Working from home has become increasingly common across the UK, particularly since the COVID-19 pandemic. However, with this shift has come confusion around whether employees can claim tax relief for additional household expenses.

This guide explores the work from home tax deduction in the UK, explaining who is eligible, what can be claimed, and how to apply under HMRC guidance.

What Is A Work From Home Tax Deduction In The UK?

A work from home tax deduction in the UK allows eligible employees to claim relief for additional household costs that result from working remotely. This relief is offered by HMRC and applies only when an employee is required to work from home by their employer and incurs extra expenses as a result.

The scheme is primarily designed to support employees who are not fully reimbursed for these costs. It is not intended for those who choose to work from home for convenience.

Employees can only claim if they have paid income tax during the year they are claiming for, and the relief is limited to the amount of tax paid in that year.

Tax relief is given based on:

- The amount spent on allowable expenses

- The taxpayer’s income tax rate (20%, 40%, or 45%)

HMRC typically adjusts the employee’s tax code for current claims. For claims relating to past tax years, a refund is issued or the tax code is retroactively updated.

Who Is Eligible To Claim Tax Relief For Working From Home?

Eligibility for the work from home tax deduction is determined by whether the employee must work from home due to the nature of their job or employer’s setup. HMRC provides clear criteria for eligibility.

You may be eligible if:

- Your job requires you to live far from your employer’s office

- Your employer does not have office space available

- You are required to work from home for all or part of the week

You are not eligible if:

- You choose to work from home

- Your contract allows optional remote working

- Your employer has an office, but you cannot go there occasionally (e.g., the office is full)

It’s important that the employee can prove the necessity of home working, especially when claiming expenses beyond the flat rate.

What Expenses Can You Claim While Working From Home?

Employees can only claim tax relief for specific, additional household costs incurred due to working from home. These expenses must be directly related to work and not reimbursed by the employer.

Allowable expenses include:

- Business-related phone calls made from a personal line

- A proportion of gas and electricity used to heat and power the workspace

Non-allowable expenses include:

- Rent or mortgage payments

- Broadband or internet (unless it is exclusively work-related and not used personally)

- Furniture or equipment that has personal use

Any expenses claimed must be solely for business use and supported by evidence if claiming the actual amount rather than the flat rate.

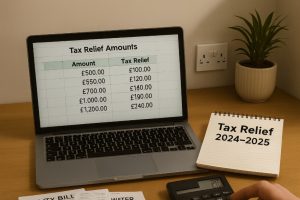

How Much Tax Relief Can You Claim For Working From Home?

HMRC allows employees to claim tax relief in two ways: using the flat rate method or by calculating and providing evidence of actual costs.

Flat Rate Method

Employees may claim a standard amount of £6 per week, with no receipts required. This is the most common method and is intended for simplicity.

| Weekly Claim | Annual Total | 20% Taxpayer Relief | 40% Taxpayer Relief |

| £6 | £312 | £62.40 | £124.80 |

This approach suits employees with minimal additional costs or who want to avoid gathering receipts and calculations.

Actual Cost Method

Employees with higher additional costs may choose to claim the exact amount spent. This requires:

- Evidence such as receipts or itemised bills

- A method to show how much of the cost relates to work use only

For example, if monthly electricity bills increased due to using a home office heater, the work-related proportion can be calculated and claimed.

| Item | Monthly Cost | Work-Related Use | Claimable Amount |

| Electricity (estimated use) | £80 | 25% | £20 |

| Phone calls | £10 | 100% | £10 |

| Total | £90 | — | £30 |

The total claimable amount in this example would be £30 for that month, which would be taxed at 20% or 40% depending on the income bracket.

How Can You Claim Work From Home Tax Deductions Through HMRC?

The method for claiming tax relief depends on whether the employee files a Self Assessment tax return or uses HMRC’s simplified online service.

For most employees who are taxed under PAYE, the process involves using the online form on GOV.UK. The steps are as follows:

- Access the HMRC portal via your Government Gateway account

- Answer the eligibility questions

- Choose the flat rate or actual cost method

- Submit any required documentation (only for actual cost claims)

For employees who submit a Self Assessment tax return:

- Include the home working expense claim under employment expenses

- Ensure the correct tax year and amounts are included

- Retain receipts and evidence in case of audit

Claims can be made for:

- The current tax year

- The four previous tax years

If your claim is approved for a current tax year, HMRC will typically adjust your tax code, reducing the amount of tax deducted from your pay. For older years, a refund is issued.

What Are The Rules If Your Employer Reimburses Your Expenses?

If your employer fully covers your additional home working expenses, you cannot make a claim for tax relief. HMRC only allows claims for costs not already reimbursed.

However, if your employer only partially reimburses costs, you can claim the remaining amount. The claimable portion is the difference between what you spent and what your employer covered.

For example:

- You spent £150 in total on work-related home expenses

- Your employer reimbursed £100

- You may claim tax relief on the remaining £50

It’s also important to note that:

- You cannot claim for a replacement item if your employer already provided one, even if you prefer a different brand or model

- You should not claim for upgrades or personal preferences if a suitable work item is already available from your employer

Only the portion not funded by your employer qualifies for tax relief.

What Has Changed Post-COVID In HMRC’s Work From Home Tax Rules?

During the COVID-19 pandemic, HMRC introduced temporary measures that allowed millions of employees to claim work from home tax relief, even if they were not formally required to work remotely.

From April 2020 to April 2022:

- Employees could claim the £6/week flat rate even if they worked from home for just one day in the tax year

- This applied to anyone working remotely due to lockdowns or health restrictions

From April 2022 onwards, the original rules were reinstated:

- Employees must be required to work from home to claim tax relief

- Voluntary home working no longer qualifies

Employees who claimed during the pandemic without clear justification may not be able to continue making such claims unless their circumstances meet HMRC’s current criteria.

What Common Mistakes Should People Avoid When Claiming?

Claiming tax relief for working from home might seem straightforward, especially with the flat rate option, but HMRC has very clear rules. Many individuals unknowingly make errors that can either lead to rejected claims or HMRC investigations.

Understanding the common mistakes and how to avoid them ensures your claim is compliant and stands a better chance of being approved without delay.

1. Claiming Without Meeting Eligibility Criteria

One of the most frequent errors is attempting to claim tax relief despite not being required to work from home. Since April 2022, HMRC has returned to its pre-pandemic rule: you must be mandated by your employer to work remotely. Simply choosing to work from home, even for convenience or better productivity, does not qualify.

Mistakes to avoid:

- Assuming hybrid working automatically qualifies

- Believing that having an office full once in a while counts as being “unable to work onsite”

- Confusing pandemic-era rules with current ones

2. Overstating or Misreporting Expenses

When using the actual cost method, employees must accurately calculate the portion of costs attributable to work. Overestimating usage or failing to separate personal and business use could invalidate the claim.

Common issues include:

- Claiming full broadband costs, despite using it personally

- Including full electricity bills without calculating the work proportion

- Claiming rent or mortgage costs, which are not allowable under HMRC’s employment expense rules

3. Claiming for Non-Deductible Items

Not all items used at home for work are claimable. HMRC only allows relief on specific expenses that are exclusively for business use and not reimbursed by your employer.

Examples of non-deductible claims:

- Office chairs or desks purchased for comfort but used personally

- Technology upgrades (e.g. a newer monitor or faster laptop) when your employer already provided equipment

- Home renovations or room conversions used as a workspace

4. Failing to Provide Documentation

When claiming for exact amounts, HMRC expects to see supporting documentation such as:

- Receipts for equipment

- Itemised bills for utilities

- A method of apportioning costs (e.g. room-use hours per day)

Failure to provide these documents may result in:

- Delays in processing

- Reduced claim amounts

- Potential denial of the claim

If you’re unsure whether your claim requires evidence, use the flat rate method, which doesn’t require documentation.

5. Claiming for the Wrong Tax Year

You must have paid income tax in the year for which you’re making the claim. If you attempt to claim relief for a year in which you had no tax liability (e.g. due to being unemployed, on maternity leave, or under the personal allowance threshold), HMRC will not approve the claim.

Additionally, if you’re submitting claims for previous tax years, ensure each year is clearly outlined and substantiated with proper figures.

6. Failing to Reapply Each Year

Many employees think that once they apply, the claim rolls over annually. However, unless your circumstances remain unchanged and HMRC has adjusted your tax code permanently, you’ll often need to reapply for each tax year.

This is particularly important if:

- You stop working from home

- Your tax code hasn’t been updated

- You start claiming actual costs instead of the flat rate

By carefully reviewing HMRC’s requirements and avoiding these common mistakes, employees can ensure their claims are valid, properly supported, and processed without issue.

What Alternatives Or Benefits Exist If You Can’t Claim Tax Relief?

Not everyone qualifies for HMRC’s work from home tax relief, especially under the tighter post-pandemic rules. However, this doesn’t mean you’re entirely without support.

There are alternative benefits, reimbursements, and deductions that may apply to your situation depending on your employment type and your employer’s policies.

1. Employer-Provided Support

Even if you can’t claim tax relief, your employer might offer non-taxable reimbursements or allowances. These could include:

- A monthly home-working allowance (up to £6/week tax-free)

- Direct reimbursement for specific purchases like keyboards, headsets, or monitors

- Partial coverage of broadband or phone costs

As long as these payments meet HMRC’s criteria, they are not considered taxable income, and you won’t need to pay tax or National Insurance on them.

Tip: Check with your HR or finance department to see if any work-from-home policies exist internally.

2. Claiming Other Employment-Related Tax Reliefs

If you’re ineligible for home-working relief, you may still be able to claim tax relief on other allowable expenses, depending on your job.

These could include:

- Professional membership fees: Subscriptions to organisations relevant to your role (e.g. Royal Society, ACCA, CIPD)

- Uniform maintenance: Washing and upkeep of required work clothing or uniforms

- Tools and equipment: If you purchase tools or devices specifically for your job and aren’t reimbursed

Many employees overlook these deductions, even though they can lead to a meaningful reduction in taxable income.

3. Self-Employment Deductions

If you are self-employed or move to self-employment in the future, the rules are far more flexible regarding home working costs.

Self-employed individuals can claim a portion of:

- Rent or mortgage interest

- Utilities

- Broadband

- Home insurance (if business-related)

There are two options:

- Flat rate method based on hours worked from home

- Actual cost method based on floor space and usage

This is especially beneficial for freelancers, consultants, and gig economy workers using their home as their main place of business.

4. Use Of Flexible Workspace Allowances

Some industries or organisations offer stipends to cover alternative working arrangements. For example, if you’re not eligible to work from home but your employer requires flexibility, they may offer a coworking allowance or cover travel expenses to other office locations.

While not a direct tax deduction, these benefits can reduce your out-of-pocket expenses.

5. Personal Budget Adjustments and Utility Rebates

Although not tax-related, you may also consider:

- Switching to a business energy tariff if working from home full-time

- Reviewing your council tax band if your property usage has changed

- Exploring broadband discounts or flexible contracts for home businesses

These won’t reduce your tax liability but can indirectly lower your monthly costs associated with working from home.

Conclusion

For eligible employees, claiming the work from home tax deduction offers a straightforward way to recover a portion of expenses incurred from remote working.

While the flat rate provides a simple option, those with higher expenses may benefit from itemised claims. It’s vital to ensure all claims comply with HMRC rules to avoid errors or penalties.

Even though the rules have tightened post-COVID, understanding your entitlements can help ensure you’re not missing out on legitimate relief.

FAQs About Work From Home Tax Deduction in the UK

Can I claim tax relief if I work from home part-time?

Yes, if you’re required to work from home for part of the week and meet eligibility conditions, you can claim tax relief for the applicable days.

Is broadband cost claimable for home working?

Only if the broadband service is exclusively used for work and not for personal use. Otherwise, it does not qualify for relief.

Can self-employed individuals claim home office expenses?

Yes, self-employed individuals can claim a wider range of allowable expenses, including rent, heating, and equipment, based on business use proportion.

How do I claim work from home expenses for previous tax years?

You can claim for the past four tax years via your Personal Tax Account or through Self Assessment, depending on your filing status.

Will HMRC check my receipts or bills?

Yes, if you are claiming actual costs rather than the flat rate, HMRC may request proof such as bills or calculations to validate your claim.

Do I need to renew my work from home claim each year?

Yes, claims are typically valid for one tax year. You’ll need to reapply or confirm circumstances for each new year.

What if I switch from employed to self-employed during the year?

Each employment type has separate rules. You’ll need to claim as an employee for the portion of the year under PAYE, and as self-employed for the rest.