Inflation has become one of the most pressing economic concerns for governments, businesses and consumers across the world.

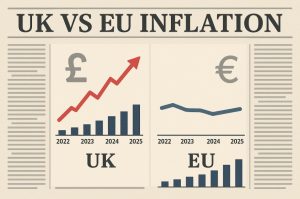

While most countries experienced inflationary pressure following the COVID-19 pandemic and the Ukraine war, the United Kingdom has faced significantly more stubborn inflation than its European neighbours and the United States.

In 2025, the UK continues to battle a rate of inflation higher than the eurozone average, raising critical questions about the structural and policy-driven causes behind this trend.

What Is the Current State of UK Inflation Compared to Europe in 2025?

As of mid-2025, the UK continues to report a higher rate of inflation than both the eurozone and the United States.

Data from the Office for National Statistics indicates that the UK’s Consumer Price Index (CPI) increased by 5.2% over the past 12 months.

In comparison, the eurozone experienced a 3.4% increase, while the US registered a slightly lower rate of 2.9%.

Despite the downward trend from 2023 highs, the UK’s inflation remains stubborn. While global economic pressures are partly responsible, domestic conditions have played a substantial role in maintaining elevated price levels.

Factors contributing to this include:

- Slower decline in energy and food prices

- Ongoing labour shortages that push up wages

- Trade frictions post-Brexit

- Currency depreciation increasing import costs

The difference in inflation rates underscores the unique challenges facing the UK economy that go beyond global market conditions.

What Are the Key Factors Driving Higher Inflation in the UK?

The elevated inflation in the UK is not merely a by-product of global economic events it is also deeply rooted in domestic factors.

While the aftermath of the COVID-19 pandemic and the geopolitical instability caused by Russia’s invasion of Ukraine did set off a wave of inflation across the globe, the UK’s inflationary pressures have proven to be more persistent and severe due to a mix of structural weaknesses, policy choices, and market-specific challenges.

1. Exchange Rate and Import Costs

The weakening of the British pound since the Brexit vote in 2016 has had long-term consequences.

A weaker currency makes imports more expensive, and the UK, being heavily reliant on imported goods especially food and energy feels this impact acutely.

When the pound falls in value against the euro or dollar, businesses pay more for foreign products and raw materials, which increases overall production costs and consumer prices.

2. Energy Price Volatility

Although energy prices surged across Europe due to the Ukraine conflict, the UK’s exposure was more pronounced due to several factors:

- Limited domestic energy storage capacity

- High dependency on volatile global LNG markets

- Lack of long-term energy purchasing agreements seen in some EU countries

Even after wholesale prices started to decline in late 2023, UK energy bills remained high due to supplier contracts, weaker hedging strategies, and slower government response.

These elevated costs feed into inflation by affecting household utility bills and the cost structure of energy-intensive industries.

3. Food Supply Chain Disruptions

Brexit-related trade barriers and a lack of agricultural labour have created bottlenecks in the UK’s food supply chain.

Imported food from the EU faces added checks, fees, and delays at borders, which not only increases costs but also leads to shortages that push prices up further. The disruption has affected:

- Perishable goods like fruit, vegetables, and dairy

- Meat processing industries reliant on EU labour

- Retailers who now carry higher transportation and compliance costs

As a result, food inflation has remained disproportionately high in the UK compared to neighbouring European countries.

4. Labour Market Pressures

The UK’s labour market has tightened significantly over the last few years. EU nationals once made up a substantial portion of the workforce in sectors such as health care, hospitality, logistics, and construction.

Post-Brexit immigration rules, combined with demographic trends such as an ageing population and a rise in economic inactivity, have created staff shortages.

To fill vacancies, employers have been forced to raise wages a trend that contributes to inflation in two ways:

- Higher wages increase household disposable income, boosting demand

- Businesses pass wage costs onto consumers through higher prices

The result is a wage-price spiral, where inflation drives wage demands and wage increases reinforce inflation.

5. Services Sector Inflation

Another unique aspect of UK inflation is the role of the services sector. Unlike the EU, where goods inflation dominates, the UK’s inflation is increasingly driven by price increases in services, such as hospitality, leisure, education, and health care.

Services tend to be labour-intensive and less exposed to international competition, making it harder to bring prices down through trade.

Because services account for over 70% of UK consumer spending, even modest increases in service prices have a large impact on overall inflation metrics.

6. Delayed Monetary Policy Response

The timing and pace of the Bank of England’s interest rate hikes have also played a part. In the early stages of the inflation crisis, the BoE was cautious in tightening monetary policy, concerned about stifling economic recovery.

This delay allowed inflationary pressures to embed themselves further into the economy, making them harder to reverse.

Compared to the European Central Bank (ECB), which took a more coordinated approach across its member states, the UK’s monetary policy response was slower and less impactful in the early phase.

7. Supply Chain Vulnerabilities

COVID-19 exposed weaknesses in the UK’s just-in-time supply chains. Even as many countries recovered, the UK faced extended disruptions due to:

- Port congestion

- Shortages of drivers and logistics personnel

- A lack of diversification in sourcing key goods

These issues increased the cost and reduced the availability of both consumer and industrial goods, adding further upward pressure on prices.

8. Housing and Rental Costs

The UK housing market has also contributed to inflation. A combination of high demand, limited supply, and increased interest rates has driven up both mortgage costs and rents.

For many households, rising housing expenses constitute a growing share of monthly budgets, adding to headline inflation and reducing consumer confidence.

How Has Brexit Affected the UK’s Inflation Rate?

Brexit has had far-reaching implications for the UK’s inflation trajectory. Unlike eurozone countries that continue to benefit from the free movement of goods and labour, the UK has reintroduced trade barriers with its largest economic partner.

Key Brexit-related impacts include:

- New customs checks leading to delays and increased import costs

- Regulatory divergence that raises compliance expenses for businesses

- Decline in EU migrant labour, especially in agriculture, healthcare, and hospitality

- Reduced competition, which places upward pressure on prices

According to a 2024 analysis from the Centre for Economic Performance, Brexit added approximately 3–4 percentage points to food price inflation since the transition period ended. These added costs are now embedded in consumer pricing structures.

The lack of reciprocal arrangements for trade and labour mobility has created bottlenecks that continue to impact supply chains, resulting in persistently higher prices in key sectors.

Is the Labour Shortage in the UK Fueling Price Pressures?

One of the most pressing domestic contributors to inflation is the UK’s ongoing labour shortage. Several industries, including healthcare, construction, agriculture, and logistics, are facing difficulties in recruiting and retaining staff.

The reduction in the availability of EU workers post-Brexit has been a major factor, along with demographic changes and a rising number of economically inactive individuals.

As businesses compete for a smaller pool of workers, wages have been rising steadily. While this benefits workers, it also increases operating costs for employers, who then pass these costs on to consumers.

Here’s a comparison of wage growth trends between the UK and the eurozone in 2025:

| Sector | UK Average Wage Growth | Eurozone Average Wage Growth |

| Healthcare | 6.1% | 3.4% |

| Logistics | 5.7% | 3.0% |

| Retail | 4.8% | 2.9% |

| Hospitality | 5.5% | 3.2% |

Higher wage growth is particularly problematic when productivity does not rise at the same pace, leading to increased unit labour costs and sustained inflation.

Are Monetary Policies in the UK and Europe Aligned?

The approach of the Bank of England (BoE) to managing inflation differs in both timing and intensity from that of the European Central Bank (ECB). While both institutions target a 2% inflation rate, the tools and effectiveness of their policies vary.

The BoE has raised its base interest rate to 5.25% by mid-2025, compared to the ECB’s more moderate 3.75%. Despite the steeper rate increases, the UK is seeing slower results in terms of inflation control.

This reflects differences in how inflation behaves within each economy. The UK’s inflation is more services-driven, whereas EU inflation remains more responsive to global commodity price fluctuations.

Below is a comparative look at key monetary policy metrics in 2025:

| Indicator | Bank of England (UK) | European Central Bank (EU) |

| Base Interest Rate | 5.25% | 3.75% |

| Inflation Target | 2% | 2% |

| Primary Inflation Components | Wages, services | Energy, imports |

| Policy Effectiveness | Limited | Moderate |

The UK’s reliance on its financial sector complicates interest rate policy. Higher rates put pressure on the balance sheets of financial institutions, increasing the risk of instability in the sector. This forces the BoE to act cautiously despite elevated inflation.

How Do Energy and Food Costs Compare Between the UK and Europe?

The UK has faced some of the highest energy bills in Europe during the recent inflationary cycle. Structural weaknesses, such as limited energy storage and reliance on volatile international markets, have made the country particularly vulnerable to global price swings.

Moreover, the UK’s departure from the EU has limited its access to coordinated energy responses, such as cross-border electricity and gas sharing.

Food inflation remains elevated as well, due to:

- Labour shortages in agriculture

- Increased cost of imported food from the EU

- Regulatory friction and delays at borders

- Reduced domestic production capacity

The EU, in contrast, benefits from more resilient supply chains within the single market, and stronger trade agreements with neighbouring countries, which help moderate food price inflation.

What Structural Differences Exist Between the UK and EU Economies?

The structure of the UK economy contributes significantly to its inflation persistence. The dominance of the financial services sector is a unique feature of the UK landscape.

In 2025, the services sector accounts for over 80% of the UK’s GDP, with financial services alone contributing 8%. While lucrative, this concentration limits economic diversification.

Key structural contrasts between the UK and eurozone economies include:

- The eurozone has a larger manufacturing base and more diversified export portfolio

- EU economies maintain stronger regional development policies

- The UK has a higher proportion of high-skill, high-wage jobs concentrated in London and the South East

- Public investment in industrial and science-based sectors in the EU is relatively higher

This over-reliance on financial services not only increases inflation sensitivity to interest rate policy but also crowds out other sectors that could contribute to long-term stability and resilience.

Can Fiscal Measures Help Reduce UK Inflation in the Future?

Monetary policy alone has proven insufficient to manage the UK’s current inflation profile. Fiscal measures can play a supportive role in addressing structural inflationary pressures.

Some of the recommended strategies include:

- Increased investment in manufacturing and research-led industries

- Expanding regional infrastructure and job creation programmes

- Reforming immigration policy to allow targeted labour market relief

- Supporting low-income households to stabilise demand without overstimulating the economy

Rebalancing the economy away from an over-concentration in services, especially finance, could create broader growth and reduce inflation sensitivity.

Policies aimed at strengthening the industrial and technology sectors would also make the UK more competitive and better able to withstand external shocks.

Conclusion

Inflation in the UK has been shaped by a mix of global disruptions and uniquely domestic issues, including Brexit, labour shortages, and an unbalanced economic structure.

While monetary policy has attempted to contain price growth, it is increasingly clear that a broader economic transformation is necessary.

Rebalancing the UK economy towards manufacturing and science-led industries, alongside targeted fiscal interventions, could create a more resilient economic environment.

Only then can the UK hope to achieve inflation levels comparable to those seen in the eurozone and the US.

FAQs About UK and EU Inflation in 2025

What is the average inflation rate in the UK vs the EU in 2025?

As of early 2025, the UK’s inflation rate is approximately 5.2%, compared to 3.4% in the eurozone.

Why are UK food prices increasing faster than in Europe?

Import barriers, weakened currency, and Brexit-related trade friction have driven up food prices more sharply in the UK.

How does wage growth affect inflation differently in the UK?

Wage growth in the UK is partly driven by labour shortages, especially post-Brexit, which fuels demand and raises prices more than in EU economies.

Has Brexit permanently raised UK inflation?

While it’s not permanent, Brexit has introduced long-term trade and labour constraints that have pushed prices up significantly.

Why is the Bank of England raising rates more aggressively?

The Bank of England faces more stubborn inflation due to structural issues and is therefore forced to implement steeper rate hikes.

Are UK households more vulnerable to inflation than EU households?

Yes, due to higher exposure to energy market fluctuations and less social protection compared to some EU states.

How long will UK inflation remain above the EU average?

Projections suggest UK inflation may remain elevated into 2026 unless significant structural reforms are undertaken.