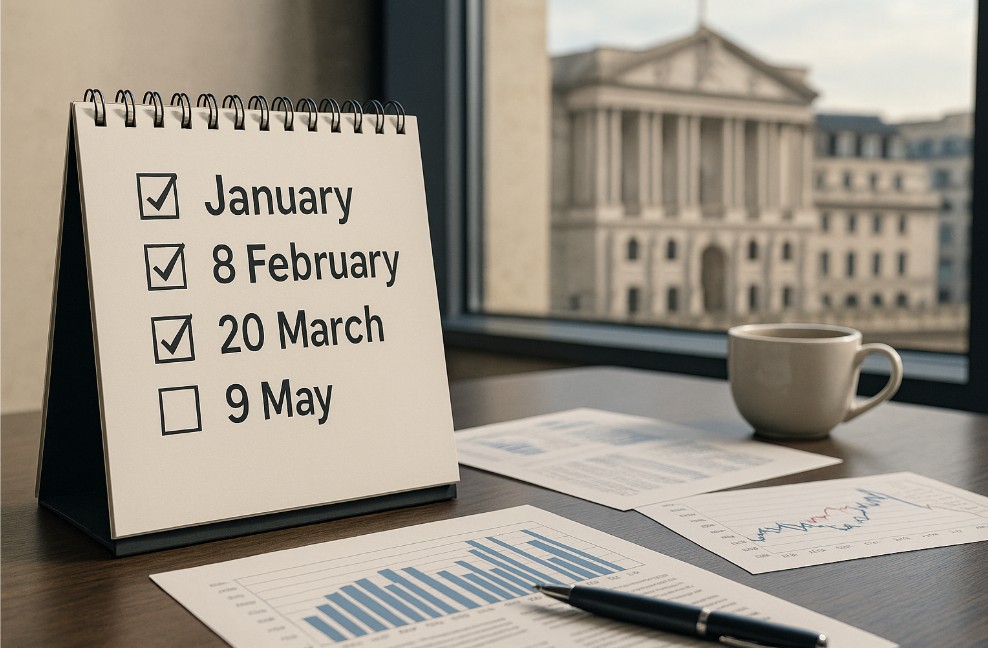

The MPC is expected to meet again on 7 August 2025, which falls in line with its six-week review schedule. The committee consists of nine members, including the Governor of the Bank of England and a selection of internal and external economic experts. These members vote on whether to maintain, increase, or decrease the base rate based on current economic data and forecasts.

During periods of financial instability, such as economic shocks or market volatility, the MPC has the flexibility to meet outside the normal cycle. This ensures that urgent monetary policy decisions can be made when needed.

What Does the Bank of England Base Rate Mean for Borrowers and Savers?

The Bank of England base rate is one of the most influential financial benchmarks in the UK economy. It acts as the foundation upon which commercial banks, building societies, and other lenders set their own interest rates for a wide range of financial products.

This includes mortgages, personal loans, credit cards, and savings accounts. As such, the base rate plays a significant role in determining how much individuals and businesses pay to borrow money, and how much they earn on savings.

Impact on Borrowers

When the Bank of England raises the base rate, borrowing generally becomes more expensive. This is because lenders often increase their interest rates in response, passing the additional cost onto customers. Conversely, when the base rate is lowered, borrowing becomes cheaper, encouraging spending and investment.

The impact varies depending on the type of loan product:

- Mortgages: Homeowners with variable or tracker mortgages feel the effects of base rate changes most directly. Even a small increase in the rate can translate into noticeably higher monthly repayments. Those on fixed-rate deals are insulated during the term but may face higher costs when remortgaging.

- Personal Loans and Credit Cards: While not always directly linked to the base rate, many lenders adjust personal loan and credit card rates in line with it. A higher base rate can lead to increased interest charges on outstanding balances, especially for borrowers who carry over debt month to month.

- Business Loans: Companies with variable-rate loans or overdrafts may see higher interest costs, which can impact profitability and investment plans.

In practical terms, a base rate increase of 0.25% may seem small, but over the term of a mortgage or loan, it can add thousands of pounds in interest. For example, on a £250,000 mortgage with 20 years remaining, a 0.25% rise could add over £30 to monthly payments, depending on the loan terms.

Impact on Savers

For savers, the base rate is equally important but in a different way. When the base rate rises, banks and building societies often (though not always) increase the interest rates on savings accounts. This means savers can earn a better return on their deposits, particularly on fixed-term savings products or high-interest accounts.

However, the extent to which banks pass on the base rate rise varies. Some providers delay changes or offer only partial increases, especially for easy-access accounts. That’s why savers need to shop around regularly and compare offers.

The base rate is especially significant for those who rely on interest income, such as pensioners or individuals with large cash reserves. Even modest increases in interest rates can meaningfully boost monthly income from savings, making it easier to keep up with inflation and maintain purchasing power.

Summary of Impacts

| Group | Base Rate Rise | Base Rate Fall |

| Mortgage Holders | Higher monthly repayments (if variable) | Lower repayments, easier to manage debt |

| Credit Card Users | Increased interest on unpaid balances | Lower borrowing costs (may vary by lender) |

| Personal Loan Borrowers | Higher total interest over the loan term | Reduced interest, more affordable loans |

| Business Borrowers | Higher financing costs | Improved cash flow and investment capacity |

| Savers | Better returns on deposits | Reduced interest income |

The base rate’s dual function increasing the cost of borrowing while boosting savings income, reflects its role in moderating economic activity. When inflation is high, raising the base rate can encourage saving and reduce demand. When growth is sluggish, a lower rate can stimulate borrowing and investment.

Ultimately, the impact on individuals depends on their financial position. Borrowers may be adversely affected by rising rates, while savers often benefit. Understanding this relationship helps consumers make more informed decisions about managing debt, securing mortgages, and choosing where to keep their savings.

How Are Tracker Mortgages Affected by Changes in the Base Rate?

![]()

Tracker mortgages are directly linked to the Bank of England base rate, which means any change in the base rate is reflected almost immediately in the interest rate paid by the borrower. These mortgage products typically track the base rate plus a set margin defined in the agreement.

For example, if a borrower has a tracker mortgage with a rate set at base +1%, and the base rate is 4.25%, the total mortgage interest rate would be 5.25%. Should the base rate increase by 0.5%, the mortgage rate would increase to 5.75%, impacting monthly repayments.

Tracker mortgage borrowers are often the most immediately affected by interest rate changes. They may consider switching to a fixed-rate deal if rates continue rising, depending on their lender’s terms and early repayment fees.

What Happens to Fixed-Rate Mortgages When the Base Rate Changes?

Fixed-rate mortgages offer a set interest rate for a specific term, typically two, five, or ten years. During this period, repayments remain the same regardless of base rate changes. However, once the fixed term ends, borrowers are usually moved onto the lender’s standard variable rate (SVR), which is often influenced by the Bank of England base rate.

The SVR is generally higher than the fixed rate, meaning borrowers could see an immediate rise in monthly costs unless they secure a new deal. As a result, homeowners are encouraged to begin reviewing options around six months before the end of their current deal.

Borrowers coming off historically low fixed rates may face significantly higher offers, as market conditions have shifted over recent years. Despite this, new fixed-rate options can still be more cost-effective than remaining on an SVR.

Do SVR and Discount Mortgages Change with the Base Rate?

Standard Variable Rate (SVR) mortgages are not directly linked to the Bank of England base rate, but they often move in anticipation of or in reaction to rate changes. Lenders set their SVRs independently, and these can fluctuate at any time, though most are adjusted in response to central bank actions or market sentiment.

Discount mortgages are pegged to a lender’s SVR and offer a reduction (e.g., 1% below SVR) for a set period. Since they rely on the SVR, they are indirectly impacted by changes in the base rate.

Unlike tracker mortgages, which follow the base rate precisely, SVR and discount mortgages offer less predictability. This lack of clarity can make it difficult for borrowers to anticipate payment changes, prompting many to prefer fixed-rate alternatives.

Should You Fix Your Mortgage Rate Ahead of the Next Review?

With the next interest rate review scheduled for August 2025, many borrowers are evaluating their options. Fixing a mortgage rate ahead of a potential rate increase can provide protection from rising monthly payments and give financial certainty over a set period.

Most lenders allow you to secure a mortgage deal up to six months in advance. If you’re approaching the end of your current deal, now is an ideal time to start reviewing options. Some of the most competitive two- and five-year fixed rates may be higher than in previous years, but they still tend to be lower than SVRs.

Benefits of fixing your mortgage rate:

- Predictable monthly repayments

- Protection against potential rate hikes

- Easier budgeting and financial planning

- Shield from market volatility

What Role Does the Bank of England Interest Rate Play in the UK Economy?

The Bank of England’s base interest rate is one of the most powerful tools for managing the UK economy. It influences consumer behaviour, business investment, inflation levels, and overall economic stability.

By adjusting this rate, the Bank of England aims to steer the economy in a direction that aligns with its key objectives, most notably maintaining price stability, supporting employment, and fostering sustainable economic growth.

Controlling Inflation

One of the Bank of England’s primary responsibilities is to keep inflation close to a government-set target, currently 2%. Inflation refers to the rate at which prices for goods and services rise over time.

While moderate inflation is a sign of a growing economy, excessive inflation erodes purchasing power, making it more expensive for households and businesses to maintain their standard of living.

To control high inflation, the Bank may increase the base rate. A higher base rate discourages borrowing and encourages saving, as loans become more expensive and savings accounts offer better returns. This generally reduces consumer spending and demand, which can help ease inflationary pressures.

On the other hand, if inflation is too low or the economy is in danger of deflation (a general decline in prices), the Bank may lower the base rate. This encourages people and businesses to borrow and spend, stimulating demand and pushing prices up.

Influencing Consumer Spending and Saving

Interest rates directly impact consumer behaviour:

- When interest rates rise, borrowing becomes more costly. Mortgages, personal loans, and credit cards all become more expensive to service. As a result, consumers tend to reduce spending and prioritise saving, especially as savings accounts begin offering higher returns.

- When interest rates fall, borrowing becomes more attractive and saving less rewarding. This often leads to increased consumer spending, which can drive business revenues and boost economic activity.

This balancing act between saving and spending is central to maintaining economic stability. It allows the Bank to respond to various economic challenges, whether that’s overheating growth or stagnant demand.

Supporting Employment and Economic Growth

The base rate also plays a key role in employment and overall economic output. Lower interest rates reduce the cost of borrowing for businesses, enabling them to invest in expansion, hire more staff, and launch new projects. This can lead to job creation and a rise in consumer confidence.

Conversely, higher interest rates can cool an overheating economy but may also slow business investment. Companies might cut back on hiring, reduce output, or delay growth initiatives due to increased financing costs.

In this way, the Bank of England must carefully balance its interest rate decisions to avoid unintended consequences, such as rising unemployment or slowing economic progress.

Managing Exchange Rates and Foreign Investment

Another significant function of the base rate is its influence on the UK’s currency and foreign investment. When interest rates rise, the pound typically strengthens, as higher rates offer better returns for foreign investors. A stronger pound makes imported goods cheaper, which can help reduce inflation.

However, a stronger currency can also hurt UK exporters, as British goods become more expensive for overseas buyers. Lower interest rates tend to weaken the pound, which can boost exports but may also increase the cost of imports, potentially driving up inflation.

These dynamics mean the base rate not only affects domestic conditions but also plays a role in the UK’s global economic positioning.

Stabilising the Financial System

During periods of economic uncertainty or crisis such as the 2008 financial crash or the COVID-19 pandemic, the base rate can be used as an emergency lever to stabilise the financial system.

By slashing rates to historically low levels (as low as 0.1% in March 2020), the Bank of England encouraged banks to lend more freely, ensured liquidity in the financial markets, and helped cushion the economic blow to households and businesses.

In these circumstances, the base rate acts as both a signal of monetary policy direction and a practical tool for maintaining confidence in the economy.

Summary of the Base Rate’s Economic Role

| Function | Effect of Higher Interest Rate | Effect of Lower Interest Rate |

| Inflation Control | Slows price increases | Encourages moderate inflation |

| Consumer Spending & Saving | Reduces spending, boosts saving | Increases spending, discourages saving |

| Business Investment & Employment | Discourages expansion and hiring | Encourages borrowing, job creation |

| Exchange Rate Management | Strengthens the pound | Weakens the pound |

| Financial Market Stability | May reduce excessive speculation | Provides support during downturns |

A Tool of Fine-Tuned Economic Policy

The Bank of England’s interest rate decisions are not made in isolation. They are based on thorough analysis of data including GDP, unemployment, inflation trends, market sentiment, and global economic shifts.

Through regular reviews and occasionally unscheduled ones during crises, the Bank uses interest rates to fine-tune the economy in a way that promotes both short-term stability and long-term growth.

In essence, the base rate is a vital mechanism through which monetary policy is implemented. Its influence ripples through every corner of the UK economy, from household budgets and business strategies to international investment and economic confidence.

How Often Does the Bank of England Review and Change the Base Rate?

The Bank of England’s Monetary Policy Committee holds a scheduled meeting approximately every six weeks. During each meeting, members vote on whether to change the base rate based on a comprehensive assessment of economic indicators.

While not every meeting results in a change, the MPC’s decisions are closely watched by financial institutions, investors, and consumers. These reviews are accompanied by a statement that outlines the rationale behind the decision, along with economic forecasts.

Occasionally, in response to unexpected economic developments, the Bank may hold emergency meetings to adjust the rate outside of the regular schedule.

What Is the Historical Timeline of the Bank of England Base Rate?

The Bank of England’s base rate has fluctuated widely over its centuries-long history. From long periods of stability to sharp spikes and historic lows, the base rate reflects the broader economic context of each era.

Notable periods include:

- From April 1719 to June 1822, the rate remained at 5%, then dropped to 4%, showing over a century of consistency

- In November 1979, the base rate reached its highest point ever at 17%, driven by inflationary pressure

- In March 2020, amid the COVID-19 pandemic, the rate was cut to 0.1% to stimulate economic activity, marking a historic low

How Can You Predict a Change in the Bank of England Base Rate?

Although exact rate changes cannot be predicted, economists and analysts rely on several key indicators to forecast the MPC’s decisions. These indicators reflect the health and direction of the UK economy and help determine whether an increase or decrease is likely.

Common factors considered include:

- Inflation Rate: Persistent inflation above the Bank’s 2% target may lead to higher rates

- Economic Growth: Strong GDP performance can result in higher rates to prevent overheating

- Unemployment: High unemployment often triggers rate cuts to stimulate hiring and spending

- Global Market Conditions: Events such as geopolitical tensions or changes in international policy can influence the MPC’s thinking

Table: Key Indicators and Their Potential Impact on Interest Rates

| Indicator | Likely Impact on Base Rate | Explanation |

| Rising Inflation | Increase | To cool spending and stabilise prices |

| Slowing GDP Growth | Decrease | To stimulate economic activity |

| High Unemployment | Decrease | To support job creation and consumption |

| Strong Retail Sales | Increase | May signal overheating economy |

| Low Consumer Confidence | Decrease | Encourages lending and economic optimism |

Keeping an eye on these indicators, as well as public commentary from MPC members and Bank of England reports, can offer clues into future policy movements.

Frequently Asked Questions

What does the Monetary Policy Committee consider before setting the base rate?

The MPC examines various economic indicators such as inflation trends, unemployment data, and GDP growth. It also evaluates global market movements and domestic fiscal policies before making a decision.

Can the Bank of England raise or cut the rate between scheduled meetings?

Yes, in times of economic crisis or urgent need, the Bank may hold emergency meetings and adjust the rate outside its normal six-week schedule.

How does the base rate affect my credit card interest?

While not directly tied to the base rate, credit card providers may adjust their interest rates based on wider borrowing costs. A base rate hike often leads to higher credit card APRs.

Will savings rates improve if the Bank of England raises the base rate?

Generally, yes. Banks usually increase savings account interest rates following a base rate rise, although not always immediately or to the same degree.

What is the difference between the base rate and APR?

The base rate is set by the Bank of England and used to influence borrowing costs. APR (Annual Percentage Rate) includes not just interest, but fees and other costs charged by lenders.

Are fixed mortgage rates influenced by predicted base rate changes?

Yes. Lenders consider forecasts and market expectations when setting fixed rates, meaning rates can change in advance of official decisions.

Is it possible to get a mortgage offer before a base rate change takes place?

Yes. Most lenders allow borrowers to secure a mortgage deal up to six months in advance. This can be a good strategy during times of expected base rate increases.